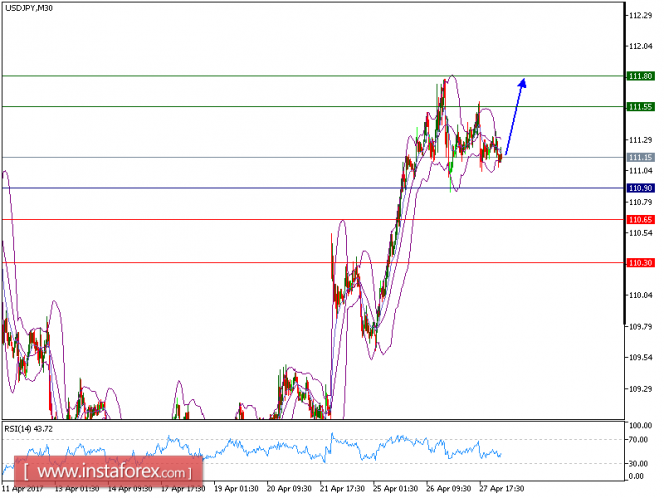

USD/JPY is expected to trade with a bullish bias above 110.90. The pair is consolidating around its 20-period and 50-period moving averages. The relative strength index is below its neutrality level at 50. Nevertheless, 110.90 represents a significant key support level, which should limit the downside potential. Even though further consolidation cannot be ruled out, its extent would be limited.

As long as 110.90 holds on the downside, look for a further upside toward 111.55 and even 111.80 in extension.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 111.55 and the second one at 111.80. In the alternative scenario, short positions are recommended with the first target at 110.65 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 110.30. The pivot point is at 110.90.

Resistance levels: 111.55, 111.80, and 112.00

Support levels: 110.65, 110.30, and 109.85

The material has been provided by InstaForex Company - www.instaforex.com