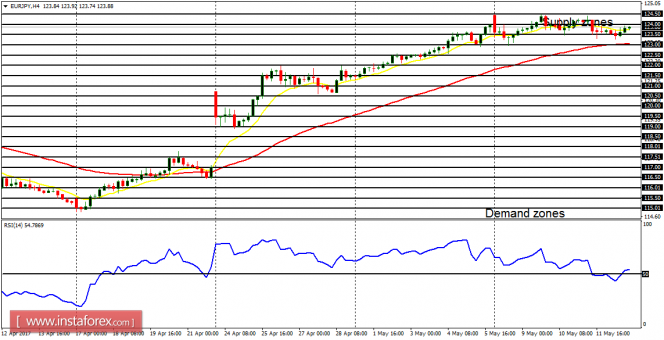

EUR/USD: The EUR/USD pair did not move significantly last week. The support line at 1.0850 has been tested, as price closed above the support line at 1.0900 on Friday. A movement above the resistance line at 1.1000 would strengthen the existing bullish bias, while a movement below the support line at 1.0700 would result in a clean bearish signal.

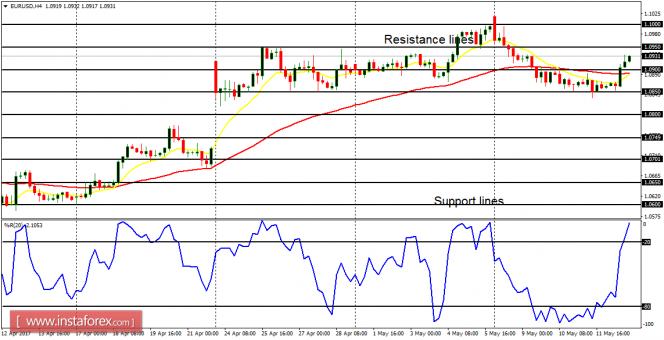

USD/CHF: This currency trading instrument went upwards by 230 pips last week, almost testing the resistance level at 1.0100, before the pullback that was witnessed on Friday. The initial bullish movement of the last few days of the week undermined the recent bearish outlook on the market; whereas the pullback that was witnessed on Friday scuttled the bullish effort of the week. There ought to be a directional movement of at least, 200 pips to the upside or downside before a directional bias can be formed. Right now, the bias is neutral in the short term.

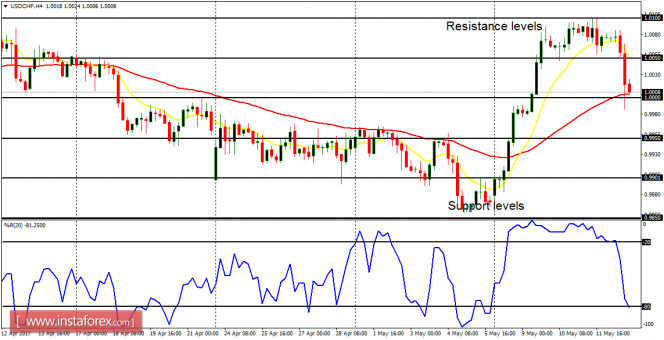

GBP/USD: The Cable consolidated throughout last week in the context of an uptrend. Price tested the accumulation territory at 1.2850, but closed above it. A closer look at the market reveals that the uptrend is getting tired, thereby increasing chances of a large pullback, which could happen this week. A movement below the accumulation territory at 1.2800 would result in a bearish bias.

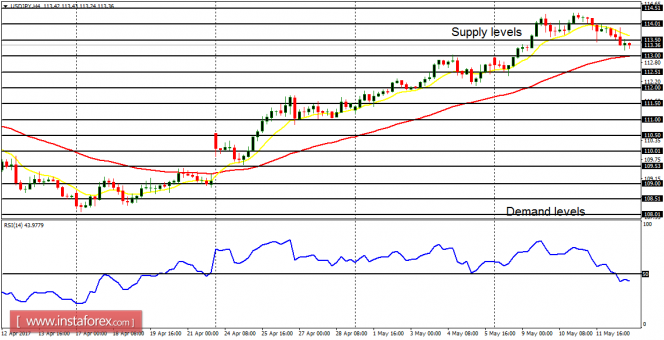

USD/JPY: This pair went upwards by 160 pips last week, going briefly above the supply level at 114.00, and then coming down by 80 pips. Price closed below the supply level at 113.50 on Friday, moving close to the demand level at 113.00. The supply levels at 113.50, 114.00 and 114.50, could be reached this week, as price turns to rally again. Otherwise, a strong pullback would be witnessed.

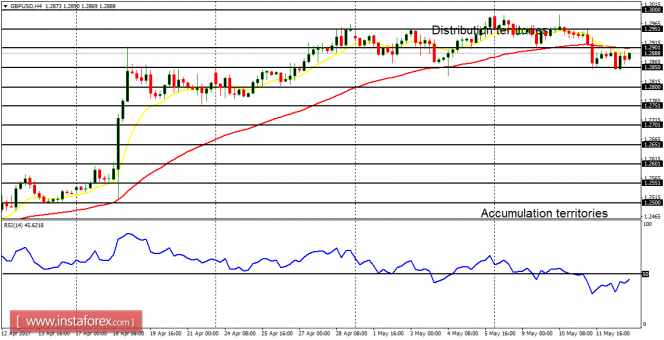

EUR/JPY: In the context of a downtrend, price moved generally between the demand zone at 123.00 and the supply zone at 124.50. The market went sideways last week, and further sideways movement would result in a short-term neutral outlook. A rise in momentum is also a possibility this week, which may propel price further north (to lay emphasis on the recent bullish outlook), or propel price southwards, to create a bearish signal.