It happened! What seemed like an impossible dream six months ago, managed to come true. "Bulls" in the North Sea grade tested a psychologically significant level of $70 per barrel, although they could not gain a foothold above it on the first attempt. Will they reach it the near future? On one hand, looking at such a serious upward trend, there will be few people who will think of actively selling oil, and corrections are quickly redeemed. On the other hand, black gold has "bear" drivers, which it still ignores. What should be done for the time being?

The prolongation of the OPEC agreement, strong global demand, geopolitical risks and bad weather in the US and China allowed Brent and WTI to add more than 50% to their value since June last year. The weakness of the US dollar also played into the hands of the bulls. It feels strained because of its inability to win back seemingly strong positive news in the form of tax reform, the potential acceleration of GDP and inflation, as well as in the form of aggressive monetary restriction of the Federal Reserve. Traded in dollar terms, commodities tend to increase during periods of weakness of the greenback. As a result of the influence of many "bullish" oil drivers, a stable upward trend was established, and speculative net longs reached record levels for Brent (574152 contracts) and maximum levels from 2006 for WTI (437,770 contracts).

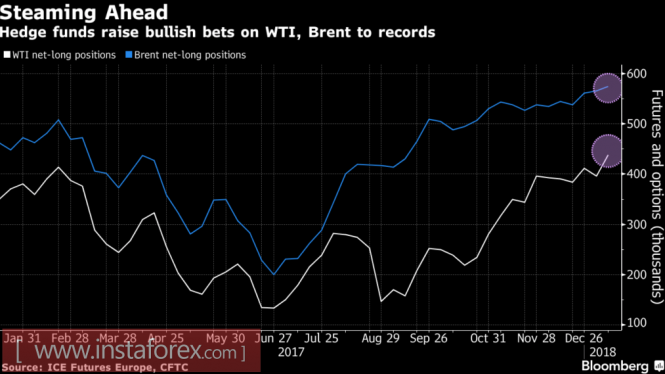

Dynamics of speculative positions for Brent and WTI

Source: Bloomberg.

It is logical that as the prices increase for hedge funds and other players, the desire to lock in profits increases, especially since Goldman Sachs warns about the risks of the OPEC rhetoric restraining the "bulls", and the number of drilling rigs from Baker Hughes after a lengthy marking time shifted with it, increasing at once by 10. In my opinion, the cartel's reluctance to impede the growth of the world economy and the increase in the activity of American producers can be key factors in the potential retracement of Brent and WTI.

The cartel and other parties participating in production cut-off agreement have already begun using verbal interventions. In particular, Iran said that OPEC will arrange $60 per barrel in the North Sea grade, and Russia noted that oil is growing due to bad weather (temporary factor) and maintained its forecast of an average price of $50-60 per barrel for 2018. At the same time the forecast of the Ministry of Energy Information about the growth of black gold in the United States to 10 million b/d d this year and up to 11 million b/d next year, has not been canceled. Judging by the dynamics of drilling rigs, American producers were banally waiting for further price increases in order to insure the risks of their potential reduction through futures contracts. This will allow them to actively increase production without worrying about the worsening of the black gold market.

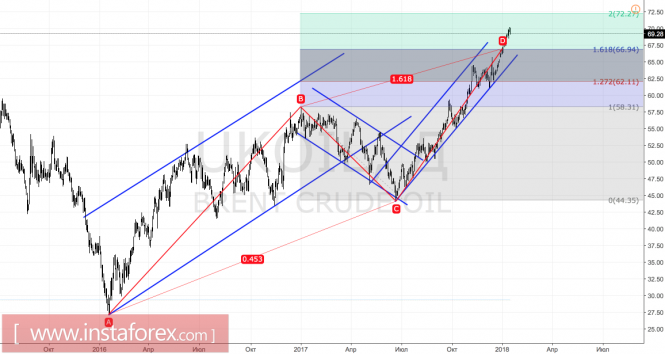

Technically, as long as quotes of the North Sea grade are above $66.95 per barrel, the mood remains "bullish". The breakthrough support will strengthen the risks of pullback in the direction of $65 and $62.1.

Brent, daily chart