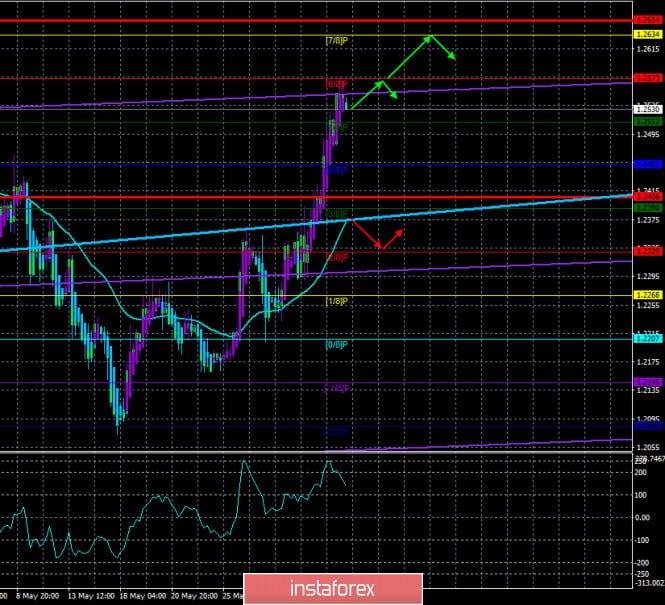

4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 104.8194

The British pound continued to break all records of strengthening against the US currency on the second trading day of the week. Since the beginning of the trading week, the pair has added more than 250 points, despite the fact that we have not seen macroeconomic statistics from the UK for more than a week, and the fundamental background from the Foggy Albion is mostly negative. However, at this time, America is frankly "outperforming" Britain in terms of the amount of negativity that the country has faced. Therefore, even without any signs of a correction, the pound continues to be bought by traders and the US dollar continues to be sold.

In an article on EUR/USD, we described in detail the situation with mass protests, pogroms, and rallies in the United States. We also discussed in detail why everything that is happening in the country is almost guaranteed to put an end to all of Trump's hopes for re-election in November 2020. In addition, there are also official studies conducted by well-known companies like YouGov, which has repeatedly correctly predicted the outcome of elections. According to the latest research from this company, the democratic presidential candidate Joseph Biden is now ahead of Donald Trump in the election ratings by 10%. Data from other research companies and resources suggest that Biden can already count on 272 electoral votes at the moment, while 270 votes will be enough to win the election. In addition, Trump is again criticized by almost half of the country. He is criticized by state governors, doctors, Democrats, and ordinary citizens who in just a few months have stopped living in a prosperous country and "moved" to a country with 30 million unemployed people, who just have time for rallies and protests that covered 45 states out of 50. Trump is not used to being criticized, but previously the US president was always ready to take certain actions both in relation to external opponents and in relation to internal enemies. Now, after a week of rallies and protests in the US, Trump is only threatening. Threatens to resort to the forces of the army, threatens to "harshly" suppress rallies, threatens the family of the deceased George Floyd. And does not perform any actions. Therefore, instead of returning to normal life, the United States is now sliding into an even stronger crisis, not only financial, but also social, and a crisis of power.

In the UK, the situation is better than in the US for the first time in a long time. At least there are no riots in the Foggy Albion right now. There are only financial problems, and a completely uncertain future. The country's government, represented by Donald Trump's "younger brother" Boris Johnson, is also mercilessly criticized and experts say that the lack of a deal with the European Union will finish off the British economy, which is already suffering after a 4-year process of "divorce" from the European Union, as well as the "coronavirus" pandemic, from which Britain suffered the most in Europe. On Monday, a new round of negotiations between the groups of Michel Barnier and David Frost began, and almost immediately it became known that the European Union sees no reason to offer London the same favorable terms of the deal that were offered to other partners. The position of Brussels remains as simple as possible. It took 7-8 years to reach agreements with other countries. London wants to achieve an even better free trade agreement without making any concessions and within just 9-10 months, 3 of which have already passed. Thus, it is highly likely that the current round of negotiations will also end in failure. And in the second half of June, Boris Johnson will personally go to Brussels, who intends to hold talks personally with Ursula von der Leyen. However, it is unclear what exactly Johnson is going to offer to the European Union and the European Commission, and why he will not offer it now? And if he is not going to make any concessions, then why is he going to Brussels at all? In general, in the coming months, the British Prime Minister risks getting another defeat in his liability. Recall that the entire list of his victories is limited so far to his personal victories and the Conservative Party in the elections (agree, this is hardly a government victory for the country), as well as the fact that Brexit will still be brought to an end this year. This is what the "majority" of British people, "as much as" 52%, wanted. Thus, 48% of the almost one hundred percent will be dissatisfied. In the past year, Scotland has continued to push for a new independence referendum and wants to leave the United Kingdom to remain in the EU. Boris Johnson is criticized for the lack of trade deals with the United States and the Alliance. His political ratings have started to fall while the political ratings of Keir Starmer, the new Labor leader, are rising and, according to some reports, he has already overtaken Johnson. This means that a new political crisis may soon occur in the UK. The current government has not coped with the "coronavirus" pandemic, can not agree on the terms of a "soft divorce" with the EU, and ordinary Britons will pay for all this. Their health, their lives, their money.

Thus, for the time being, the pound is getting more expensive and, if the situation in the United States does not improve, it may continue to grow, but its prospects, based on the fundamental background from the UK itself, remain extremely vague. Well, at the same time, China decided to suspend the purchase of some farm products from the United States. Recall that according to the latest trade agreement signed in January this year, China must annually purchase agricultural products in the United States for certain amounts, which are estimated in the tens of billions of dollars. Media reports that the reason for this decision was the regular threats of the White House to impose sanctions against China in connection with the situation around Hong Kong. According to insider information, China is also ready to completely abandon the "first phase" agreement of January 15, if Washington continues to put pressure on China, impose sanctions and duties. We believe that, therefore, the hard-negotiated trade deal at the beginning of this year is in danger of being derailed. This means that the world is on the verge of a new bad weather in the form of another or more powerful and destructive confrontation between Beijing and Washington, which will again hit the world economy.

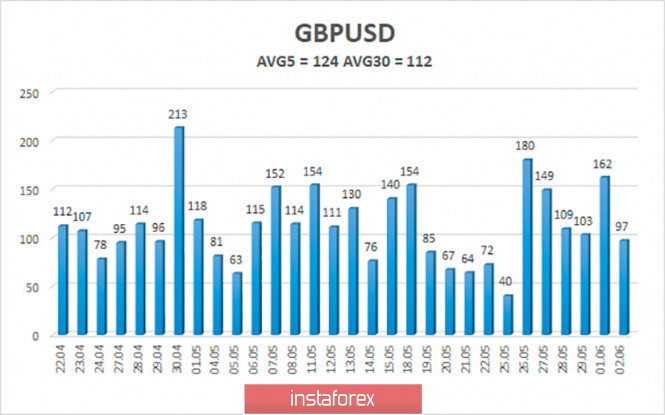

The average volatility of the GBP/USD pair has started to decline again and is currently 124 points. For the pound/dollar pair, this indicator is "high". On Wednesday, June 3, thus, we expect movement within the channel, limited by the levels of 1.2406 and 1.2654. A downward turn of the Heiken Ashi indicator will indicate a downward correction.

Nearest support levels:

S1 – 1.2512

S2 – 1.2451

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2634

R3 – 1.2695

Trading recommendations:

The GBP/USD pair continues to move up quite strongly on the 4-hour timeframe. Thus, today it is recommended to continue trading the pound/dollar pair for an increase with the goals of 1.2634 and 1.2654 and keep the longs open until the Heiken Ashi indicator turns down. It is recommended to sell the pound/dollar pair when the bears manage to return to the area below the moving average, with the first targets of 1.2329 and 1.2268.

The material has been provided by InstaForex Company - www.instaforex.com