Forecast for June 19:

Analytical review of currency pairs in the H1 scale:

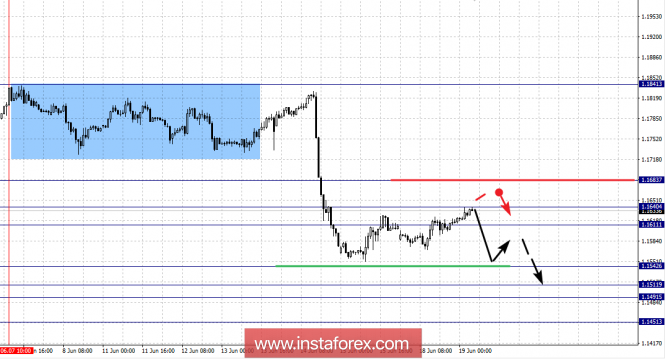

For the Euro/Dollar pair, key levels on the H1 scale are: 1.1683, 1.1640, 1.1611, 1.1542, 1.1511, 1.1491 and 1.1451. Here, we follow the development of the downward structure from June 7, where the current price is in correction. We expect continuous movement to the bottom after the breakdown of 1.1542, in this case the target is 1.1511, in the corridor 1.1511 - 1.1491 consolidation. Potential value for the bottom can be considered at the level of 1.1451, and we expect a pullback to the top.

Short-term upward movement and consolidation are possible in the corridor 1.1611 - 1.1640. Breakdown of the last value will lead to an in-depth correction, with the target at 1.1683, and this level is the key support for the downward movement.

The main trend is the downward cycle from June 7.

Trading recommendations:

Buy: 1.1611 Take profit: 1.1638

Buy 1.1641 Take profit: 1.1680

Sell: 1.1540 Take profit: 1.1511

Sell: 1.1490 Take profit: 1.1453

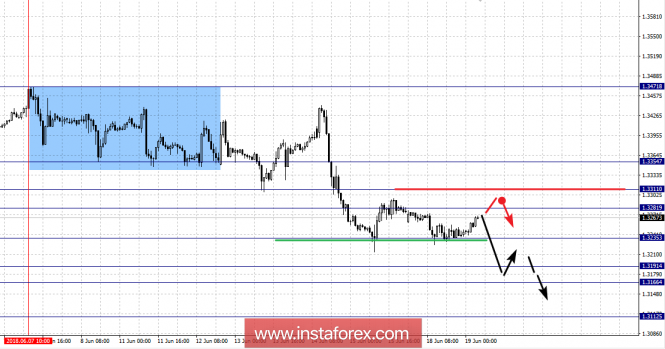

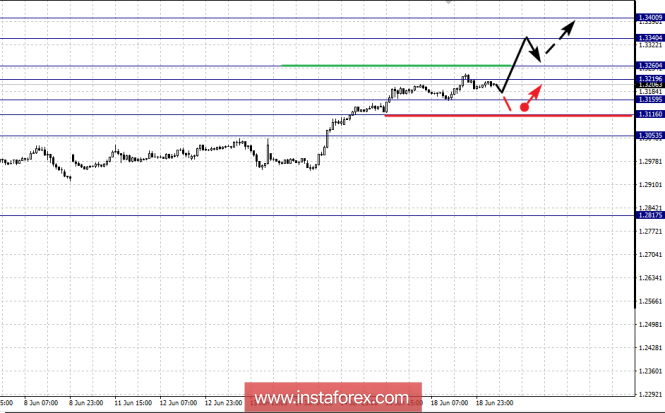

For the Pound/Dollar pair, the key levels on the H1 scale are 1.3354, 1.3311, 1.3281, 1.3235, 1.3191, 1.3166 and 1.3112. Here, we follow the development of the downward structure of June 7. We expect continuous movement to the bottom after the breakdown of 1.3235 and in this case the target is 1.3191, in the corridor 1.3191 - 1.3166 consolidation. Potential value for the bottom can be considered at the level of 1.3112, from which, we expect a pullback to the top.

Short-term upward movement is possible in the corridor 1.3281 - 1.3311. Breakdown of the last value will lead to an in-depth correction with the target at 1.3354, and this level is the key support for the downward cycle.

The main trend is the downward cycle from June 7.

Trading recommendations:

Buy: 1.3281 Take profit: 1.3310

Buy: 1.3314 Take profit: 1.3352

Sell: 1.3235 Take profit: 1.3195

Sell: 1.3164 Take profit: 1.3115

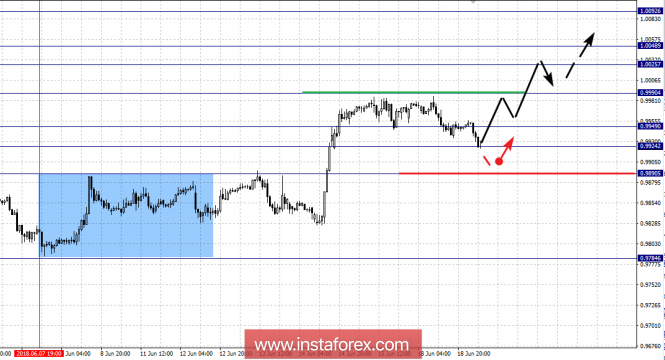

For the Dollar/Franc pair, the key levels on the H1 scale are: 1.0092, 1.0048, 1.0025, 0.9990, 0.9949, 0.9924 and 0.9890. Here, we continue to follow the upward cycle from June 7 where the price is currently in correction. We expect continuous movement to the top after the breakdown of 0.9990 and in this case the target is 1.0025, in the corridor 1.0025 - 1.0048 consolidation. The potential value for the top can be considered at the level of 1.0092 and a movement near this area would likely breakdown the 1.0050.

Short-term downward movement and consolidation are possible in the corridor 0.9949 - 0.9924, breakdown of the last value will lead to an in-depth correction with the target at 0.9890, which serves at the key support level for the top.

The main trend is the upward cycle from June 7, the correction stage.

Trading recommendations:

Buy: 0.9990 Take profit: 1.0025

Buy: 1.0050 Take profit: 1.0090

Sell: 0.9947 Take profit: 0.9926

Sell: 0.9922 Take profit: 0.9892

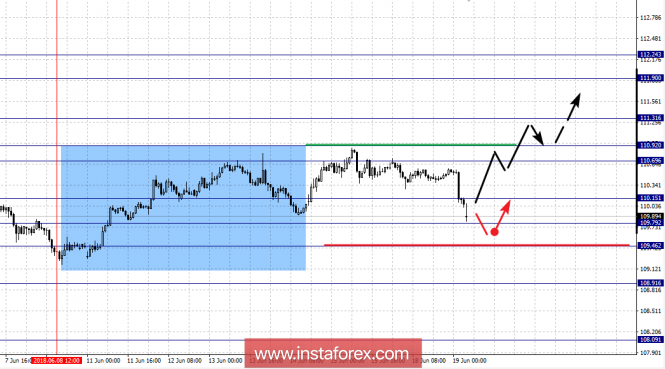

For the Dollar/Yen pair, the key levels on the scale are: 112.24, 111.90, 111.31, 110.92, 110.69, 110.15, 109.79, 109.46 and 108.91. Here, we continue to follow the formation of the local structure for the top of June 8, the price is currently in correction. We can expect a continued movement to the top after passing through the price range of 110.69 - 110.92, in this case the target is 111.31. Potential value for the top can be considered the level of 112.24, upon reaching this area, we expect consolidation in the corridor 112.24 - 111.90.

Correction is expected after the breakdown of 110.15, with the target at 109.79 in this corridor consolidation. Short-term downward movement is possible in the corridor 109.79 - 109.46, breakdown of the latter value will have to develop the downward structure, with the potential target at 108.91.

The main trend: a local structure for the top of June 8.

Trading recommendations:

Buy: 110.92 Take profit: 111.30

Buy: 111.33 Take profit: 111.90

Sell: 109.76 Take profit: 109.48

Sell: 109.44 Take profit: 108.95

For the Canadian Dollar/US Dollar pair, the key levels on the H1 scale are: 1.3400, 1.3340, 1.3260, 1.3219, 1.3159, 1.3116 and 1.3053. Here, we follow the local upward structure of May 31. Short-term upward movement is possible in the corridor 1.3219 - 1.3260, while breakdown of the last value will lead to a movement near 1.3340 level which we expect consolidation. Potential value for the top can be considered at the level of 1.3400 and from this level we expect a pullback to the bottom.

Short-term downward movement is possible in the corridor 1.3159 - 1.3116, while the breakdown of the last value will lead to an in-depth correction with the target at 1.3055, which is the key support level for the top.

The main trend is the upward structure of May 31.

Trading recommendations:

Buy: 1.3260 Take profit: 1.3338

Buy: 1.3342 Take profit: 1.3400

Sell: 1.3157 Take profit: 1.3118

Sell: 1.3114 Take profit: 1.3057

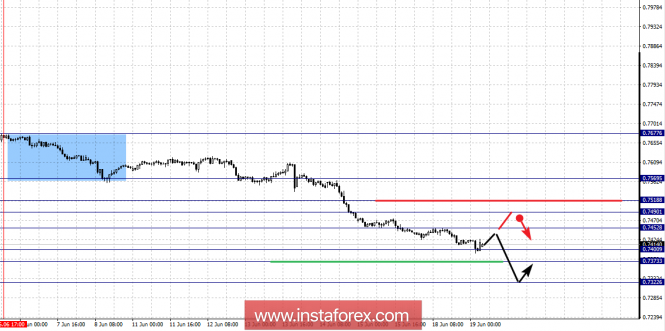

For the Australian Dollar/US Dollar pair, the key levels on the H1 scale are: 0.7569, 0.7518, 0.7490, 0.7452, 0.7400, 0.7373 and 0.7322. Here, we continue to follow the downward cycle from June 6. We expect the continuous movement to the bottom after passing through the price of the noise range 0.7400 - 0.7373, in this case the potential target is 0.7322 and upon reaching this, we expect a rollback to the top.

We expect withdrawal in the correction after the breakdown of 0.7452, with the target at 0.7490. Short-term upward movement is possible in the corridor 0.7490 - 0.7518, breakdown of the last value will have to form an upward structure with the target at 0.7569.

The main trend is the downward cycle from June 6.

Trading recommendations:

Buy: 0.7452 Take profit: 0.7490

Buy: 0.7520 Take profit: 0.7565

Sell: 0.7370 Take profit: 0.7325

Sell: Take profit:

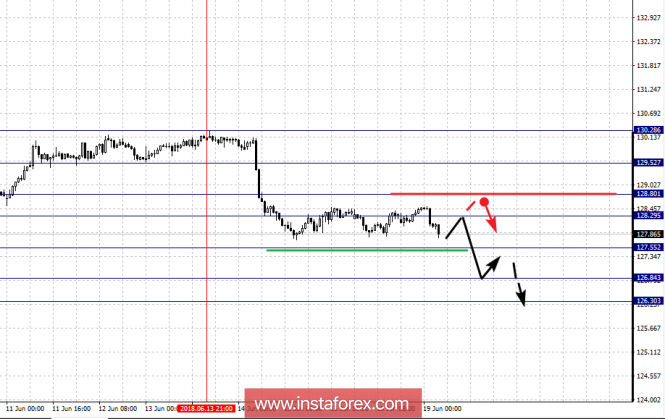

For the Euro/Yen pair, the key levels on the H1 scale are: 130.28, 129.52, 128.80, 128.29, 127.55, 126.84 and 126.30. Here, the price forms the potential downward movement from June 13. We expect continuous movement to the bottom after the breakdown of 127.55, in this case the target is 126.84. Potential value for the bottom can be considered at the level of 126.30, and we expect to formalize the expressed initial conditions for the downward cycle.

Short-term uptrend would likely be in the corridor 128.29 - 128.80, and the breakdown of the last value will lead to an in-depth correction with the target at 129.520 This level is the key support for the downward structure from June 13.

The main trend is capacity building for the bottom of June 13.

Trading recommendations:

Buy: 128.30 Take profit: 128.70

Buy: 128.85 Take profit: 129.50

Sell: 127.55 Take profit: 126.90

Sell: 126.80 Take profit: 126.35

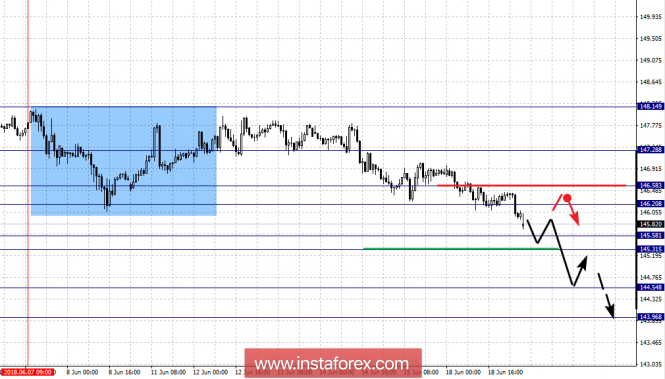

For the Pound/Yen pair, the key levels on the H1 scale are: 147.28, 146.58, 146.20, 145.58, 145.31, 144.54 and 143.96. Here, we follow the development of the downward cycle of July 7. We expect continuous movement to the bottom after passing through the price of the noise range 145.58 - 145.31, in this case the target is 144.54 near consolidation level. Potential value for the bottom can be considered at the level of 143.96, which we expect a rollback to the top.

Short-term upward movement is possible in the corridor 146.20 - 146.58. The breakdown of the last value will lead to an in-depth correction with the target at 147.28, this level is the key support for the downward structure.

The main trend is the downward cycle from June 7.

Trading recommendations:

Buy: 146.20 Take profit: 146.55

Buy: 146.65 Take profit: 147.20

Sell: 145.30 Take profit: 144.65

Sell: 144.50 Take profit: 144.00

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com