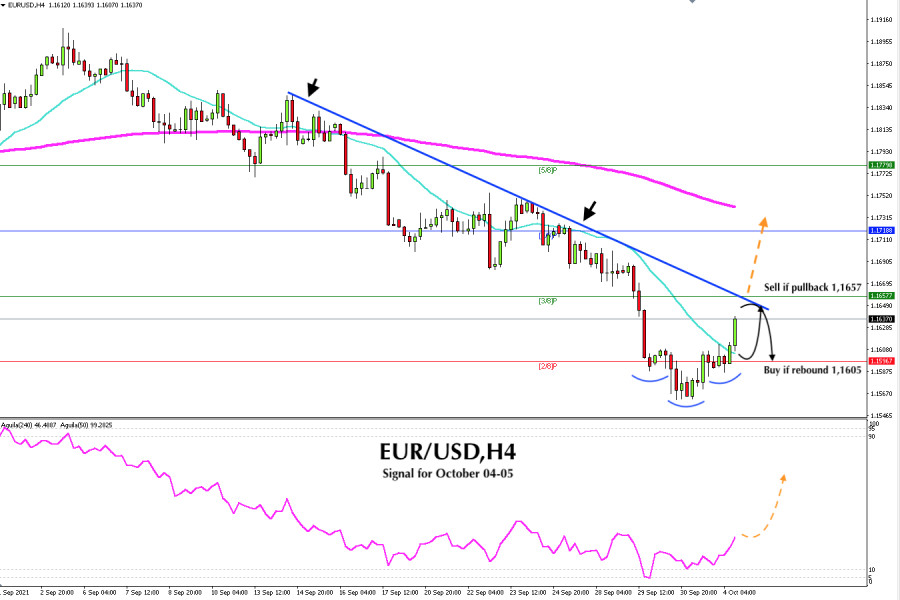

The EUR / USD pair is rebounding from the 1.1560 level. It has regained almost 90 pips of recovery. This movement is also due to the inverted shoulder head shoulder technical pattern. Meanwhile, the pair is approaching to meet its goal at 1.1657.

According to the 4-hour chart, EUR/USD is trading above the SMA of 21 and below the bearish channel. If this upward movement continues, the pair is likely to make a sharp break from the downtrend line and could have a relief from the downward pressure exerted by the dollar. The next target will be at the 200 EMA located at 1.1750.

Meanwhile, the short-term outlook for EUR / USD is seen on the negative side, first, due to the downtrend channel that cannot be beaten and, second, because the price is below the 200 moving average, which may hamper any recovery of the Euro in the short term.

On the other hand, the dollar index opened the trading operations below the SMA of 21, which gave an advance to the Euro to reach today's high at 1.1640. If the decline in the dollar index continues and it falls below 8/8 of murray, it will favor the upward movement of the Euro, so EUR/USD may break the bearish channel and reach the level of 1.1750.

The most significant news in the economic calendar this week is the US employment report (NFP) on Friday, although there will also be inflation figures and other employment indicators. These could reaffirm expectations of a cut in the Federal Reserve's bond purchase program. If the data is positive, the Euro could resume its main downward movement.

The market sentiment report shows a figure of 69.49% of traders who are buying EUR / USD. If this figure is maintained or rises, it will be a sign of weakness and the Euro could escalate again to the support of 1.1560 and up to the psychological level of 1.1500.

The eagle indicator favors the bullish movement for the Euro, with an increase in the trading volume and market strength. If the pair breaks and consolidates above 1.1650, the signal will be confirmed and it will be a good point to buy.

Support and Resistance Levels for October 04 - 05, 2021

Resistance (3) 1.1740

Resistance (2) 1.1690

Resistance (1) 1.1655

----------------------------

Support (1) 1.1611

Support (2) 1.1586

Support (3) 1.1542

***********************************************************

Trading tip for EUR/USD for October 04 - 05, 2021

Sell if it makes a pullback 1.1657 (3/8) with take profit at 1.16200 and 1.1596 (2/8), stop loss above 1.1692.

Buy if it rebounds at 1.1605 (SMA 21) with take profit at 1.1657 and 1.1718, stop loss below 1.1570.

The material has been provided by InstaForex Company - www.instaforex.com