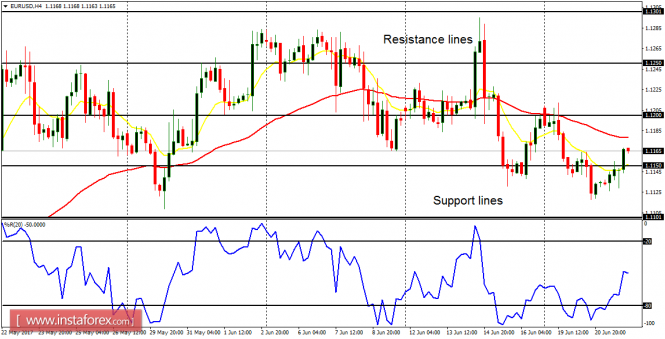

EUR/USD: Yesterday, there was an upwards bounce on the EUR/USD, in the context of a downtrend. The upwards bounce could end up giving a good short-selling signal as the price is expected to go downwards, reaching the support lines at 1.1150 and 1.1100. Some fundamental figures are expected today and they could have an impact on the market.

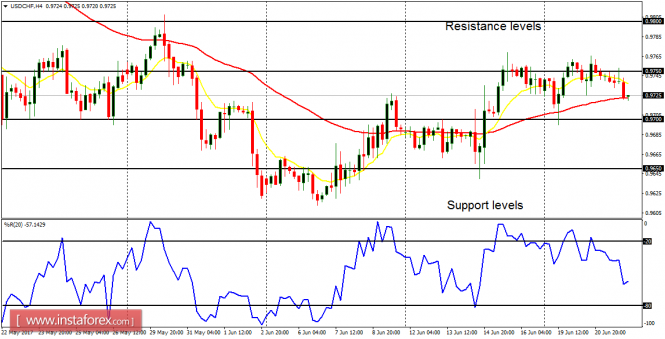

USD/CHF: The recent bullish signal on the USD/CHF is in a precarious situation, owing to the current bearish correction in the market (which is shallow anyway). There remains a possibility of price reaching the resistance level at 0.9800. The recent bullish bias cannot be invalidated unless the price goes below the support level at 0.9650.

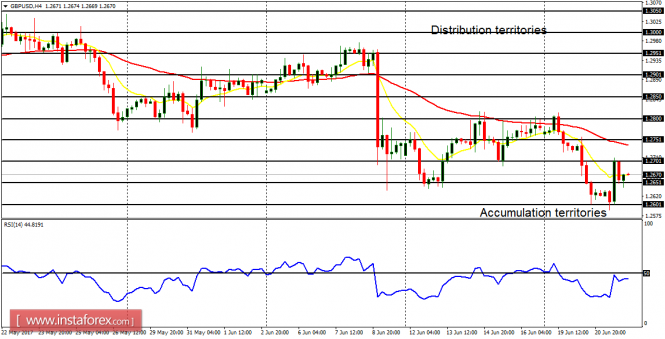

GBP/USD: The bias on the Cable remains bearish, though the price is currently choppy. The accumulation territories at 1.2650 and 1.2600 could be tested within the next few trading days. These accumulation territories were previously tested this week, and they could be re-tested as price goes south.

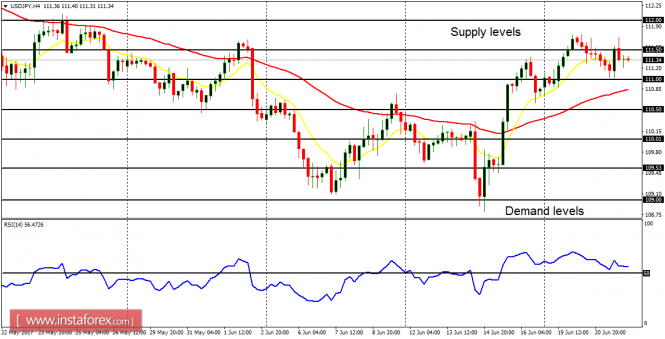

USD/JPY: The USD/JPY has continued to be corrected lower and this poses threat to the already weak bullish bias in the market. The RSI period 14 has gone below the level 50. Once the EMA 11 crosses the EMA 56 to the downside, the outlook on the market would turn essentially bearish. After all, that is what is anticipated for this month.

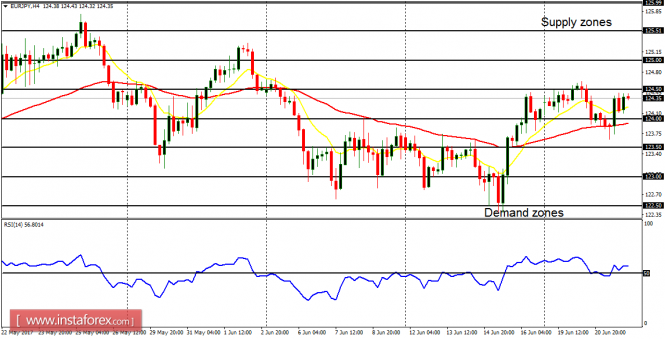

EUR/JPY: This cross has not done anything significant this week. A movement above the supply zone at 125.00 would result in a clean Bullish Confirmation Pattern, while a movement below the demand zone at 123.00 would result in a Bearish Confirmation Pattern. This is the scenario that is supposed to happen before the end of this week or early next week.