The euro bulls are gaining momentum. It seems that the euro has taken advantage of holidays in the US, and the trend is changing dramatically for the US currency. Investors were overwhelmed by the negative coronavirus news at the end of the week and still cannot fully digest it. Their first reaction to the news was rather strong, at least in the beginning. Their further perception of the situation will depend on the estimates of the World Health Organization.

Since the main support for USD comes from the stimulus cut and the expected rate hike in 2022, news of a new virus strain undermined the position of the greenback. The outbreak of an even more dangerous and vaccine-resistant virus could harm the US economy. This means that against this backdrop, the Fed is unlikely to accelerate the reduction of its bond purchases and raise the rates earlier than planned.

Investors have started to reassess the forecast for the Fed's monetary policy. According to the CME Group FedWatch Tool, markets have already priced in a 34% chance that the key rate will remain unchanged by June 2022. Back on Thursday, it was about 18%. Treasury yields fell by more than 7% from the opening price.

At the moment, the coronavirus issue can benefit the US dollar only if we consider risk assets. It is difficult for the greenback to strengthen against the euro relying on this factor. Moreover, the markets prefer not to take into account the divergence between the monetary policies of the Fed and the ECB.

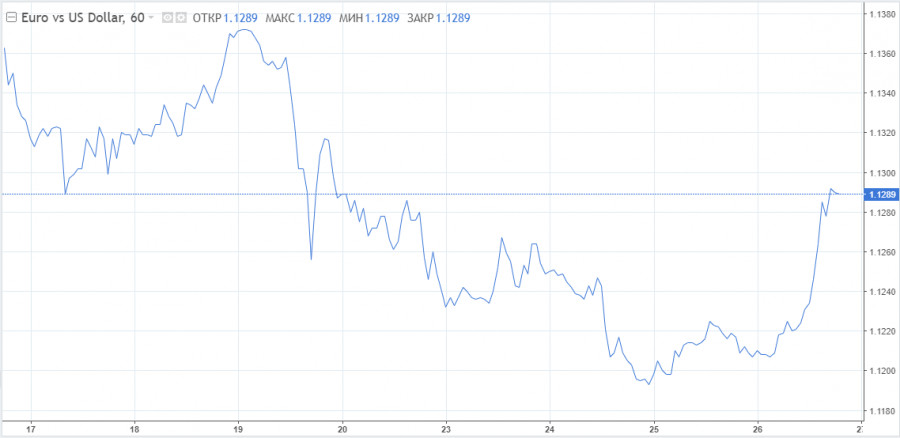

Thus, the EUR/USD pair managed to hold near the level of 1.1200. Probably, the current support has turned out to be surprisingly strong. A couple of days ago, traders almost gave up on the euro. Today, however, they point out the euro's stability and say that it is not as weak as it may seem.

The strategists have two different views on the pair. Some advocate for the growth of the euro, saying that it is too early to state the euro's defeat. There is still time for the pair to return closer to the 1.1600 level by the end of the year.

Others do not believe that on Friday the European currency will be able to show impressive growth. The rally in the US dollar is likely to continue through the next week after a short pause and an expected correction.

The panic over the coronavirus should calm down soon unless no worrisome news appears over the weekend.

Experts from the WHO say that for now "there is no need to worry." An unprecedented number of mutations can make a virus strain "unstable" and prevent it from spreading.

Meanwhile, the authorities of Great Britain and Israel have imposed travel restrictions on several African countries, while other countries remain silent.

The US has briefly commented on the situation. According to the Director of the National Institute of Allergy and Infectious Diseases, Anthony Fauci, at the moment there is no evidence that the new virus strain has penetrated into the United States. Washington will consider appropriate measures when more information becomes available. Fauci also added that the US was in close contact with scientists from South Africa.

Meanwhile, the EUR/USD pair has tested the 50-SMA at 1.1280 today, confirming its rise towards the psychological level of 1.1300. Consolidation above this level promises good prospects for the euro in the short term.

The nearest support levels are located at 1.1230, 1.1200, and 1.1185

The material has been provided by InstaForex Company - www.instaforex.com