To open long positions on GBP/USD, you need:

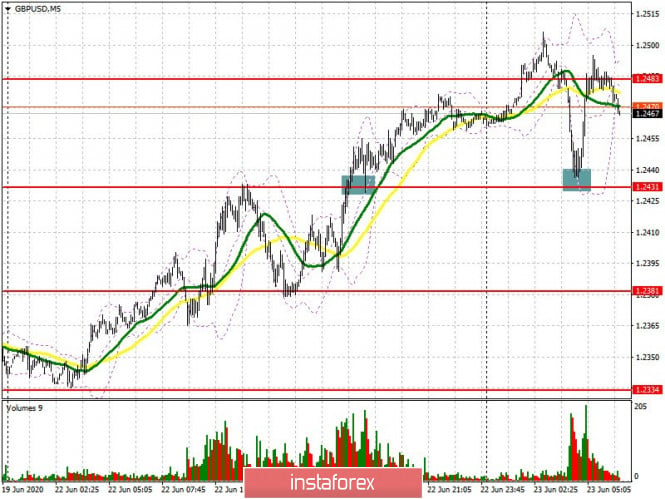

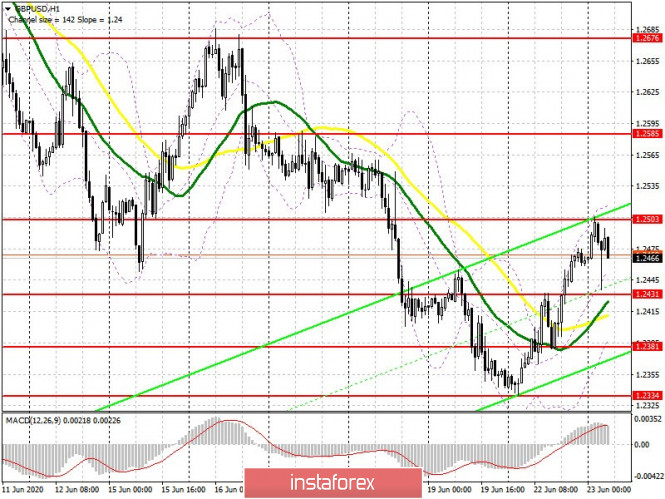

The British pound is gradually recovering its position against the US dollar, and the bulls are aiming for a reversal of the market after a good downward correction, which many have been waiting for a long time. Yesterday, if you recall my forecast for the second half of the day, then you would know that I advised you to open long positions to continue growth after the breakout of resistance 1.2431, which happened. We can clearly see how buyers achieved a breakdown level of 1.2431 on the 5-minute chart, and its top-down test was an excellent signal to buy the pound, which led to an update of the high of 1.2483, where I advised taking profits. And even if you did not have time to immediately buy the pound from the level of 1.2431, such an opportunity was offered after a sharp decline in the pair in the Asian session. The Commitment of Traders (COT) reports for June 16 recorded a reduction in short positions and an increase in long ones, which indicates a completely possible change in the market direction in favor of strengthening the pound. This once again indicates that traders are counting on progress in negotiations related to the trade deal, and are reviewing their positions, preparing for a major rising wave of the pound in the second half of the year. The COT report states that short non-profit positions decreased from 52,941 to 45,376 during the week. At that time, long non-profit positions sharply rose from 28,893 to 29,379. As a result, non-commercial net position decreased its negative value to -15,998, against -24,048, which indicates a possible market reversal and building a new bullish momentum in the medium term. As for the intraday strategy, as long as buyers control the market above 1.2431 support, we can count on strengthening the British pound. Forming a false breakout in this range after the release of a number of important data on the status of activity in the UK services sector will be an additional impulse to open long positions in order to consolidate above the high of 1.2503. This scenario will open a direct path to the resistance 1.2585 and 1.2676, where I recommend taking profits. If the pressure on the pound returns, but you don't have to expect anything good from production activity and the service sector, then after returning GBP/USD to support 1.2431, it would be best to postpone opening new long positions until you test the low of 1.2381, or buy immediately for a rebound from the weekly low of 1.2334, where there was a reversal of the downward trend yesterday.

To open short positions on GBP/USD, you need:

Pound sellers already had problems with maintaining the bearish momentum, and today it is very important to quickly return the pair to the support level of 1.2431. This can be done after the release of data on the status of the composite PMI index in the UK. Consolidating below 1.2431 will be a signal to open short positions in GBP/USD, which will lead to a repeated decrease in the pair and updating the low of 1.2381, where the moving averages are held, as well as to the support test of 1.2334, where I recommend taking profit. If the demand for the pound continues in the morning, I do not recommend rushing to open short positions from the resistance of 1.2503. It is best to wait until a false breakout is formed, and sell immediately for a rebound from a larger weekly high of 1.2585, counting on an intraday correction of 30-40 points.

Signals of indicators:

Moving averages

Trading is above 30 and 50 moving averages, indicating a bulls attempt to take the initiative again.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

If the pair decreases, support will be provided by the lower border of the indicator in the region of 1.23281. A break of the upper border of the indicator in the area of 1.2515 will lead to a new wave of pound growth.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - convergence / divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between short and long positions of non-profit traders.