Trading plan for 21/07/2017:

Lower volatility was noted during the Asian session. EUR/USD remains in a narrow daily range just below yesterday's long-term highs and is currently at 1.1635. GBP/USD is testing a strong resistance at 1.300 level. USD/JPY after yesterday's decrease to 111.50 fights back over 112.00 level. The S&P500 index reached yesterday historically the highest levels around 2,475 points and currently is in a narrow pullback cycle.

On Friday 21st of July, the event calendar is light in important data releases, but some interesting data from Canada will be released later in the day: Consumer Price Index and Core CPI and Retail Sales.

USD/CAD analysis for 21/07/2017:

The inflation data from Canada are the most important data release for today and are scheduled at 12:30 pm GMT. Market participants expect the Consumer Price Index to decrease from 0.1% to -0.1% on a monthly basis and from 1.3% to 1.1% on a yearly basis. The latest comments from the Bank of Canada indicate a possible interest rate hike before the end of 2017, so financial markets will take today's bunch of data of the Canadian CPI and retail sales to see whether data supports tighter monetary policy in Canada. If the data beats the consensus, then the markets might get even more certain that the interest rate hike is on the table that will inflate the Canadian Dollar across the board.

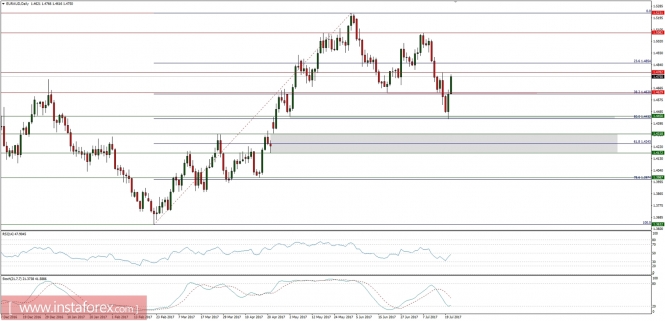

Let's now take a look at the USD/CAD technical picture. The market fell out of a parallel downward channel some time ago and now is trying to test the 2016 low at the level of 1.2459. The last down leg was developed in the narrow channel as well, mostly due to severely oversold market conditions. In this situation, any data worse than excepted might cause a temporary counter- trend bounce towards the level of 1.2682 and 1.2770. Otherwise, the market is on a good way to spike down towards the 1.2459 support before any substantial pullback will occur.

Market Snapshot: EUR/AUD breaks out above resistance

The price of EUR/AUD pair has broken above the technical resistance at the level of 1.4629 and now is trying to test the next technical resistance at the level of 1.2782. The market is bouncing from the oversold levels as well, but the momentum indicator is still below the fifty level. Any violation of this level will open the road towards the 1.5082 high.

Market Snapshot: EUR/GBP close to the next resistance

The price of EUR/GBP has broken above the range zone between the level of 0.8754 - 0.8898 and violated the local high at the level of 0.8949 (now support). Currently, the bulls are trying to test another technical resistance at the level of 0.9026 and the rising momentum indicator supports this view.