GBP/USD

The pound/dollar pair, after a more or less tangible downward correction, resumed the upward movement and came close to the highs of April 14 and 30 - 1.2647 and 1.2642. These levels have not been reached at the moment, but the likelihood that the British pound will grow and end near them is high. The ascending channel failed to keep the pair inside, although we warned about this yesterday. As a result, we have a continuing upward trend, and the upward movement can continue if buyers manage to overcome the important levels of 1.2647 and 1.2642. The entire trend is still supported by only one upward trend line, which runs quite far from the price. Therefore, sellers can wake up and begin to slowly sell the pair near the 1.2642 level. But we recommend that you wait for good sell signals and only then trade the pair for a fall.

GBP/USD 15M

The upper linear regression channel turned sideways on the 15-minute timeframe, which is almost the only sign of possibly starting a downward correction and the end of an upward trend. Interestingly, while the lower channel is again directed up.

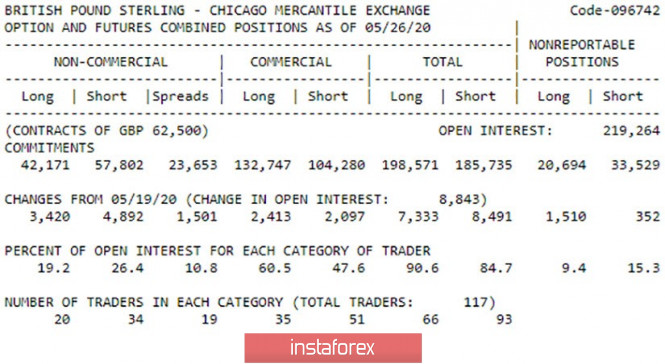

COT Report

Despite the fact that in total the demand for the pound sterling did not change among all major market participants during the reporting week (a total of 8600 contracts for buying and selling were opened), professional traders mainly bought the pound sterling at +5205 contracts, and at -1,686 transactions for contracts that got rid of the sale. Thus, the mood of traders remains upward, and in principle, the situation has not changed at the end of last week. The GBP/USD pair continued to grow in the new week, which means that demand for the pound is not declining. The new COT report may show even greater strengthening of the position of large buyers.

The fundamental background for the British pound remains negative despite the fact that this currency continues to go up in tandem with the US dollar. There were practically no important macroeconomic statistics in the UK and the United States this week, but the last trading day of the week will slightly correct this omission. Data on unemployment, NonFarm Payrolls and changes in average wages for May will be released in the United States. We believe that the last report can be ignored with a high degree of probability, and the first two with a lower one. In any case, nothing unexpected in statistics from overseas. The number of new jobs will again be negative, and the unemployment rate may jump up to 20%. However, given that the dollar has sharply fallen over the past two weeks, these reports may not add to the benefits of the euro and the pound. Moreover, no matter how bad the reports from the United States turn out to be, quotes of both pairs could still significantly fall tomorrow, since the downward correction is still brewing in both cases. Thus, we believe that technique is the most important right now. No important information from the UK has been received in recent days, but the general fundamental background remains negative.

There are two main scenarios as of June 5:

1) The initiative for the pound/dollar pair remains in the hands of buyers, who so far stick with purchases while aiming for 1.2642 and 1.2664. However, opening new long positions now carries increased risks, since the pair is near a strong level. We recommend considering new purchases of the British pound only after overcoming 1.2642 and 1.2647. In this case, the bulls will confirm their serious intentions for further growth.

2) Sellers continue to remain in the shadow and will be ready to return to the market if buyers depart from the level of 1.2642 (1.2647). Short positions can even begin to be considered near the level of 1.2642 (on the rebound), but in this case they will be openly counter-trend, and therefore dangerous. We consider the minimum necessary condition for sellers to overcome the area of 1.2403 - 1.2423. Then it will be possible to sell the pair with the goals of the trend line (1.2355) and Senkou Span B line (1.2276). In this case, Take Profit will be from 45 to 120 points.

The material has been provided by InstaForex Company - www.instaforex.com