The head of the Federal Reserve, Janet Yellen, confirmed in her next speech the Fed's intention to follow the pace of a gradual rate hike. According to her, a delay for too long is associated with the risk of overheating the labor market and therefore, the FOMC should not be too slow and wait until inflation returns to the target level of 2%.

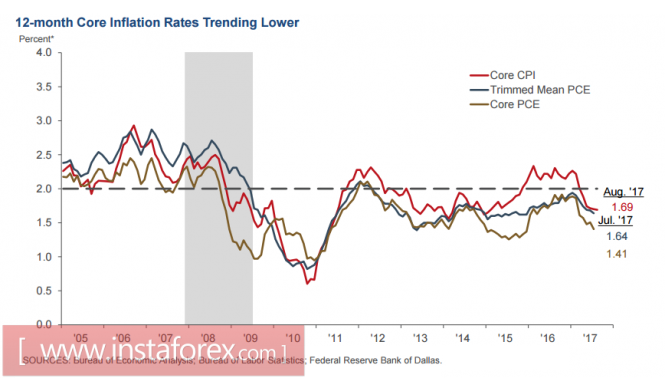

Meanwhile, Inflation is on a positive trajectory that needs not hurry in its course. TheCore inflation declined for 3 consecutive months and currently remains below the long-term average. Fed's concern about weak price increases is understandable as the consumer price index (PCE) without food and energy is also declining. Insisting on another rate hike under current conditions means agreeing with a certain degree of risk.

However, Yellen believes that low inflation is a temporary phenomenon. The reason for this confidence was repeatedly voiced earlier. Based on the assumption that a stable decrease in unemployment will be associated with an increase in the average wage and growth in real incomes of the population, the Fed placed great hopes on the growing labor market which naturally will contribute to the correction of consumer prices.

The market favorably accepted the speech of the head of the Federal Reserve while the dollar strengthened somewhat across the spectrum of the market. At the end of the day, the futures market had a 76% chance of another rate hike in December, which corresponds to a strong confidence. This sets a bullish tone for the dollar which will contribute to its growth.

Today, three more members of the FOMC namely, Bullard, Brainard, and Rosengren, will present their vision on the situation of the rates and its development. Obviously, the Fed wants to manage market expectations as closely as possible. Hence, the market reaction will likely be positive too, which will support the dollar. Unless, of course, it is leveled by frankly poor macroeconomic data. A report on durable goods orders for August will be published today after the dip of 6.8% in July. The market expects an increase of 1% and any deviation from the forecasts will have a noticeable effect on the dollar.

The main factor that the market will be concentrated in the next 24 hours is likely in the presentation of a detailed tax reform plan in the Congress. This has been a long-awaited event as the main directions of the reform were presented back in April. The expectations of the plan presentation are confidently positive.

It is planned to announce several important changes at once which investors will appreciate. It is a question of tax holidays when repatriating income received abroad, a tax deduction for capital expenditures and, of course, a reduction in the corporate tax rate. Currently, the main intrigue is focused on the volume of decline, whereas a rate cut of 15% has been previously announced and there is a tendency for the market to change it into 20% since the present budget revenues fall much stronger than forecasts. In particular, the budget revenues in August amounted to 97.8% similar to the same month last year. Reductions were observed in nine of the last 18 months and revenues amounted to only 88% of the planned budget which is significantly lower than expected. Nonetheless, lack of funds is offset by the growth of borrowing but this process requires a quick response.

If expectations are met, the market will have a new impetus to growth. In particular, the shares of companies with large cache volumes accumulated abroad will also grow and there will also be an increase in momentum for the growth of a company with a high level of capital-intensive fixed assets, which will eventually boost the growth of the stock market. The presentation of the plan will provoke demand for the dollar that will eventually become the main driver of the trend reversal to the north.

Protective assets can be the most affected. At the end of the day, gold may move lower than the support area of 1288 while the euro will continue correction towards support level of 1.16. The yen will test resistance at 112.80 for strength.

The material has been provided by InstaForex Company - www.instaforex.com