Trading plan for 06/09/2017:

The currencies stabilized after yesterday's selloff in USD and the Asian session went rather calm. The EUR/USD pair is trading just above 1.1900, waiting for the ECB meeting tomorrow. USD/JPY is at 108.70. It only slightly moved from the lows at the level of 108.50. In the Japanese stock market, the Nikkei fell only 0.14% today, but the Chinese Hang Seng is a bit worse: -0.7%.

On Wednesday 6th of August, the event calendar is quite busy, especially during the US session. But first, Germany will issue the Factory Orders data and Italy will present the Retail Sales data. Then, the Bank of Canada will announce the Overnight Rate and Rate Statement, together with the Trade Balance and Labour Productivity data. Later on, the US will post the ISM Non-Manufacturing Index data.

Analysis of EUR/USD for 06/09/2017:

The German Factory Orders report released at 06:00 am GMT was far below the expectations. Market participants expected a drop from 0.9% to 0.2%, but the delivered number was at the level of -0.7% on a monthly basis. Moreover, on a yearly basis, the factory orders dropped from 5.1% to 5.0% instead of a rise to 5.8% as per market expectations. The consumer goods orders fell -3.0%, investment goods orders shrank -0.7%, and capital goods orders decreased -0.7% ( domestic -5.1%, foreign +2.2%). Only exports orders were unchanged. The recent data from the German economy were good and this is the first time this year when a part of the data underperforms. Whether that will be the beginning of a more serious slowdown, we will find out soon.

The market reaction to the data was limited as global investors are waiting for the European Central Bank interest rate decision tomorrow. Let's take a look at the technical picture on the H1 time frame. The market has formed some kind of a triangle pattern between the levels of 1.1980 - 1.1820 as the volatility is limited. The main support area between the levels of 1.1817 - 1.1865 is still not violated and the momentum indicator is not showing any developments in either direction. The market is likely to trade sideways until the ECB meeting.

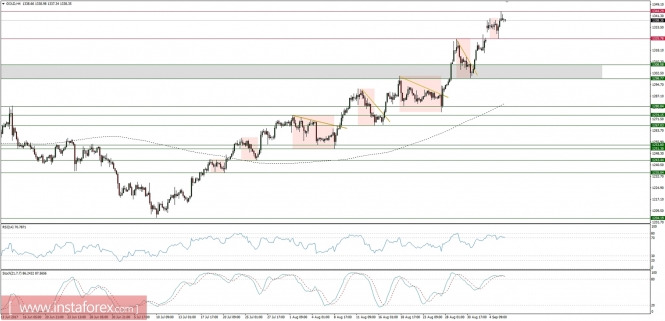

Market Snapshot: Gold still trades on highs

Gold has filled the weekend gap and bounced from the technical support at the level of $1,325. The new local high was made at the level of $1,344, but the market is trading in overbought conditions and there is a visible bearish divergence between the price and momentum indicator. The technical support at the level of $1,325 is the key level to the downside for bears.

Market Snapshot: SPY declines more towards the trend line

SPY (S&P500 ETF) declined yesterday after failing to make another higher high above the level of 248.88. The price has bounced from the golden trend line support around the level of 245.00, but the indicators are still pointing to the downside. Any escalation in geopolitical tensions will make the bears dominate this market again. The low at the level of 243.93 is the key level to the downside.