To open long positions on GBP/USD, you need:

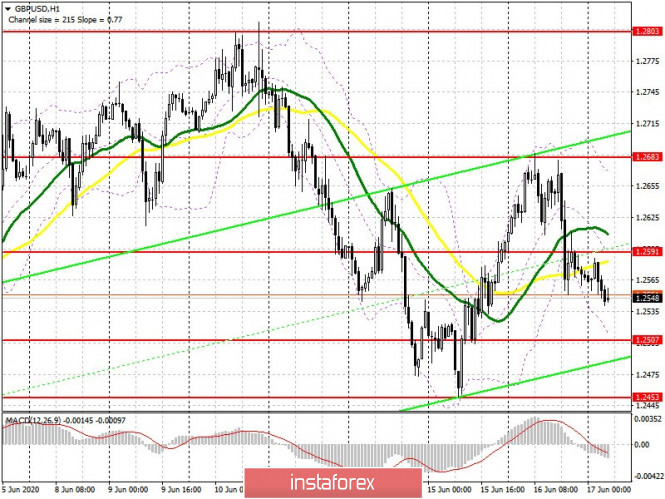

Yesterday, data on a sharp increase in US retail sales caused the British pound to fall, as there is still belief that British Prime Minister Boris Johnson will be able to find a compromise and reach a trade agreement with the EU. On the 5-minute chart, you can see how after the breakthrough of 1.2620 support in the afternoon, the pair returned to this level, but there was literally a couple of points before its test, which would be a signal to open short positions, after which the market continued to decline to the next support area of 1.2536, the test of which took place today at the Asian session. At the moment, the situation is not as scary for buyers of the pound, however, an operational return to the resistance level of 1.2591 is required, and inflation data in the UK for May this year can help. The bulls will be able to gain a foothold above 1.2591 if the indicator is above zero. This will cause the pound to grow to the area of this week's high at 1.2683, where I recommend taking profits. The farther target is still the area of 1.2801, the update of which will indicate the resumption of the bullish trend formed in early May of this year. If the pressure on the pound returns, then it is best to return to long positions only after updating support 1.2507 and form a false breakout there. You can buy GBP/USD immediately for a rebound only at this week's low at 1.2453. It is important to remember that COT reports have undergone major changes that could affect the British pound. The COT report for June 9 showed a sharp decrease in short positions and an increase in long ones, which indicates a completely possible change in the market direction in favor of strengthening the pound. There was a reduction in short non-profit positions from the level of 63,014 to the level of 52,941. By the way, this is the first reduction in short positions since April 14. At this time, long non-profit positions rose sharply from 26,970 to 28,893. As a result, the nonprofit net position reduced its negative value to -24,048, versus -36,044, which indicates a possible market reversal and building a new bullish momentum in the medium term.

To open short positions on GBP/USD, you need:

Most likely, the market will remain under pressure, and inflation data may turn out to be much worse than forecasts of economists, which will only increase consumer insecurity after the pound's fall from yesterday. Bears will initially aim for support at 1.2504, however, consolidating below this level will not lead to breaking the bullish trend, as this requires dealing with the more serious level of 1.2453, which is where the pound sharply grew this week. A good signal to open short positions in the first half of the day will be to form a false breakout in the resistance area of 1.2591, slightly higher than where the moving averages pass. In the absence of activity on the part of sellers in this range, it is best to postpone selling until the resistance test of 1.2683, based on a rebound of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is carried out below 30 and 50 moving average, which indicates the formation of a downward correction in the pair.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

If the pound rises in the morning, you can sell at a rebound from the upper border of the indicator at 1.2660. A break of the lower border at 1.2507 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between short and long positions of non-profit traders.