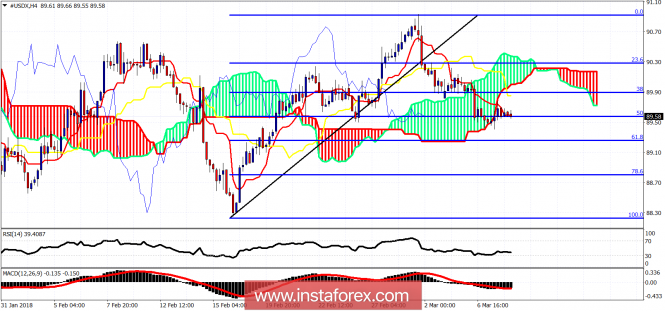

The Dollar index remains under pressure. Price has broken below the 4-hour Kumo and has turned short-term trend from neutral to bearish. Price continues to make lower lows and lower highs while trading below both the tenkan- and kijun-sen.

Next important short-term support is at 89.25 where we find the 61.8% Fibonacci retracement. As long as price is below the Kumo trend will be bearish. For trend to change to bullish in the 4hour chart we will need to see a break above 90.40. Price could bounce from the 61.8% Fibonacci retracement and move higher to test the cloud from below.