Trading plan for 15/05/2017:

Overall, there was a quiet trading session in Asia. The Shanghai Composite's stock market is up 0.3% with generally positive moods. The Japanese Nikkei is down 0.2% under pressure of depreciated USD/JPY. The USD remains without direction, still feeling a slight disappointment with the US data published on Friday.

On Monday 15th of May, the event calendar is bereft of important news releases. However, global investors will pay attention to the Empire State Manufacturing Index data from the US and digest the weekend political and economic developments.

Analysis of EUR/USD for 15/05/2017:

The Empire State Manufacturing Index data is scheduled for release at 12:30 pm GMT, and market participants expect an increase from 5.2 points a month ago to 7.2 points for the reported month. This index is a monthly survey of manufacturers in New York conducted by the Federal Reserve Bank of New York. Any number better than expected would mean the sentiment in this sector of economy is positive and the manufacturing contribution to the overall GDP in the next quarter might be bigger than expected.

Let's now take a look at the EUR/USD technical picture on the H4 timeframe. After bouncing from the technical support at 1.0851, the price is now testing the golden trend line from below. This is the key moment for the market as any violation of the golden trend line would mean that bulls are in control over this market and they will likely try to test the recent local high at the level of 1.1020. Please notice that the weekend gap still hasn't been filled.

Market snapshot: GBP/USD rebounds from the trend line support

After the plunge caused mostly by the Bank of England's interest rate decision and statement, GBP/USD is now rebounding towards the local swing high at the level of 1.2990. Importantly, the market conditions look overbought on the daily chart, so a failure at the current levels would cause a strong corrective sell-off in this pair.

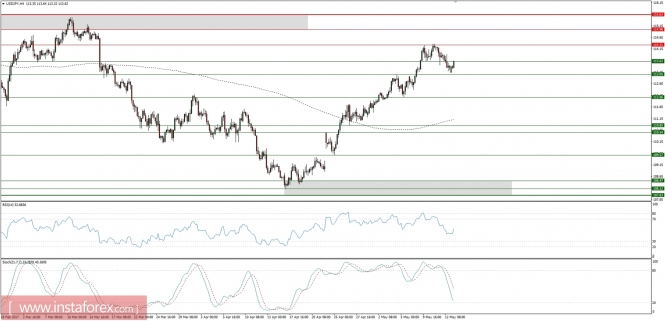

Market snapshot: USD/JPY bounces from the nearest support

The USD/JPY pair has bounced from the support at the level of 113.05 and now is testing the nearest technical resistance at 113.62. The momentum is biased slightly towards the upside, but the stochastic clearly shows that the prices has not reach the oversold levels just yet. If the level of 113.62 is not clearly violated, then the market might get back to the sell-off mode fairly quickly, targeting the levels of 113.05 and 112.06.