Despite the absence of important events in the economic calendar for the Land of the Rising Sun, the Japanese yen can still easily claim a role of the most interesting currency for the last full week of August. The reason could be seen in the reduced sensitivity of the major world currencies to macroeconomic statistics. So, the US dollar was rather calm about the strong data on the labor market, the retail sales, and the consumer sentiment index from the University of Michigan. Add to that the dollar's response to the political situation in the US. The dollar hardly reacted to the dissolution of Donald Trump's economic advice, the rumors about the departure of Gary Cohen from the White House, and the resignation of Stephen Bennon. The policy continues to eclipse the economy. In such conditions, the demand for the assets-shelters goes off scale.

It is a wonder if the Bank of Japan could foresee the direction of the policy which targets the yield curve that indicates that it will not be able to control the yen's rate. Theoretically, pegging the USD / JPY pair to the yield of US Treasuries in a situation where the Fed raises the federal funds rate should have sparked a green light before the devaluation of the local currency, increased inflation expectations, and accelerated consumer prices. In practice, it turned out differently. Geopolitics and the loss of faith of investors in Donald Trump lead to lower rates of the US debt market and falling quotations USD / JPY.

Dynamics of USD / JPY and US Treasury yields

Source: Trading Economics.

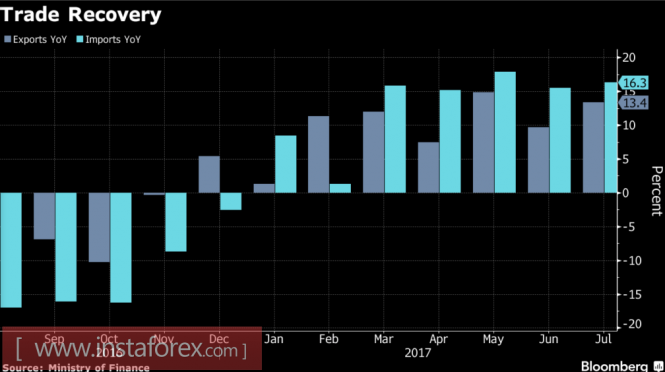

In such cases, few people look at the internal statistics for the Land of the Rising Sun. What difference does it make if the GDP in the second quarter was the best growth since the beginning of 2015 (+ 1% m / m)? Does it matter that external demand does not keep pace with domestic demand? This, coupled with the revaluation of the yen, is reflected in the outstripping of import dynamics (+ 16.3% y / y) over exports (+ 13.4% y / y). The main driver for change in USD / JPY pair is the events occurring in the States. Meanwhile, the yen appears to only go with the flow.

Dynamics of Japan's exports and imports

Source: Bloomberg.

In this respect, further dynamics of the analyzed pair will depend on the change in the world view of investors. It was not expected that Trump's economic advice would be so effective that their dissolution would finally kill the hopes for the dispersal of the US GDP to 3%. It wasn't expected as well that the withdrawal of the main supporter of the trade war with China will lower the bond yields below its current amount. Rather, the expectations were on the contrary. Putting things in order in the White House will increase the chances of realizing the tax reform and will strengthen the dollar.

It is generally believed that the "bears" for the USD / JPY pair will soon have new trump cards in the form of a problem with regards to the ceiling of the national debt and the potential correction of US stock indices. Nevertheless, few believe in the technical default of the United States. That's why the rollback of the S&P 500 is said to come for a very long time, but it is still there. The factors are clearly short-term and their repayment will make it possible to buy the dollar.

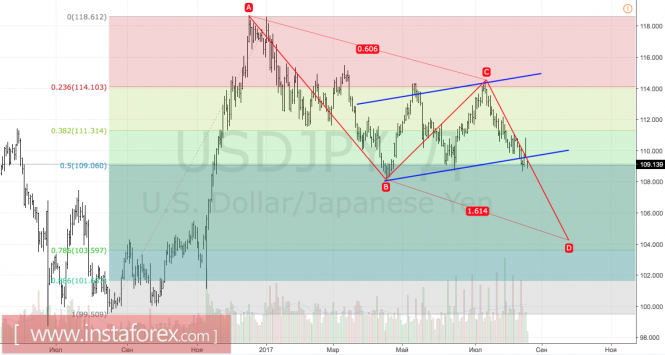

Technically, a break below the supports at 109 and 108 activates the pattern AB = CD and will increase the risk of continuing the downward path towards the direction of 104. On the contrary, the inability of the "bears" to keep the quotes below the lower limit of the upward trading channel will be an indication of their weakness.

USD / JPY, daily chart