Overview:

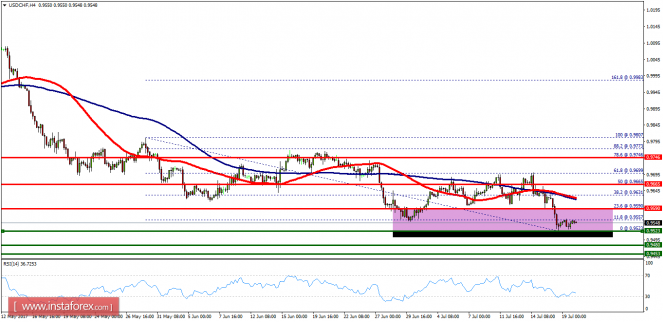

- This week, the USD/CHF pair fell from the level of 0.9665 to bottom at 0.9523 yesterday. The USD/CHF pair has faced strong support at the level of 0.9523 (the double bottom).

- So, the strong support has been already faced at the level of 0.9523 and the pair is likely to try to approach it in order to test it again and form a double bottom.

- Hence, the USD/CHF pair is continuing to trade in a bullish trend from the new support level of 0.9523; to form a bullish channel.

- According to the previous events, we expect the pair to move between 0.9523 and 0.9665. Also, it should be noted major resistance is seen at 0.9665, while immediate resistance is found at 0.9590. Then, we may anticipate potential testing of 0.9665 to take place soon.

- Moreover, if the pair succeeds in passing through the level of 0.9665, the market will indicate a bullish opportunity above the level of 0.9665. A breakout of that target will move the pair further upwards to 0.9746.

- Buy orders are recommended above the area of 0.9523 with the first target at the level of 1.9590 and continue towards the levels of 0.9665 and 0.9746. On the other hand, if the USD/CHF pair fails to break out through the resistance level of 1.9590; the market will decline further to the level of 0.9453.