Trading plan for 26/04/2017:

The Asian stock market started the third day of gains amid the wave of optimism triggered by the French election. The Euro is gaining ground like other European currencies, the Yen loses a little. Crude Oil is bouncing up after weak API report yesterday.

On Wednesday 26th of April, the event calendar is light in important economic releases, but global investors will keep an eye on the retail sales data from Canada and Crude Oil inventories from the US.

USD/CAD analysis for 26/04/2017:

The Retail Sales data from Canada are scheduled for release at 12:30 pm GMT and market participants expect a decrease in sales from 2.2% to 0.0% on a monthly basis. Retail Sales is a leading indicator for the economy. Rising consumer spending fuels economic growth, confirms signals of high consumer confidence and may spark inflationary pressures.

Let's now take a look at the technical picture of USD/CAD on the H4 timeframe. The bulls are in control over this market, but the overall trading conditions look overbought at this timeframe. They have managed to break out above the technical resistance at the level of 1.3596, but no follow through occurred and the price has reversed. Currently, the most important support is at the level of 1.3534. If the data are better than expected, then the price might break out below that level heading towards the next technical support at the level of 1.3493. Please notice the bearish divergence between the price and the momentum oscillator supports the view.

Crude Oil analysis for 26/04/2017:

The Crude Oil inventories are scheduled for release at 02:30 pm GMT and market participants expect another drawdown of -1,100k barrels after -1034k barrels last week. Oil price is in decline and the reason for the falls at night was the API report, according to which US Crude Oil Inventories rose by 900k barrels last week. If today's stockpiles decline even more than 1,100k barrels, then oil price will slip even lower.

Let's now take a look at the Crude Oil technical picture on the H4 timeframe. The market is trading in oversold conditions with a clear bullish divergence. The next important technical resistance is a zone between the levels of 50.00 - 50.23 and only a clear, impulsive violation of this zone with a candle close above it will bring back the bulls to control over this market.

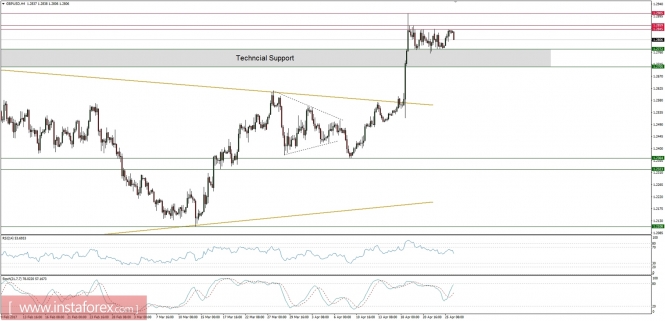

Market snapshot. GBP/USD still consolidating the gains

The price of the GBP/USD pair did not make a new high or new low as it is still in a sideway corrective cycle that might be about to end. The technical support is still at the level of 1.2772 - 1.2705 any only a daily candle close below this level would change the bias from bullish to bearish.