Oil prices finished the week with a confident growth. June futures for Brent reached $75/ barrel, and there are all prerequisites to the fact that the growth will continue, as most of the factors affecting the quotes are openly bullish.

Until quite recently, only optimists were positive regarding the prospect of the OPEC + agreement. The grounds for this were really serious - everyone knows that the compliance rate of the OPEC members has always been at a very low level, and with the decline in oil quotes, the chances of being able to persuade them to synchronize the extraction at the same time in the face of an acute shortage of foreign exchange resources looked utopian. However, time has shown that skeptics have underestimated the determination of OPEC +, which managed to achieve all the stated objectives, and moreover, there are rumors about the preparation of a longer agreement, calculated with a horizon of 10 or even 20 years.

Undoubtedly, this factor played in favor of bulls, but there was one more factor, which even recently seemed even more important than the OPEC + deal. This is a record increase in production in the US, which not only reached the position of a world leader, but also announced plans to close the falling volumes from OPEC +.

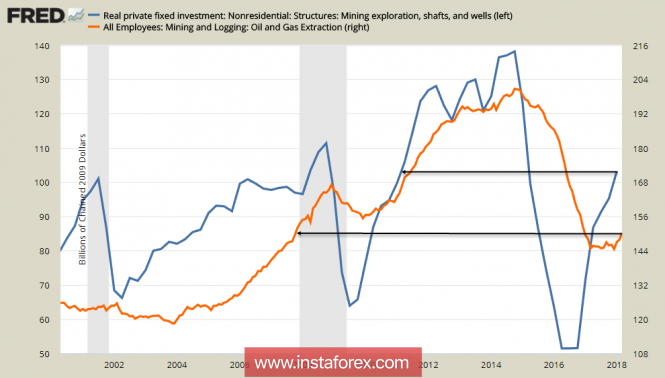

So, there are several puzzles with oil shale, and the first of them follows directly from the chart below.

On Friday, the first preliminary data on GDP in the first quarter was published, among others there were figures on investments in the oil industry.

Indeed, three quarters in a row there has been an increase in investments, but this growth is just a rollback from a record decline in 2016, and at the moment the investment volume is at the level of 2 square meters in 2011, that is, certainly below the peak values of 2014. In order to justify a record growth in production, this amount of investment is clearly insufficient, especially given the short life of shale wells.

Employment in the sector and in general came in at a fantastically low level, corresponding to the levels seen in December 2007, and this is against the backdrop of the recovery of the labor market.

So, record growth in oil production in the US occurs against a background of low investment, a record low employment in the sector and an increase in production costs in shale fields due to the depletion of wells drilled between 2014-2016. This is the number one mystery.

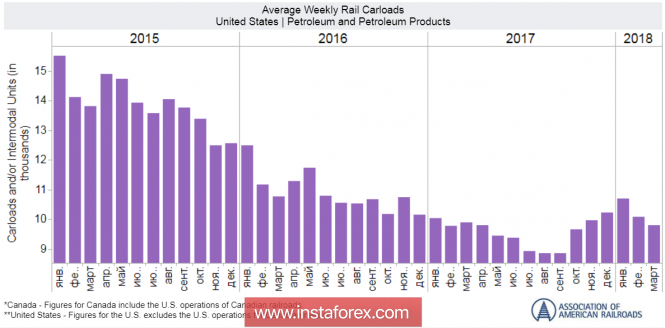

The second riddle we will find if we consider the dynamics of cargo transportation of oil and petroleum products according to the Association of American Railways. A decline in traffic up to 4 square meters in 2017 is understandable and is associated with the overall stagnation of the sector, but growth in the past 6 months is negligible and significantly less than in 2015 and 2016, when production was significantly lower. How can one explain the simultaneous increase in oil production to record levels, a full load of oil refining industries and a low level of freight traffic?

Все эти загадки получают свое разрешение, если принять во внимание особенности статистического учета. В последние полгода компании сдают в качестве текущей добычи запасы нефти на промыслах, то есть добытые в прошлые периоды. All these puzzles will be clarified, if one would take into account the features of statistical accounting. In the past six months, companies are handing out oil reserves in the fields, that is, mined in the past, as current production. This made it possible to show record production, but at the same time, it reduced the global level of reserves, which in the short run will help to increase oil prices rather than decrease, as the achievement of a global balance can happen more quickly.

As for geopolitical factors, they are in favor of further growth of quotations. The International Monetary Fund predicts a steady growth in the world economy, with the highest rates being recorded in countries that are major importers of raw materials. The International Energy Agency reports an increase in oil consumption in 2017 by 1.6%, which is a record for the last 10 years, and already by 2019 the agency predicts an oil shortage.

Both investors and analysts are waiting for further oil growth - the fundamental factors are clearly bullish. The technical picture indicates the danger of correction to the support of 70.20/70.40 in the coming week, after which the growth will most likely resume.

The material has been provided by InstaForex Company - www.instaforex.com