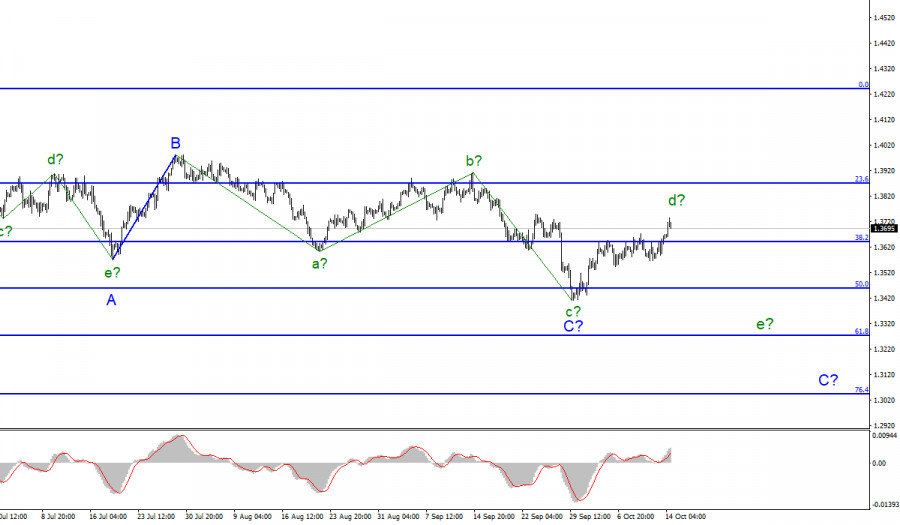

Wave pattern

The wave counting for the Pound/Dollar instrument has become more complicated and now it is expected to continue building a downward trend section. The instrument made a successful attempt to break through the low of the previous waves a and e. Thus, adjustments were made to the wave pattern and now it has acquired the form of a downward trend section, which may be corrective in nature. This assumption is prompted by the internal structure of the proposed wave A, which cannot be called impulsive. The assumed wave c in C also assumed an absolutely non-impulsive form in this section of the trend. There are only three waves visible in it. However, within the corrective structures, wave patterns can be either three-wave or five-wave and take a very complex form. Thus, after completing the construction of the current wave, presumably d in C, I expect a resumption of the decline in quotes within the framework of wave e in C. However, it should also be taken into account that wave C can turn out to be three-wave. In this case, the construction of a new upward trend section could now begin.

Good statistics or bad, the markets still cannot break through 1.3643

The exchange rate of the Pound/Dollar instrument moved with an amplitude of about 35 basis points on Thursday. This is about the same as the day before and the day before that. However, today the markets managed to make a successful attempt to break the 1.3643 mark. If the current wave count is correct, then the increase in quotes may end today or tomorrow.

There was no news background for the Pound/Dollar instrument today, but Britain has been a very generous provider of non-economic news in recent weeks. More recently, the market has had to react to the fuel chaos in the UK. Then it became known that there was a shortage not only with fuel and that the deficit could last until Christmas. And in addition, once every few weeks, Britain considers it its duty to put forward a new threat to the European Union, which stubbornly does not want to be led by a country that has left it at will.

Note that Boris Johnson considers the Northern Ireland protocol ineffective and insists that Brussels start new negotiations on this issue. However, the EU is not going to change the already signed agreement in favor of Britain, and only because Britain wanted to. The European Union has expressed a desire to find a compromise but is not going to blindly follow London's lead. Britain, on the other hand, threatens to apply article 16, which allows, in force majeure circumstances, to refuse to fulfill certain points of the Brexit agreement unilaterally.

General conclusions

The wave pattern has changed dramatically in recent weeks. It received a downward view, but not an impulse one. However, since the construction of an upward wave is continuing now, I advise you to wait for its completion before selling the instrument in order to build the expected wave e in C. A successful attempt to break the 1.3643 mark, but from top to bottom, maybe a confirmation of the readiness of the markets for new sales.

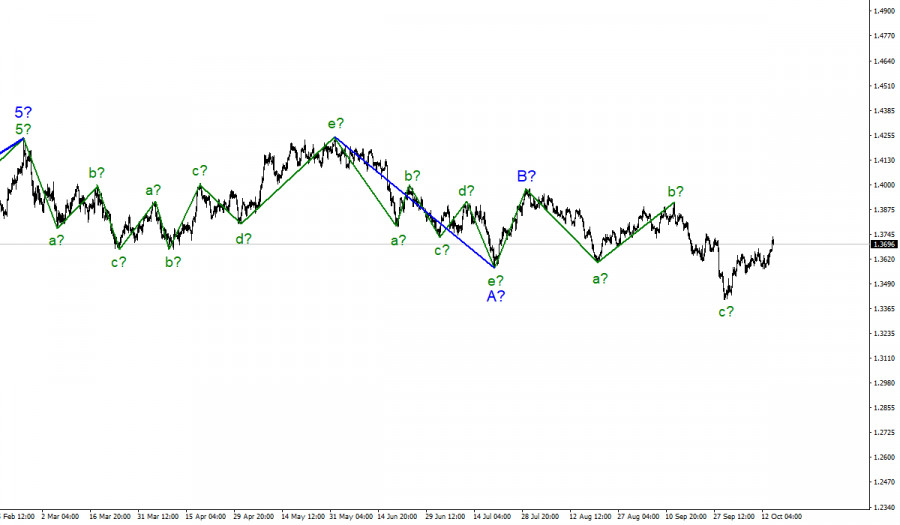

The upward section of the trend, which began its construction a couple of months ago, has taken a rather ambiguous form and has already been completed. The construction of the upward trend section has been canceled and now we can assume that on January 6, the construction of a new downward trend section began, which can turn out to be almost any size.

The material has been provided by InstaForex Company - www.instaforex.com