Trading plan for 04/04/2017:

Little movement has taken place during the Asian session, as a large part of the market (China, Hong Kong, Taiwan, and India) celebrates the feast. The climate is calm, albeit with a predominance of risk aversion, as a result of yesterday's bombing in Russia.

On Tuesday 4th March the event calendar is quite busy, so the global investors will keep an eye on Trade Balance data from the US and Canada and American Factory Orders. There is a scheduled speech from ECB President Mario Draghi later on the day as well.

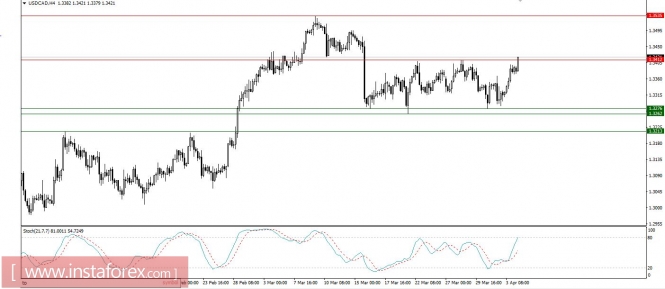

USD/CAD analysis for 04/04/2017:

The Trade Balance data from Canada are scheduled for release at 12:30 pm GMT and the market participants still expect a surplus of 0.7bln Dollars, 0.1bln less than a month ago. This means that exports are greater than imports, so the Canadian economy is still in expansion mode.

Let's now take a look at the USD/CAD technical picture at the H4 time frame before the data are released. The bulls are trying to break out above the technical resistance at the level of 1.3412. If the data are better than expected, the price might rally higher towards the next technical resistance at the level of 1.3535. If the data are worse than expected, the price should get back to the trading range.

EUR/USD analysis for 04/04/2017:

The Trade Balance data from the US are scheduled for release at 12:30 pm GMT. The market participants expect the trade deficit to narrow from -48.5bln Dollars to -46.0 bln Dollars. Moreover, the Factory Orders (scheduled for release at 02:00 pm GMT) are expected to decrease from 1.2% to 1.0% on month-to-month basis. The real action, however, is centered on the implied one-year forecast, which is set to pop 6.9%. If accurate, the gain will mark the strongest year-over-year increase in nearly three years.

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The bears are getting close to the golden trend line, but the downward momentum seems to be decreasing. If the good data do not help the Dollar, the market might dive even deeper to test the next technical support at the level of 1.0599.

Market snapshot: GOLD tries to break the trend line

The yellow metal is gaining momentum ahead of the dynamic trend line resistance around the level of $1,260. If the break out is successful, then the next resistance is seen at the level of $1,263 and it might be tested before the market conditions will become overbought. It is an important level to keep an eye on.

from www.instaforex.com https://www.instaforex.com/forex_analysis/90093/?x=BPDZ