The Dollar index as expected is bouncing and reversing its course off the 61.8% Fibonacci retracement and the 92.50 level which was our target. I believe that we are now in the early stages of the next upward move towards 97. Worst case scenario for bulls would be a shallow bounce towards 94 and a rejection.

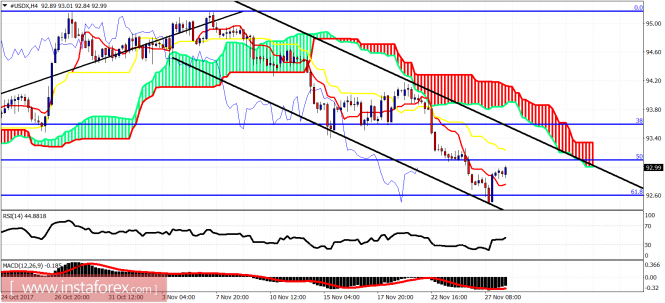

Black lines - bearish channel

The Dollar index is in a bearish trend as long as the price is below the 4 hour Kumo and inside the bearish channel. Short-term resistance is at 93.25 and next at 93.85. Support is at 92.75. Since yesterday price is showing reversal signs. A minimum bounce towards 93.80 is expected. However, my primary scenario is a bigger bounce to new highs above 95.