EUR/USD has been impulsively bullish recently after bouncing off from 1.1700 price area which led the price to climb higher above 1.1850 resistance area. Currently, the price is showing some bearish pressure in the bullish trend which is expected to push the price lower in the coming days. Due to the dovish rhetoric in the recent FOMC meeting, USD weakened which encouraged EUR to gain momentum despite having a weak status in the market currently. Today, German Import Prices report is going to be published which is expected to decrease to 0.4% from the previous value of 0.9%, M3 Money Supply is expected to be unchanged at 5.1%, Private Loans are expected to have a slight increase to 2.8% from the previous value of 2.7%, and German GfK Consumer Climate report is expected to have a slight increase to 10.8 from the previous figure of 10.7. The forecast of the eurozone's economic reports today is quite mixed whereas any negative result will result in further weakness and gains on the USD side. As for USD, today FOMC officials Dudley, Harker and FED Chair nominee Powell are going to speak about the nation's key interest rates and future monetary policy where December Rate hike possibility will be discussed. Currently, Fed officials are expected to make hawkish remarks as a December Rate hike was quite confirmed earlier. Additionally, CB Consumer Confidence report is going to be published which is expected to decrease to 123.9 from the previous figure of 125.9, Richmond Manufacturing Index report is expected to increase to 14 from the previous figure of 12. As of the current scenario, the economic events in the US are expected to have a benign impact on the market's upcoming directional movement where the expectations are quite positive, but any negative outcome may lead to further weakness of USD against EUR in the coming days.

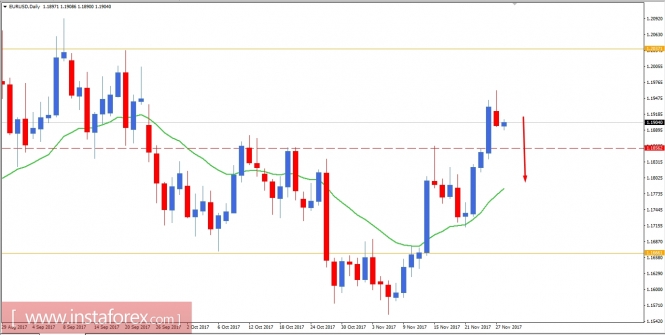

Now let us look at the technical chart. The price was bearish yesterday having a good amount of bullish rejection along the way. The price is currently residing above 1.1850 price level which is expected to push below 1.1850 area towards the dynamic level of 20 EMA. As the price remains below 1.1960 price area, the bearish bias is expected to continue further.