EUR/USD 1H

The EUR/USD pair resumed the upward movement on the hourly timeframe on June 10. Thus, the correction turned out to be extremely weak, and the bears showed that they were extremely few in the market, as well as their desire to buy the US dollar. Yesterday, during the publication of the results of the Federal Reserve meeting, the euro/dollar began to rise again, so the hope that the US central bank will support its currency collapsed. The pair reached the resistance level of 1.1417 very quickly and does not show any signs of starting a new round of correction. Quotes of the pair even returned to the upward channel, which, of course, is now no longer relevant. Thus, based on the results of the past trading day, we can only state that buyers remain masters of the situation, and sellers remain on the fence. Thus, the European currency can continue to rise in price.

EUR/USD 15M

There was no reason to expect the correctional movement to begin on the 15-minute timeframe on Wednesday. Both linear regression channels are still directed upward, so the upward trend remains valid in the short term.

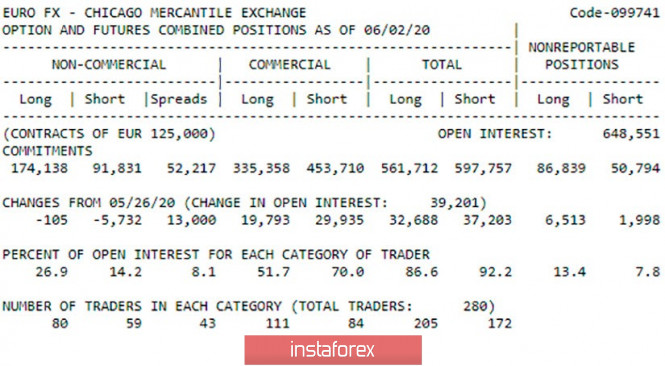

COT Report

The latest COT report showed what we did not expect to see. It turned out that professional traders did not increase purchase contracts during the reporting week, but closed contracts for sale in euros. Thus, the effect was similar. But market participants who use foreign exchange contracts for hedging risks and for operating activities frolic in full swing. New 20,000 purchase contracts and 30,000 sales contracts were opened. As you can see, there was no effect from as much as +10,000 thousand sales contracts. Thus, the situation was terrible. Despite the fact that the total number of net sales contracts increased by about 5,000, the euro showed the strongest growth. This further leads us to the idea that the euro's growth is somewhat random and may be completed in the near future. However, the first trading days of the new week do not allow us to conclude that the upward trend is complete.

The overall fundamental background for the EUR/USD pair remains neutral. A report on inflation in the United States was published yesterday, which showed its decline to 0.1% y/y, which is already very close to deflation. However, we have already said that this indicator has no significance for the economy and traders. And it happened, market participants did not react to the information received. In the evening it became known that the Fed left the key rate unchanged, about zero, which caused a new round of sales of the US currency. Although, by and large, the lack of changes in the parameters of monetary policy can hardly be called bearish factors for the dollar. However, market participants now absolutely do not need any reason to sell US currency. There are formal occasions - great! All ten members of the Monetary Committee voted in favor of the invariance of the rate, and in an accompanying statement it was said that the FOMC does not expect a rate increase until the end of 2022. In addition, the Fed revised its forecasts for GDP and unemployment. Now the US central bank expects -6.5% of GDP in 2020 and + 5% in 2021. The unemployment rate, according to Fed Chief Jerome Powell and the company, will be 9.3% this year.

Based on the foregoing, we have two trading ideas for June 11:

1) It is possible for EUR/USD to grow further with the goal of the resistance level of 1.1542. To do this, buyers need to continue to stay above the Kijun-sen critical line and overcome the level of 1.1417, which will confirm the readiness for new purchases. At the same time, the strength of the bulls is not unlimited, and the normal correction for the pair did not happen, so we advise you not to forget about Stop Loss. Potential Take Profit is about 100 points.

2) The second option involves consolidating the EUR/USD pair under the Kijun-sen line, which will allow sellers to again try to join the game and begin forming a downward trend. In this case, it is recommended to open sell positions with the target of 1.1157 (Senkou Span B line). The potential Take Profit in this case is 140 points.

The material has been provided by InstaForex Company - www.instaforex.com