Trading plan for 04/05/2017:

The Dollar keeps up gains from Wednesday due to the optimistic tone of the FOMC statement. Australia's foreign trade data did not help the AUD, which is the weakest currency in the G10. Stock indexes in Asia are mostly gaining. Gold is falling in value due to strong USD.

On Thursday 4th of May, the event calendar is busy with a bunch of PMI releases from across the Eurozone, PMI Services data from the UK, Trade Balance data from Canada, Factory Orders and Trade Balance data from the US. Moreover, there are speeches from ECB President Mario Draghi and BOC Governor Stephen Poloz scheduled later in the day.

EUR/USD analysis for 04/05/2017:

The PMI Services and PMI Composite data from the Eurozone are scheduled for release between 08:00 am and 09:00 am GMT. Market participants expect an improvement both in PMI Services and Composite sectors of the economy, so the sentiment remains on an elevated level. All the figures are expected to be released above the level of fifty, so the expansion cycle continues in the Eurozone.

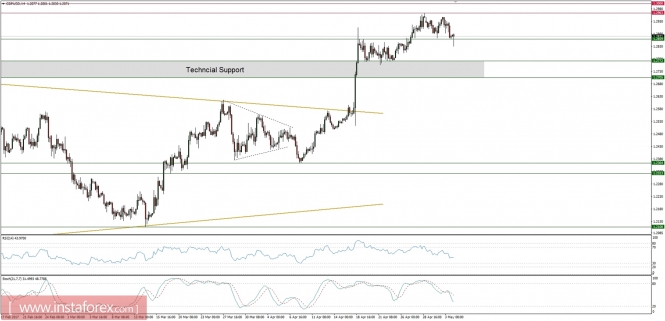

Let's now take a look at the EUR/USD technical picture on the H4 timeframe. The pair is still trading inside of the triangle/wedge pattern with the weekend gap not filled yet. Better-than-expected data from the Eurozone might spark another rally towards the technical resistance at the level of 1.0950, but the price should be capped there as the momentum is still too weak to push the price above this level. The next technical support is seen at the level of 1.0854 and 1.0820.

GBP./USD analysis for 04/05/2017:

The PMI Services data from the UK are scheduled for release at 08:30 am GMT and market participants expect a slight deterioration from 55.0 to 54.6 points for the reported month. As the services sector is the catalyst for the economic growth and the economy tends to be very consistent and predictable, so the impact on the markets might be limited unless there is an significant decline in the data.

Let's now take a look at the GBPUSD technical picture on the H4 timeframe. The technical support at the level of 1.2859 was violated, but the price bounced up immediately and currently is trading back in the middle of the range. The momentum is still biased to the downside, so this move might be the beginning of a larger correction possibly towards the technical support at the level of 1.2705.

Market snapshot: Gold declines even lower after the FOMC statements

The price of Gold has declined more towards the 38%Fibo at the level of $1,229 after yesterday's hawkish FOMC statement. The 38%Fibo and the technical support at the level of $1,226 are the key intraday support levels as any violation of this support will open the road towards the 50%Fibo at the level of $1,208. The next resistance is seen at the level of $1,239 - $1,241.