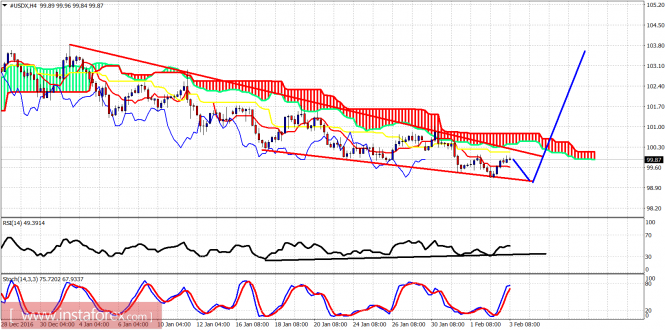

The Dollar index is bouncing off the lower wedge boundary. The price is still inside the downward sloping wedge and below trend resistance. The Dollar index is expected to make volatile moves today as we wait for the announcement of the Non-Farm Payrolls in the USA.

Blue lines - possible path ahead

The Dollar index is falling inside the wedge pattern. The trading range is getting narrower. I expect new lows towards 99 but I prefer to be neutral and wait for the breakout above the wedge to enter long positions. The RSI is diverging. This is another warning that the trend might soon reverse to the upside.

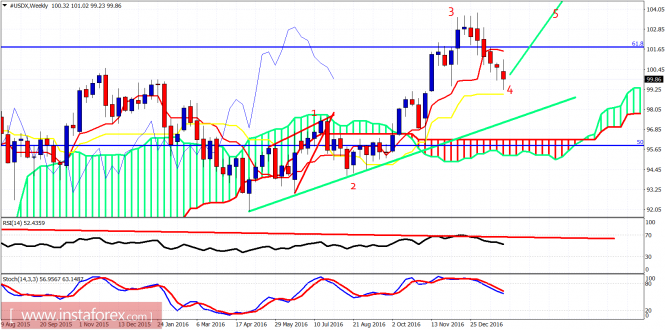

Green line - long-term support trendline

In the weekly chart of the Dollar index I believe the upside has still unfinished business. We could see new highs towards 105 if the Dollar index reverses soon. It is important for the bulls to hold the weekly kijun-sen (yellow line indicator) which was our initial target.

The material has been provided by InstaForex Company - www.instaforex.com