4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - sideways.

CCI: -63.5571

Well, if a few days ago we doubted that the euro/dollar pair could go into a sideways movement since there were a sufficient number of technical factors that speak in favor of the beginning of a new downward trend, now we can say with confidence that the euro/dollar quotes are trading in a side channel. During the past day, the pair again failed to continue the downward movement, so a new upward turn was made and a new round of upward movement was started with a new overcoming of the moving average line, which ended very quickly. At the same time, the prospects for the European currency remain very vague, since no positive news is coming from Europe right now. However, the situation in America now can not be interpreted as "positive". The fact is that in recent weeks, the problem of the "coronavirus epidemic" has again become acute across the ocean. At least, this is what most analysts and representatives of the healthcare sector believe. However, we believe that the first wave was not completed in the United States either. Just in contrast to the more conscious countries that were not in a hurry to remove quarantine measures, and more far-sighted rulers who think not only about the upcoming elections and political ratings, there was no decline in the growth rate of the virus in America. This is why the United States remains in first place in the world in terms of the number of diseases. This is not about the number of tests performed or the size of the country's population. And the country probably does not need to say what the repeated "lockdown" threatens.

On the first trading day of the week, there were no important reports or events in Europe or the United States. In Germany, the consumer price index for June was published, which was better than the forecast values and amounted to 0.9% y/y. However, this is not surprising, since the European economy has begun to recover, and Europe has managed to stop the spread of infection with the help of strict quarantine measures. Even in the most infected countries, such as Italy and Spain, the daily increase in new cases is minimal. Therefore, it is the European economy that can now fully embark on the path of recovery, although Christine Lagarde expects it to shrink by almost 9% by the end of 2020, while in America they expect a fall of 5-6%. However, its future will still depend on the results of the fight against "coronavirus" infection. If the second wave of the disease begins in Europe, then the growth of the European GDP will be slowed down.

At the same time, after a long break, the chief epidemiologist of the United States Anthony Fauci went on the air, who said that the situation with the"coronavirus" in the United States is beginning to become very serious. Anti-records for the number of new cases are updated daily in the United States. However, many health officials believe that the actual number of infected people in the United States is much higher than the official number. In general, all this situation does not add optimism to buyers of the US currency. So far, the dollar is not under pronounced pressure, but in the future, if COVID-2019 continues to spread across the US at the same pace, it will affect the US economy. Accordingly, the country's macroeconomic indicators may continue to decline instead of recovering.

Meanwhile, Donald Trump just can't live a day without a scandal. On June 28, Donald Trump posted a video of one of his supporters on his Twitter page, which clearly shows a white man shouting the phrase "White Power" several times. The fact that the American President deliberately retweeted this video to his page means that he approves of what is happening in the video. Naturally, a new racist scandal immediately unfolded on the network, and the video was deleted a few hours later. The White House immediately made it clear that Donald Trump did not notice any racist chants and does not support them. However, most Americans who do not encourage Trump's policies immediately concluded that the president has racist tendencies. To be honest, we continue to believe that Trump is doing everything possible not to be re-elected in November 2020...

On the second trading day of the week, the European Union is scheduled to publish the consumer price index for June in a preliminary value. It is expected that the main indicator in annual terms will be 0.1%, while the base indicator (excluding food and energy prices) may be 0.8% y/y, continuing to slow down. However, much more important and significant events are planned for the second half of the day, when the US will host speeches by the head of the Federal Reserve Jerome Powell and Treasury Secretary Steven Mnuchin. Naturally, it is not known what the two main financiers of the country will say, but these are potentially two very important speeches. We continue to hold our opinion that in the current conditions, Mnuchin and Powell simply can't tell the markets anything but negative. For sure, both economists will touch on the topic of a new package of financing for the US economy, as well as the topic of "coronavirus", which can lead to a new downturn in the economy. If their speech is overly "dovish", the US dollar may continue its decline, which began at the beginning of the new trading week. Also scheduled for the US trading session is a speech by ECB Vice-President Luis de Guindos, who, in turn, can share prospects and forecasts related to the European economy.

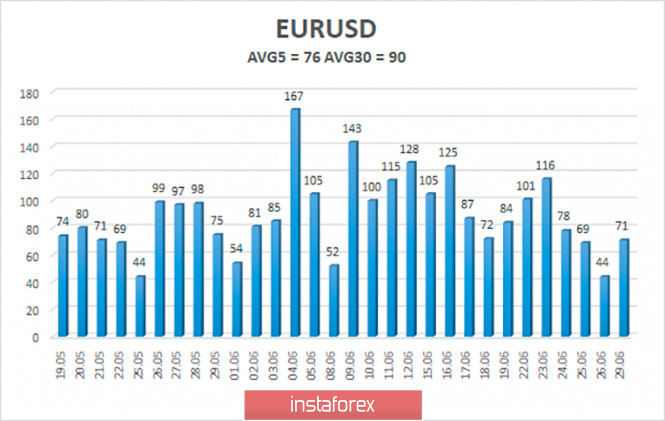

The average volatility of the euro/dollar currency pair as of June 30 is 76 points and is characterized as "average", but in general, the volatility continues to decrease. We expect the pair to move today between the levels of 1.1153 and 1.1305. A new turn of the Heiken Ashi indicator upward will signal a new round of upward movement, possibly within the side channel.

Nearest support levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1475

R3 – 1.1597

Trading recommendations:

The euro/dollar pair managed to change the direction of a movement twice over the past day and finally settled again below the moving average line. Thus, at this time, short positions with the goals of 1.1153 and 1.1108 are relevant, which it is recommended to keep open until the MACD indicator turns up. At the same time, there is a probability of a price rebound from the level of 1.1170 – the previous local minimum. It is recommended to return to buying the pair not before fixing the price above the moving average with the goals of 1.1305 and 1.1353, but these goals are very close, and the probability of a flat is high.

The material has been provided by InstaForex Company - www.instaforex.com