Dear colleagues.

For the EUR / USD pair, we have expanded the potential for the upward structure from May 30 to the level of 1.1907. For the GBP / USD pair, we expect movement towards the level of 1.3457. The level of 1.3354 is the key support. For the USD / CHF pair, we expect the continuation of the movement downwards after passing through the price of the noise range at 0.9842 - 0.9826. The level of 0.9897 is the key support. For the USD / JPY pair, the price issued a pronounced structure for the upward trend of May 29. The upward movement is expected after the breakdown of 110.08. For the EUR / JPY pair, we expect the movement towards the level of 129.22. The level of 127.52 is the key support. For the GBP / JPY pair, we follow the development of the upward cycle from May 29. The continuation of the upward movement is expected after the breakdown of 148.00.

Forecast for June 6:

Analytical review of currency pairs in the scale of H1:

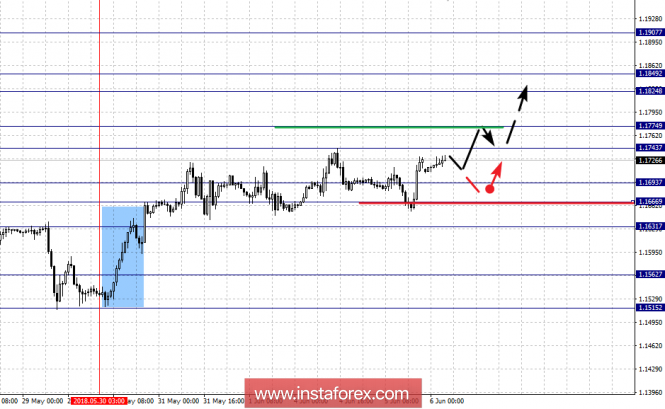

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1907, 1.1849, 1.1824, 1.1774, 1.1743, 1.1693, 1.1666, 1.1631 and 1.1562. Here, we continue to follow the upward structure of May 30. Short-term upward movement is expected in the area of 1.1743 - 1.1774. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.1824. In the area of 1.1824 - 1.1849 is the consolidation of the price. The potential value for the top is the level of 1.1907. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 1.1693-1.1666. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1631. This level is the key support for the upward structure of May 30. Its breakdown will lead to the development of a downward structure. In this case, the potential target is 1.1562.

The main trend is the upward structure of May 30.

Trading recommendations:

Buy: 1.1743 Take profit: 1.1772

Buy 1.1775 Take profit: 1.1822

Sell: 1.1691 Take profit: 1.1666

Sell: 1.1664 Take profit: 1.1632

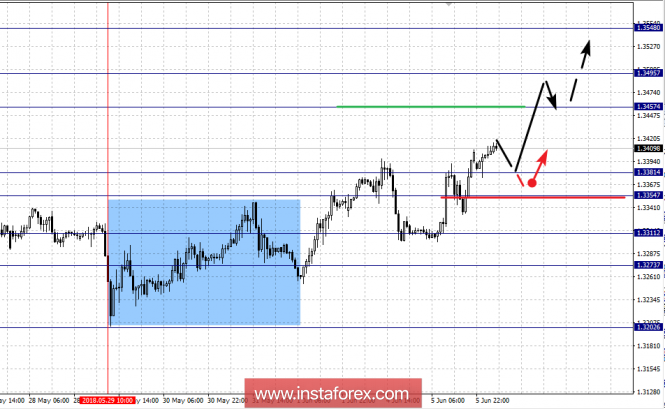

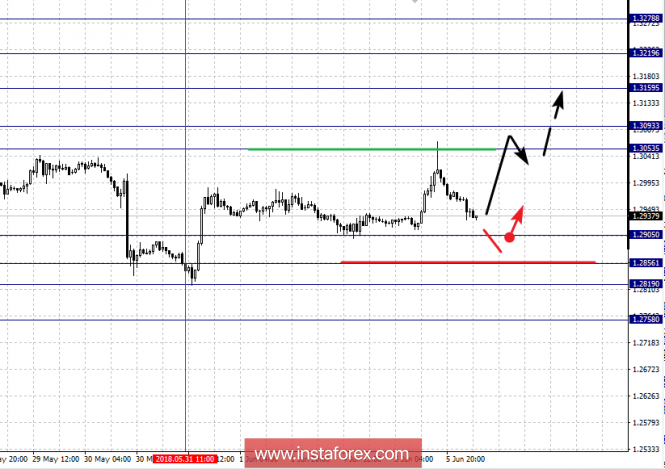

For the GBP / USD pair, the key levels on the scale of H1 are 1.3548, 1.3495, 1.3457, 1.3381, 1.3354, 1.3311 and 1.3273. Here, we follow the upward structure from May 29. Currently, we are waiting for the movement towards the level of 1.3457. The breakdown of this level, in turn, will lead to a movement towards the level of 1.3495. Near this level, we expect the consolidation of the price. The potential value for the top is the level of 1.3548. From this level, we expect a departure towards correction.

Short-term downward movement is possible in the area of 1.3381 - 1.3354. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3311. This level is the key support for the top. It's breakdown will lead to a downward structure. In this case, the potential target is 1.3273.

The main trend is the upward structure of May 29.

Trading recommendations:

Buy: 1.3460 Take profit: 1.3490

Buy: 1.3497 Take profit: 1.3545

Sell: 1.3380 Take profit: 1.3355

Sell: 1.3352 Take profit: 1.3313

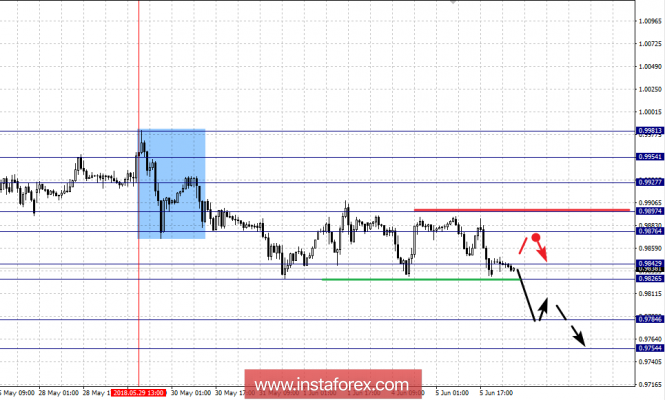

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9954, 0.9927, 0.9897, 0.9876, 0.9842, 0.9826, 0.9784 and 0.9754. Here, the subsequent development of the downward structure from May 29 is expected after passing the price of the noise range at 0.9842 - 0.9826. In this case, the target is 0.9784. The potential value for the bottom is the level of 0.9754. Upon reaching this level, we expect a rollback upward.

Short-term upward movement is possible in the area of 0.9876 - 0.9897. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9927. This level is the key support for the downward structure. Its breakdown will allow us to count on the movement towards 0.9954.

The main trend is a local downward structure from May 29.

Trading recommendations:

Buy: 0.9876 Take profit: 0.9895

Buy: 0.9898 Take profit: 0.9925

Sell: 0.9826 Take profit: 0.9786

Sell: 0.9782 Take profit: 0.9755

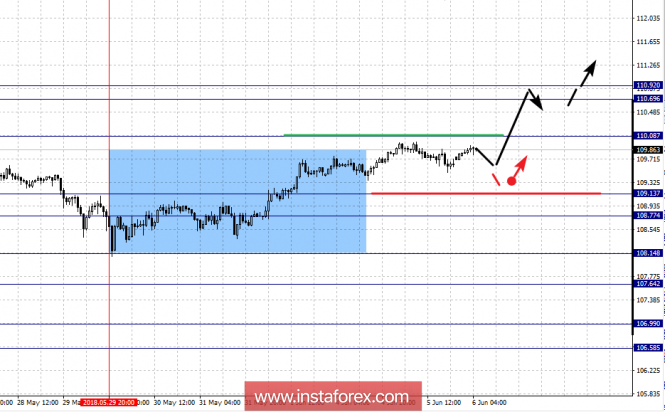

For the USD / JPY pair, the key levels on a scale are: 110.92, 110.69, 110.08, 109.13, 108.77, 108.14, 107.64, 106.99 and 106.58. Here, the price is in deep correction from the downward structure on May 21. The development of the upward movement is expected after the breakdown of 110.08. In this case, the first target is 110.69. In the area of 110.69 - 110.92 is the consolidation of the price.

Short-term upward movement is possible in the area of 109.13 - 108.77, hence the probability of a turn upwards is high. The breakdown of the level of 108.75 is expected after the continuation of the development of a downward trend. In this case, the first potential target is 108.14.

The main trend is a downward structure from May 21, a stage of deep correction.

Trading recommendations:

Buy: 110.10 Take profit: 110.66

Buy: Take profit:

Sell: 109.12 Take profit: 108.80

Sell: 108.70 Take profit: 108.20

For the CAD / USD pair, the key levels on the scale of H1 are: 1.3278, 1.3219, 1.3159, 1.3093, 1.3053, 1.2905, 1.2856, 1.2819 and 1.2758. Here, we follow the upward structure of May 31. The development of this level is expected after passing the price of the noise range of 1.3053 - 1.3093. In this case, the target is 1.3159. Near this level is the consolidation of the price. The breakdown of 1.3160 will lead to the movement towards the level of 1.3219. From this level, there is a high probability of a departure towards correction. The potential value for the top is the level of 1.3278.

Short-term downward movement is possible in the range 1.2905 - 1.2856. The breakdown of the last value will lead to the development of the the downward structure. In this case, the potential target is 1.2758.

The main trend is the upward structure of May 31.

Trading recommendations:

Buy: 1.3093 Take profit: 1.3156

Buy: 1.3162 Take profit: 1.3216

Sell: 1.2905 Take profit: 1.2858

Sell: 1.2819 Take profit: 1.2760

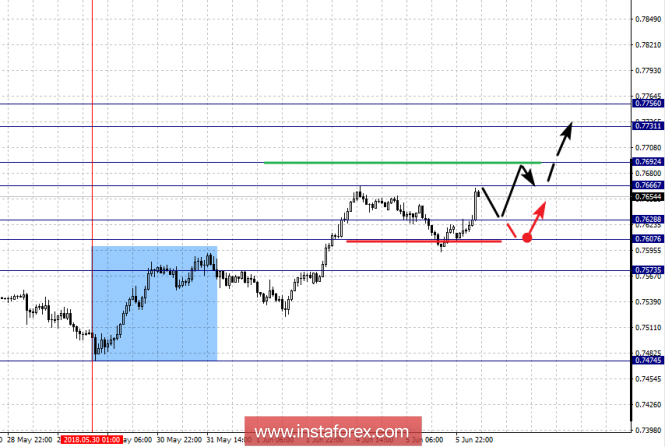

For the AUD / USD pair, the key H1 scale levels are: 0.7756, 0.7731, 0.7692, 0.7666, 0.7628, 0.7607 and 0.7573. Here, we follow the development of the upward cycle of May 30. The continuation of the upward movement is expected after the breakdown of 0.7666. In this case, the target is 0.7692. In this range is the consolidation of the price. The breakdown at the level of 0.7692 should be accompanied by a pronounced upward movement. The target here is 0.7731. The potential value for the top is the level of 0.7756. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 0.7628 - 0.7607. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7573. This level is the key support for the upward structure.

The main trend is the upward cycle of May 30.

Trading recommendations:

Buy: 0.7666 Take profit: 0.7690

Buy: 0.7694 Take profit: 0.7730

Sell: 0.7626 Take profit: 0.7608

Sell: 0.7602 Take profit: 0.7575

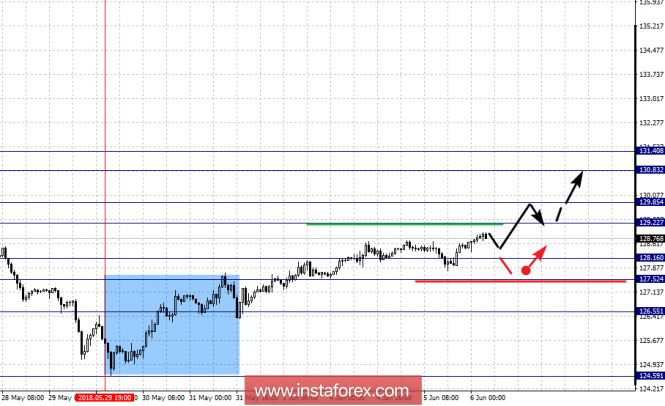

For the EUR / JPY pair, the key levels on the scale of H1 are: 131.40, 130.83, 129.85, 129.22, 128.16, 127.52 and 126.55. Here, we follow the upward structure of May 29. Short-term upward movement is expected in the area of 129.22 - 129.85. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 130.83. In the area of 130.83 - 131.40 is the consolidation of the price.

Short-term downward movement is possible in the area of 128.16 - 127.52. The breakdown of the last value will lead to in-depth correction. Here, the target is 126.55. This level is the key support for the top.

The main trend is the upward structure of May 29.

Trading recommendations:

Buy: 129.22 Take profit: 129.83

Buy: 129.87 Take profit: 131.40

Sell: 128.14 Take profit: 127.55

Sell: 127.50 Take profit: 126.60

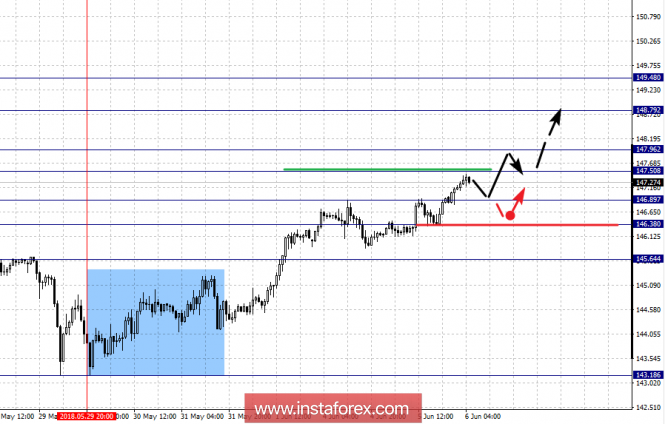

For the GBP / JPY pair, the key levels on the scale of H1 are: 149.48, 148.79, 147.96, 147.50, 146.89, 146.38 and 145.64. Here, we follow the development of the upward cycle of May 29. Short-term upward movement is possible in the area of 147.50 - 147.96. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 148.79. The potential value for the top is the level of 149.48. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 146.89 - 146.38. The breakdown of the last value will lead to in-depth correction. Here, the target is 145.64. This level is the key support for the top.

The main trend is the upward cycle from May 29.

Trading recommendations:

Buy: 147.50 Take profit: 147.94

Buy: 148.00 Take profit: 148.75

Sell: 146.85 Take profit: 146.40

Sell: 146.35 Take profit: 145.70

The material has been provided by InstaForex Company - www.instaforex.com