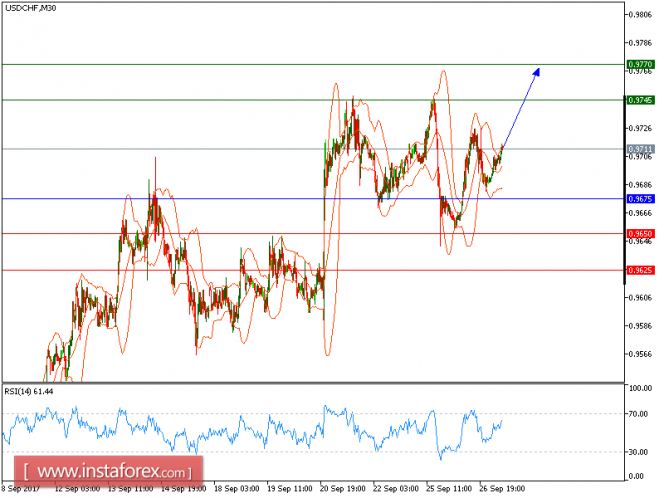

USD/CHF is expected to trade with a bullish bias above 0.9675. Although the pair posted a pullback from 0.9725 (the high of September 26), a support base at 0.9675 has formed and has allowed for a temporary stabilization. Even though a further consolidation cannot be ruled out, its extent should be limited.

Federal Reserve Chairwoman Janet Yellen commented that the central bank has to raise interest rates gradually as it would be imprudent to keep monetary policy on hold until inflation is back to 2%. She added, "Without further modest increases in the federal funds rate over time, there is a risk that the labor market could eventually become overheated, potentially creating an inflationary problem down the road that might be difficult to overcome without triggering a recession."

Hence, above 0.9675, look for a further rebound with targets at 0.9745 (highs of September 21 and 25) and 0.9770 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, Stop Loss: 0.9675, Take Profit: 0.9745

Resistance levels: 0.9745, 0.9770, and 0.9795

Support levels: 0.9650, 0.9625, and 0.9775

The material has been provided by InstaForex Company - www.instaforex.com