Overview:

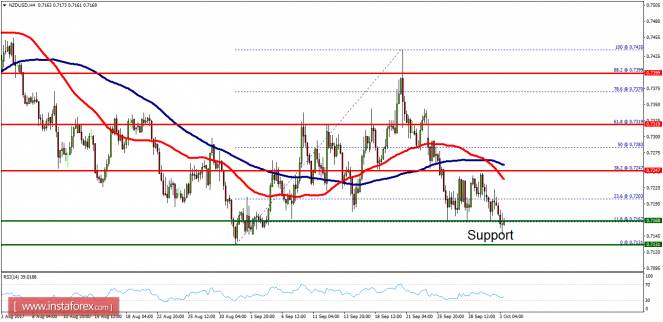

- The NZD/USD pair has faced a major support at the level of 0.7131 which represents a double bottom on the H4 chart. So, the strong resistance has been already faced at the level of 0.7131 and the pair is likely to try to approach it in order to test it again. The level of 0.7131 represents a double bottom for that it is acting as minor support this week. Furthermore, the NZD/USD pair is continuing to trade in a bullish trend from the new support level of 0.7131. Currently, the price is in a bullish channel. According to the previous events, we expect the NZD/USD pair to move between 0.7131 and 0.7167. Additionally, the RSI is still signaling that the trend is upward as it remains strong above the moving average (100). This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend. Buy orders are recommended above the area of 0.7167/ 0.7131 with the first target at the level of 0.7247. If the trend is be able to break the first resistance at the level of 0.7247, then the market will continue rising towards the weekly resistance 2 at 0.7319 (note that the double top is set at 0.7435). However, stop loss should be set at the level 0.7100 because the last bearish wave is seen at the price of 0.7131.