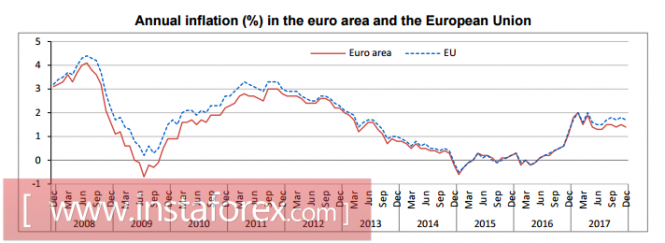

Eurozone

Consumer prices in the eurozone rose by 1.4% in 2017, as evidenced by the final data of Eurostat, published on Wednesday. The result was slightly lower than the level of November (+ 1.5%), but it coincided with the forecasts, and therefore did not have a noticeable effect on the fluctuations of the euro.

A little later, a member of the Board of Governors of the ECB, Ewald Nowotny, commenting on the confident dynamics of the euro, said that its strengthening was not useful. According to Nowotny, the regulator does not have any specific target at the euro rate, and therefore will simply follow the developments.

Despite neutral comments, the ECB is obviously concerned about the growth of the euro against the backdrop of a tightening of the Fed's policy. From the dynamics of events, one can make a simple conclusion that if the ECB starts its own tightening program, the euro will react to it with an even more confident growth that will look nonsense against the background of a growing spread of yields in favor of the dollar.

The euro has formed a local high, and will now, most likely, decline in the technical correction. The nearest resistance at 1.2092 is the level of the previous high, the next is 1.1916, if it survives, the chances of resuming growth will remain high.

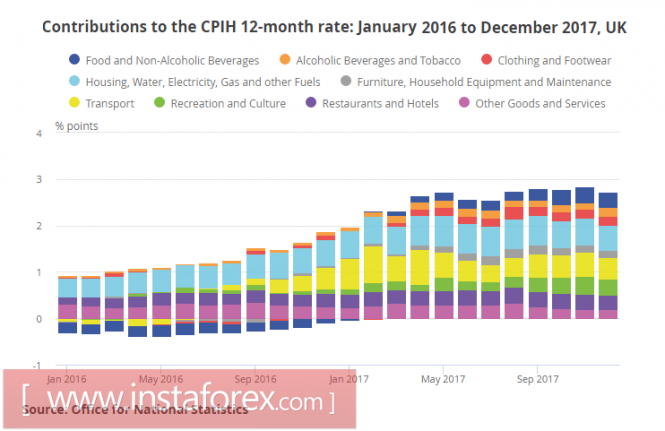

United Kingdom

Slowing consumer inflation did not spare the UK, which happened for the first time in six months. The annual growth in 2017 was 3.0%, which is slightly lower than 3.1% a month earlier, when the highest price growth was registered in five years. The result coincided with the forecasts, but the pound reacted with confident growth, because, in addition to macroeconomic indicators, several political parameters played in its favor.

It is unclear who initiated the discussion of the idea of a repeat vote on Brexit, but it is clear that European officials liked this idea. The head of the EU, Donald Tusk responded first, saying that the desire of the British to remain in the European Union will be met with the approval of European politicians.

A little later, European Commission President Jean-Claude Juncker went even further by announcing that he hoped for the return of Great Britain to the European Union after it left the bloc next year.

Meanwhile, by the end of March an agreement on the transition period must be concluded. British banks, according to Reuters, are preparing to move their operations to the territory of the EU, if the agreement is not reached. This will be a compulsory measure, as banks may lose the ability to serve customers from the EU due to changes in legislation. If this threat is realized, it will have a negative impact on the pound rate, as part of the investment flows will be deployed from the UK to the European continent.

The pound in the meantime completely declined after Brexit, coming close to level 1.40. The pound is supported by external factors, in particular, the rise in commodity prices and the general weakness of the dollar. Until the end of the week the upward momentum will push the pound up a possible correction to 1.3720 or 1.3612 players will use for new buying.

Oil

Oil is trading near the three-year highs, close to the level of $ 70/bpd. The number of long speculative contracts on BRENT on the New York Stock Exchange (NYMEX), according to the latest report of the CFTC, also reached three-year highs, according to WTI the situation is even clearer - the long-term odds are the highest for the whole history of observations, that is, since 2006.

Oil is supported by several factors at the same time - a tough OPEC + position, which leads to market balancing, the obvious weakness of the US shale sector, which, despite the growth of quotations, does not return investments so far, as well as a worldwide trend towards growing interest in risk. In the current conditions, it is not necessary to expect a full turn, the risk of decline to 67.95 exists, but it is highly likely to be used for new purchases.

The material has been provided by InstaForex Company - www.instaforex.com