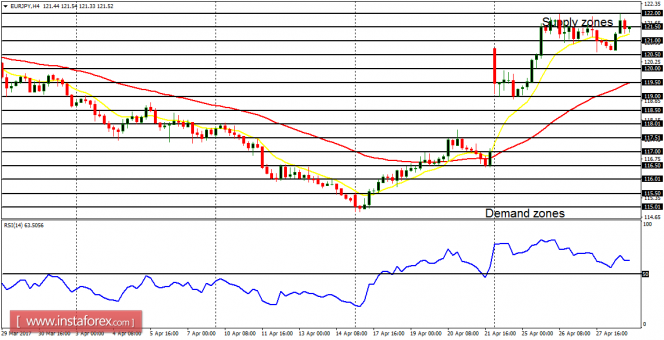

EUR/USD: The EUR/USD opened last week with strong gap-up as other EUR pairs did. Other EUR pairs moved further upwards following this gap-up – which was not filled – but the EUR/USD generally consolidated. There has been an attempt to breach the resistance line at 1.0950 to the upside, and this might meet a transitory success. However, the outlook on the market (as well as other EUR pairs), is bearish for this week. This means the gap that opened last week might eventually be filled.

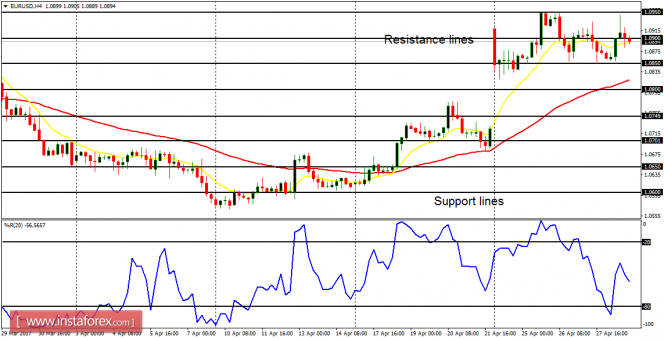

USD/CHF: There is a short-term bearishness here; plus the price has generally moved between the support line at 0.9900 and the resistance line at 1.0000. That was a sort of sideways movement in the context of a downtrend. This week and next, the market is supposed to move below the support levels at 0.9900 and 0.9800, reinforcing the current bearishness in the market. On the other hand, the market could go above the resistance levels at 1.0000 and 1.0100, creating a Bullish Confirmation Pattern on the 4-hour chart.

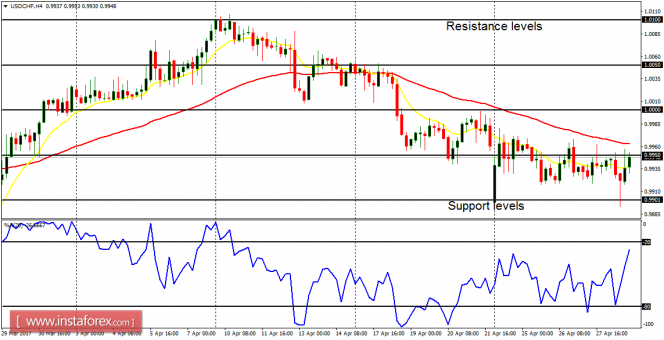

GBP/USD: The cable was trading sideways from April 24 to 26 and then went further upwards to test the distribution territory at 1.2950 before closing around that distribution territory on Friday. Since April 10, the price has gone upwards by 570 pips (though the most serious bullish movement occurred on April 18). The outlook on the market is bullish for this month – GBP pairs may be seen going upwards in May. The distribution territories at 1.3000 and 1.3050 could be reached soon. Nonetheless, this does not rule out some bearish effort along the way, but the general movement would be bullish.

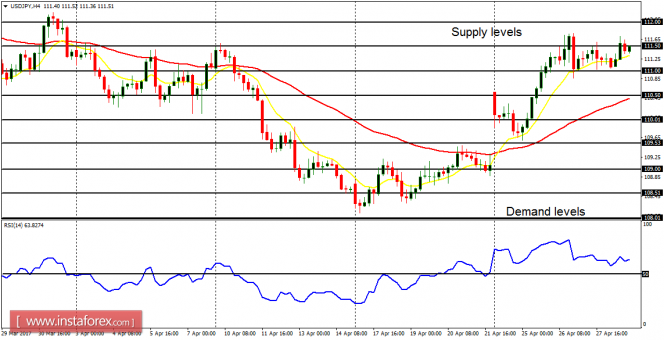

USD/JPY: The USD/JPY pair opened with a gap-up last week, and so were other JPY pairs. The price went further upwards, reaching the supply level at 111.50, and other supply levels at 112.00, 112.50 and 113.00 might possibly be tested. The upwards gap has resulted in a bullish bias in the market, but that may not last long, because the pair is likely to experience a large pullback this week. The outlook on the pair is also bearish for the month of May.

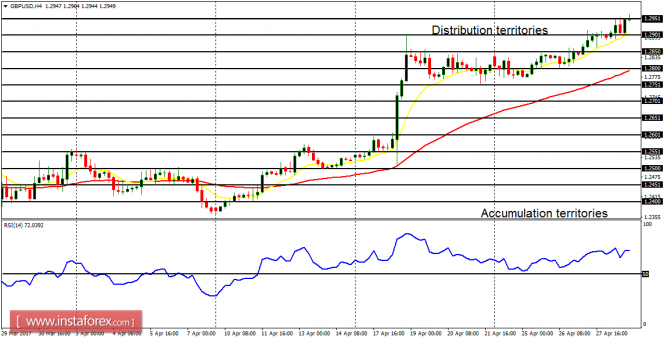

EUR/JPY: Just like other JPY pairs, this cross pair opened with a massive gap-up last week, and went further upwards on Tuesday. The price almost tested the supply zone at 122.00, and further northward journey may be experienced. However, this may not last long as the outlook on the market is bearish for this week and this month. Therefore, a serious selling pressure may assume soon.