4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -37.7517

For most of the first trading day of the week, the European currency continued to adjust. Thus, we have witnessed the biggest correction in the past month. Technically, the future prospects of the euro/dollar currency pair now depend on whether there will be an overcoming of the moving average or a rebound. If the former, then sellers will finally get a real chance to start forming a downward trend. We have repeatedly stated that the situation in the US continues to be very difficult, however, traders have repeatedly played it back, as only in the last month, the euro rose by 7 cents, and a few weeks before that by another 6. Thus, just two and a half months of increased pandemics in America and mass riots, the US dollar lost positions by about 12 cents. For comparison, with a favorable fundamental background for the whole of 2019, the dollar rose by 2 cents against the euro. Thus, we are almost sure that the euro currency will now start to fall significantly, since at the moment this currency is already heavily overbought. At a minimum, you need to see a major correction before the upward movement can resume. Of course, if the situation in the United States does not change for the better, the euro will continue to rise in price, but not immediately and so sharply.

On Monday, August 3, in the EU countries, business activity indices in manufacturing sectors were published. In Spain, Italy, France, Germany and the EU as a whole, business activity indices exceeded the forecast values and all amounted to more than 50. Unfortunately, the fact that the spheres of production and services are currently recovering (it simply can't be otherwise, since quarantines and lockdowns have been canceled) was already known to everyone without these reports, so the indices had no effect. No more publications were planned in the European Union for yesterday.

Meanwhile, despite the fact that the US dollar has started to get more expensive, the situation with "coronavirus" in the US is not improving. As of Monday, there were only 4.6 million cases in the country. Every day, 60-70 thousand new cases continue to be recorded, and the total number of deaths is already 155 thousand. However, experts note that COVID-2019 is almost completely out of control. Health experts predict that another 40,000 deaths from the "coronavirus" will be recorded in August. Deborah Birks, coordinator of the White House working group on the fight against coronavirus, said on Monday: "We are in a new phase. The current situation is different from what we had in March and April. The virus has spread enormously both in rural areas and in cities." Despite such a pessimistic statement by Deborah Birks, speaker of the House of Representatives of the US Congress Nancy Pelosi said that she does not trust the person of Donald Trump and believes that the coordinator of the "coronavirus" misinformed people. "I think the president is spreading misinformation about the virus, and she is his protege, so I don't have confidence in her," said Pelosi, a Democrat. However, it is difficult to disagree with her, recalling all of Trump's statements about the virus, starting in March. Now it is also difficult to disagree with the fact that the "coronavirus" practically puts an end to Trump's hopes of re-election to a second term, since Americans believe that the current government has not coped with the epidemic. Well, the more attention to the epidemic and the more victims and cases of the disease, the more Trump's chances of winning fall. Thus, it is very profitable for the US president to spread misinformation about the virus and its scale in the US, especially given the fact that misinforming for Trump is an absolutely habitual occupation. We are reminded of research by major media outlets that counted more than 20,000 cases of misinformation from Trump during his entire term as president.

Also, the United States is now faced with a new serious problem concerning assistance to the American economy. On July 31, payments of unemployment benefits allowances that were agreed to by the previous stimulus package ended. Now Democrats and Republicans need to agree on a new aid package. Democrats are in favor of maintaining the "coronavirus" allowance for benefits of $ 600 a week, at least until the end of 2020. Republicans believe that such large allowances deprive the unemployed of motivation to look for a new job, since often the total unemployment benefit significantly exceeds their wages. They suggest lowering the allowances to $ 200 a week and simultaneously developing a package where the amount of assistance will depend on their salary and should not exceed 70% of it. According to Republicans, such payments will not allow the unemployed to descend into poverty, but will motivate them to look for work, and not sit on unemployment benefits forever. It is reported that about 20 million unemployed people are currently registered in America. However, according to congressional speaker Nancy Pelosi, "Saturday's talks were productive," so there is hope that the aid package will still be accepted. Treasury Secretary Steven Mnuchin and Senate Democratic leader Charles Schumer confirmed this information. In this situation, we must recognize that the Republican's proposal looks more reasonable and logical in the current conditions, since in difficult times for the country, you need to "tighten your belt", and not throw money right and left. But the problem is that the position of the Republicans is not popular among the Americans themselves, who blame the "coronavirus", the crisis, and unemployment on the government and, of course, do not want to be deprived of the $ 2,400 allowance per month.

On Tuesday, August 4, no important macroeconomic information will be available to traders. The EU and US event calendar is empty. Thus, traders will trade based on technical factors (we discussed them in the first paragraph), as well as pay attention to the general fundamental background, which remains completely in favor of the US currency. We believe that technical factors are stronger at this time, as buyers have started to take profits on long positions. This means that you will need very good reasons to force them to make new purchases of the European currency near two-year highs.

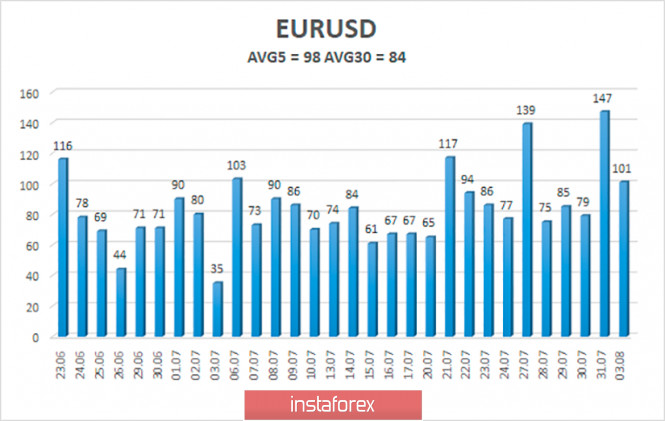

The volatility of the euro/dollar currency pair as of August 4 is 98 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1655 and 1.1851. The upward reversal of the Heiken Ashi indicator signals the end of the downward correction within the framework of the continuing upward trend.

Nearest support levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest resistance levels:

R1 – 1.1841

R2 – 1.1963

Trading recommendations:

The EUR/USD pair continues to adjust. Thus, at this time, it is recommended to continue to consider the possibility of opening purchases with the goals of 1.1841 and 1.1963, but to do this, you need to wait for the Heiken Ashi indicator to turn upward. It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first targets of 1.1655 and 1.1597.

The material has been provided by InstaForex Company - www.instaforex.com