Если в 2014-2016 самой обсуждаемой темой на Forex являлась дивергенция в монетарной политике ФРС и других центробанков, во второй половине 2017 на фоне разгона мировой экономики говорили о конвергенции, при которой оба регулятора двигаются в одном направлении, а курсы валют зависят от скорости нормализации, то в 2018 рынки помешаны на торговых войнах. Нельзя сказать, что в прошлом году протекционизм не обсуждался, напротив, выход США из ряда межгосударственных договоров намекал на серьезные проблемы в будущем. И они стали реальностью. Дональд Трамп подписал документ о введении импортных пошлин на сталь и алюминий, и теперь многое будет зависеть от того, решится ли ЕС на ответные действия.

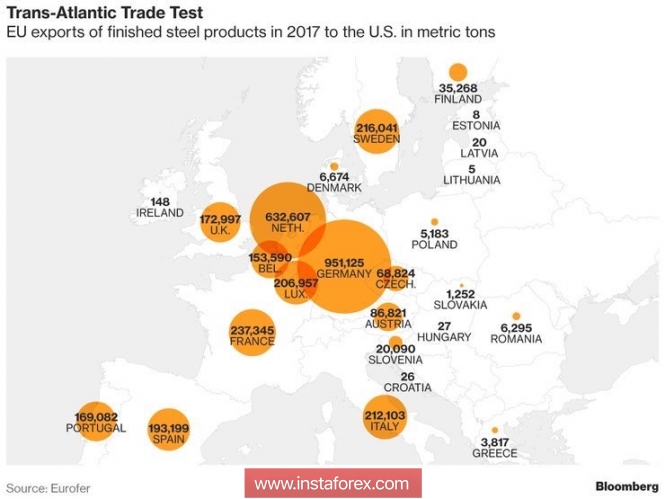

Судя по объемам европейского экспорта стали в Штаты, наибольшие проблемы новые тарифы создают Германии, которая не раз обвинялась Вашингтоном в конкурентной девальвации. ЕС угрожал ответными действиями в размере $35 млрд, однако сначала, наверняка, попытается договориться об исключении входящих в его состав стран из черного списка по примеру Мексики и Канады. Получится – торговой войны можно будет избежать, нет – нас ждет по истине увлекательное зрелище и неоценимый опыт.

Европейский экспорт стали в США

Source: Bloomberg.

If protectionism as quickly as in 2017 disappears from the focus of investors' attention, then the divergence in monetary policy of the ECB and the Fed will immediately return to the agenda. In the light of slowing inflation and falling indices of business activity in the euro area, few people talk about normalization. The ECB claims that QE will last until September or, if necessary, even further, and reduce the forecast for HCPI from 1.5% to 1.4%. This means that the central bank is unlikely to raise rates earlier than the second or third quarters of 2019. At the same time, the Fed intends to do this three or four times this year.

It must also be taken into account that import duties are an inflation factor for the US and deflationary for the euro area, so the divergence in the monetary policy of the ECB and the Fed continues to be a long-term driver for EUR / USD. It is curious that if the EU takes retaliatory measures, the fall in the yield of US bonds against the backdrop of unleashing a trade war will weaken the dollar and create an obstacle to the growth of the euro area's GDP. So is not it better to remain silent?

The most problems for the States can be created by China, which has already started talking about the threat to its own security and its readiness to respond adequately to it. The gold and foreign currency reserves of PBOC were reduced for the first time since the end of 2016, which is connected with the reassessment of the value of US Treasury bills. If Beijing, as one of the two largest holders, starts active sales, then the USD index will surely go down.

Dynamics of the gold and foreign currency reserves of China

Source: Bloomberg.

Technically, the daily pattern "Expanding wedge" continues on the daily chart of EUR / USD. Breakthrough support at 1.225 will strengthen the risks of development of correction in the direction of 1.21 and 1.2. To restore the uptrend, the bulls should return quotes to the resistance at 1.2515 and take it by storm.

EUR / USD, daily chart