To open long positions on EUR/USD, you need:

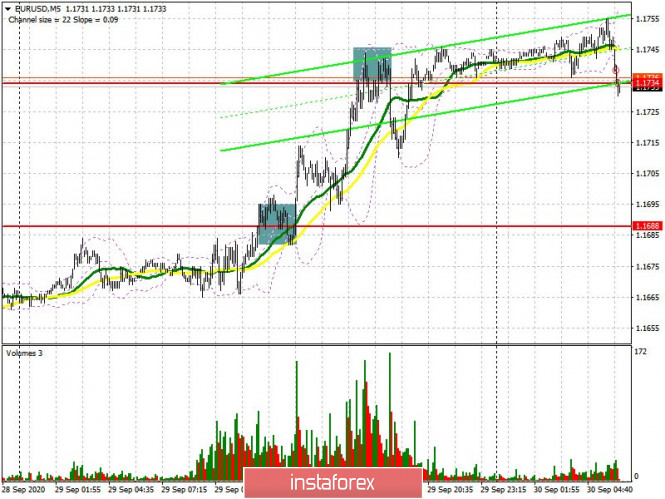

The euro strengthened during the US session, and the US data on the consumer confidence indicator did not provide significant support to the dollar. The 5-minute chart clearly shows how the bulls took resistance at 1.1688 in the morning, settling on this area made it possible to update weekly highs. The 1.1734 target was reached, from where I advised you to open short positions in anticipation of a downward correction, which happened.

The current situation is rather difficult, since the 1.1734 level is vague and it is not entirely clear how things will proceed. European Central Bank President Christine Lagarde's speech could put pressure back on the pair. Therefore, I recommend opening long positions from 1.1734 only when a false breakout forms on 1.1734, with the main goal of rising to a high of 1.1779, which is where I recommend taking profit. Consolidating above 1.1779, due to good fundamental data for the eurozone countries, will make it possible to increase long positions with the goal of updating 1.1826. In case EUR/USD falls below the 1.1734 level in the first half of the day, I recommend waiting until support at 1.1688 has been updated, slightly above which the moving averages pass, and opening long deals from there immediately on a rebound, counting on a correction of 20-30 points within the day. It is also possible to buy the euro immediately on a rebound from the low of 1.1640, testing it will lead to a reversal of the entire upward correction that has been observed this week.

The Commitment of Traders (COT) reports for September 22 showed that both long and short positions increased, but there were more of the first ones than the latter, which led to an increase in the delta. Apparently, buyers are attracted to such a low euro rate for the first time in three months, even despite the risk of a second wave of coronavirus infection across Europe. Thus, long non-commercial positions increased from 230,695 to 247,049, while short non-commercial positions only increased from 52,199 to the level of 56,227. The total non-commercial net position also increased over the reporting week to 190,822, against 178,576 a week earlier, which indicates bullish market sentiment in the medium term. The more the euro falls against the US dollar, the more attractive it will be for new investors.

To open short positions on EUR/USD, you need:

Sellers need to rehabilitate, and this can only be done by returning EUR/USD to the support level of 1.1734. Testing it from the bottom up on the reverse side forms a new entry point into short positions with the main goal of falling to the support area of 1.1688, which is where the moving averages pass, playing on the side of the bulls. The 1.1640 level will be a distant target, where I recommend taking profits, but this is only applicable if Lagarde mentions the need for additional stimulation of the European economy in the face of a new wave of the coronavirus pandemic. If the EUR/USD pair continues to strengthen its positions, then you should return sell positions after the pair grows and a false breakout appears in the resistance area of 1.1779. I recommend opening short deals immediately on a rebound only from a larger high of 1.1826, counting on a downward correction of 20-30 points within the day.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which implies that an upward correction will form in the euro.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

The breakout of the upper border of the indicator around 1.1760 will help the euro grow. In case the pair falls, support will be provided by the lower border of the indicator at 1.1688.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.