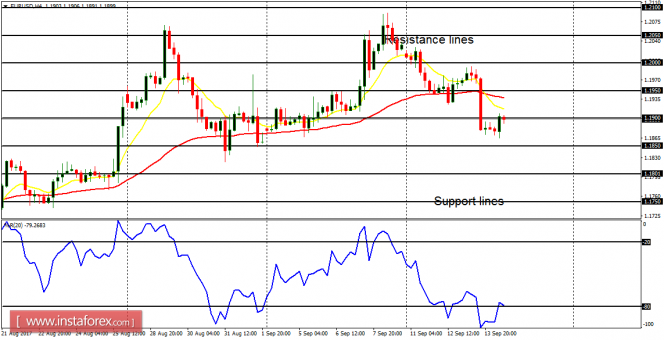

EUR/USD: A valid signal has been generated at last on EUR/USD. The EMA 11 has crossed the EMA 56 to the downside and the Williams' % Range period 14 has gone into the oversold region. Price is now below the resistance line at 1.1900, going towards the support lines at 1.1850 and 1.1800.

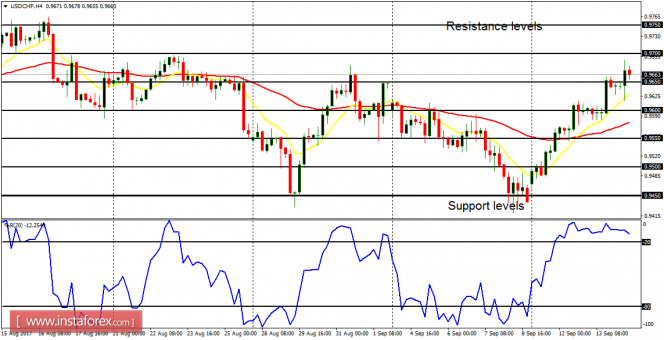

USD/CHF: There is now a valid bullish signal on USD/CHF, which has gone into the opposite direction to EUR/USD. The EMA 11 is above the EMA 56 and the Williams' % Range period 14 is in the overbought region. A further bullish movement is anticipated as price goes towards the resistance levels at 0.9700 and 0.9750.

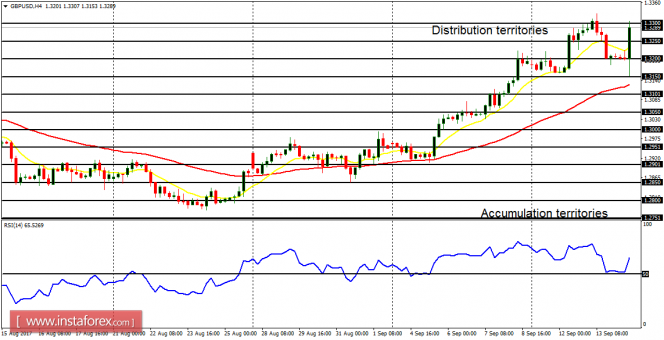

GBP/USD: The GBP/USD pair has continued to go upwards in spite of the correction it experienced yesterday. There is a Bullish Confirmation Pattern on the 4-hour chart, and a further bullish movement is anticipated today and tomorrow as price goes towards the distribution territories at 1.3300 and 1.3350.

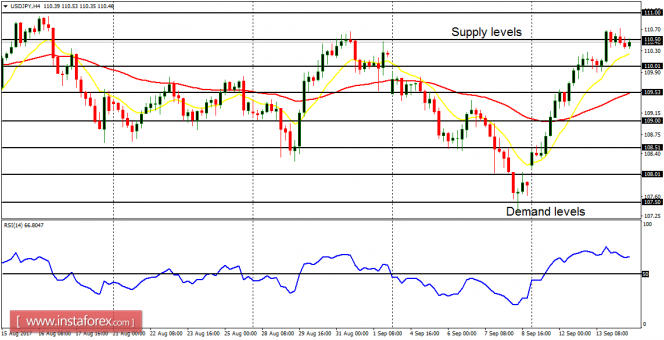

USD/JPY: This pair is in a bull market, which has been going upwards, following the gap-up that was witnessed at the beginning of this week. There is a Bullish Confirmation Pattern in the market, and the market would gain at least, another 100 pips before the end of this week. Some fundamental figures are expected today and they are supposed to have impact on the market.

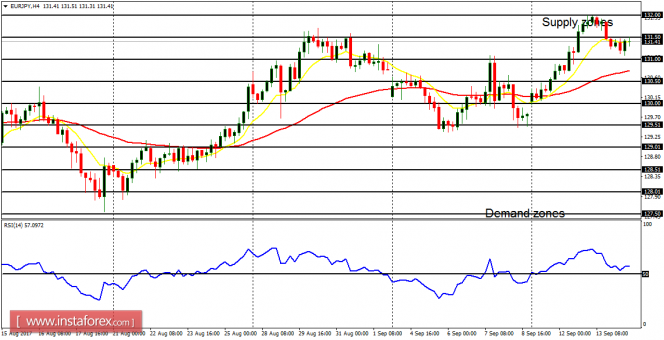

EUR/JPY: The EUR/JPY pair has gone upwards this week, enabling a bullish bias on the market. There has been a minor bearish retracement, which occurred yesterday, therefore giving opportunity to purchase the instrument at slightly higher prices. The next targets are the supply zones at 131.50, 132.00 and 132.50, which may be attained within the next few trading days.