Trading plan for 14/09/2017. A limited volatility was observed overnight, but the US Dollar is backed by the hope of the White House's success in implementing tax reform policies. AUD jumped on good data from Australia's labor market, although slight disappointment with readings from China hampered growth. Gold remains in reverse, Crude Oil goes slightly to the tops.

On Thursday 14th of September, the event calendar is super busy with important data releases. During the London session, the Swiss National Bank will release Libor Rate decision together with Monetary Policy Assessment. Later on, the Bank of England will release Interest Rate Decision, Asset Purchase Facility, Official Bank Rate Votes, and Monetary Policy Summary data. During the US session, Consumer Price Index and Unemployment Claims will be posted from the US.

GBP/USD analysis for 14/09/2017:

The Interest Rate Decision, Asset Purchase Facility, Official Bank Rate Votes, and Monetary Policy Summary data are all scheduled for release at 11:00 am GMT. Market participants expect the Bank of England to leave the interest rate unchanged at the level of 0.25%, together with asset purchases at 435 bln. This interest rate decision and the interest rate votes and the statement might be critical for further BoE monetary policy. Market participants will find out how the recent data (prices rising significantly faster than the Bank of England's target and weaker wage pressure) will affect decision-makers' views on optimal interest rates. The key question is whether Haldane will support Saunders - McCafferty in an effort to immediately raise the price. The other important issue is the overall rhetoric of the BoE statement. If market participants find out that the overall tone was more hawkish than the last one, then the British Pound might appreciate a lot across the board (the markets will be discounting a possible future rate hike).

Let's now take a look at the GBP/USD technical picture on the H4 time frame. After a breakout above the recent technical resistance at the level of 1.3267, the price has made a new high at the level of 1.3328 and the reversed back towards the last internal demand zone. Currently, the market might be developing the Head and Shoulders pattern at the end of this rally with a neck line at the level of 1.3160. Violation of this level will open the road towards the next technical support at the level of 1.3126 and below. A lack of interest rate hike and/or dovish tone of the statement support the bearish view.

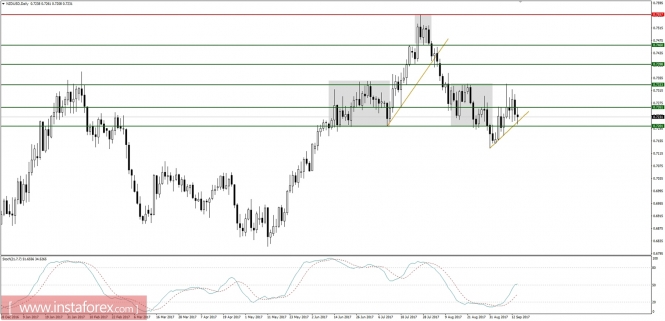

Market Snapshot: NZD/USD down after political news

The price of NZD/USD plunged from 0.7245 to 0.7210 after the publication of the latest poll before the New Zealand parliamentary elections. The results point to the Labor Party's dominance (44 percent, 43 percent) prior) over the current ruling National Party (40 percent, 39 percent prior). The Labor Party's program is negatively evaluated from an economic point of view and harms NZD, although the initial reaction is slowly extinguished. The golden trend line is the key dynamic support for the bulls.

Market Snapshot: US Dollar Index at the trend line resistance

The price of US Dollar Index has managed to bounce from the oversold market conditions and currently has hit the golden trend line resistance around the level of 92.54. It is a key level for the price for now, as a breakout higher would mean an immediate test of the next technical resistance at the level of 93.35, or a failure would mean a lower high in place and another slide towards the support at the level of 91.02.