Forecast for June 4:

Analytical review of currency pairs on the scale of H1:

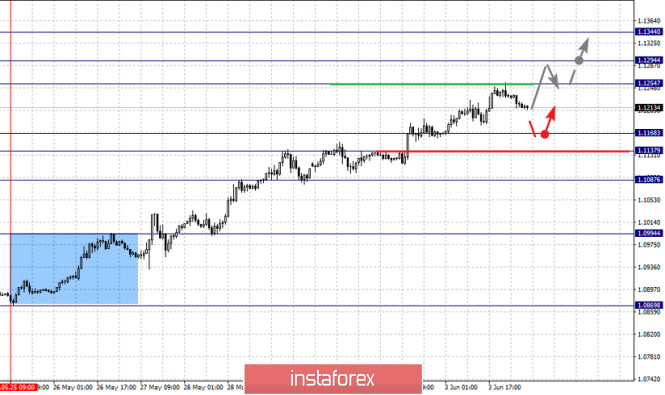

For the euro / dollar pair, the key levels on the H1 scale are: 1.1344, 1.1294, 1.1254, 1.1168, 1.1137 and 1.1087. Here, we continue to monitor the ascending structure of May 25. A short-term upward movement is expected in the range of 1.1254 - 1.1294, as well as price consolidation. For the potential value for the top, we consider the level of 1.1344. Upon reaching this level, we expect a downward pullback.

A short-term downward movement is expected in the range of 1.1168 - 1.1137. The breakdown of the last level will lead to an in-depth correction. In this case, the target is 1.1087. This level is a key support for the upward structure.

The main trend is the local structure for the top of May 25

Trading recommendations:

Buy: 1.1255 Take profit: 1.1292

Buy: 1.1295 Take profit: 1.1344

Sell: 1.1168 Take profit: 1.1138

Sell: 1.1135 Take profit: 1.1088

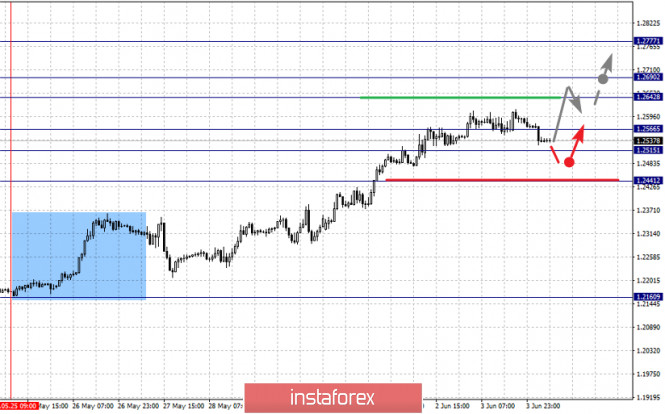

For the pound / dollar pair, the key levels on the H1 scale are: 1.2777, 1.2690, 1.2642, 1.2566, 1.2515 and 1.2441. Here, we are following the ascending structure of May 25. Short-term upward movement is expected in the range of 1.2642 - 1.2690. The breakdown of the last level will allow us to expect movement to a potential target - 1.2777. Upon reaching which, we expect consolidation, as well as a pullback to correction.

A consolidated movement is expected in the range of 1.2566 - 1.2515. The breakdown of the latter level will lead to an in-depth correction. Here, the target is 1.2441. This level is a key support for the top.

The main trend is the local ascending structure of May 25

Trading recommendations:

Buy: 1.2642 Take profit: 1.2690

Buy: 1.2692 Take profit: 1.2775

Sell: Take profit:

Sell: 1.2513 Take profit: 1.2450

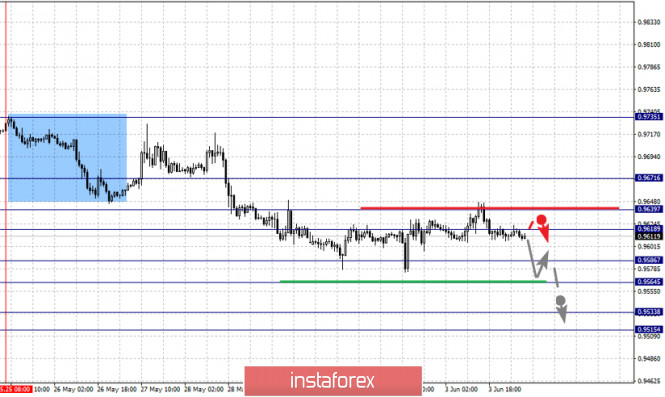

For the dollar / franc pair, the key levels on the H1 scale are: 0.9671, 0.9639, 0.9618, 0.9586, 0.9564, 0.9533 and 0.9515. Here, we are watching the downward structure from May 25. At the moment, the price is in correction. A short-term downward movement is expected in the range of 0.9586 - 0.9564. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 0.9533. For the potential value for the bottom, we consider the level of 0.9515. Upon reaching which, we expect consolidation, as well as an upward pullback.

A short-term upward movement is possible in the range of 0.9618 - 0.9639. The breakdown of the latter value will lead to an in-depth correction. In this case, the target is 0.9671. This level is a key support for the bottom.

The main trend is the descending structure of May 25

Trading recommendations:

Buy : 0.9618 Take profit: 0.9637

Buy : 0.9641 Take profit: 0.9670

Sell: 0.9586 Take profit: 0.9566

Sell: 0.9562 Take profit: 0.9535

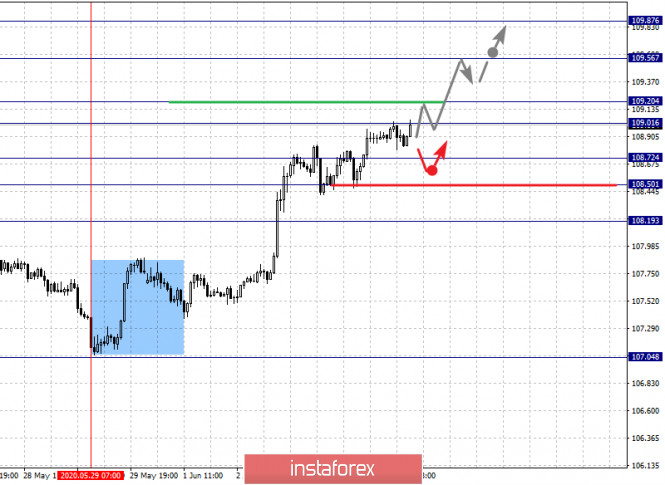

For the dollar / yen pair, the key levels on the scale are : 109.87, 109.56, 109.20, 109.01, 108.72, 108.50 and 108.19. Here, we are following the development of the upward cycle of May 29. Short-term upward movement is expected in the range of 109.01 - 109.20, as well as consolidation. The breakdown of the level of 109.20 should be accompanied by a pronounced upward movement. Here, the target is 109.56. Price consolidation is near this level. We consider the level of 109.87 to be a potential value for the upward trend; upon reaching this level, we expect a downward pullback.

A short-term downward movement is possible in the range of 108.72 - 108.50. The breakdown of the last value will lead to an in-depth correction. Here, the target is 108.19.

The main trend is the upward cycle of May 29

Trading recommendations:

Buy: 109.20 Take profit: 109.55

Buy : 109.58 Take profit: 109.85

Sell: 108.70 Take profit: 108.52

Sell: 108.48 Take profit: 108.20

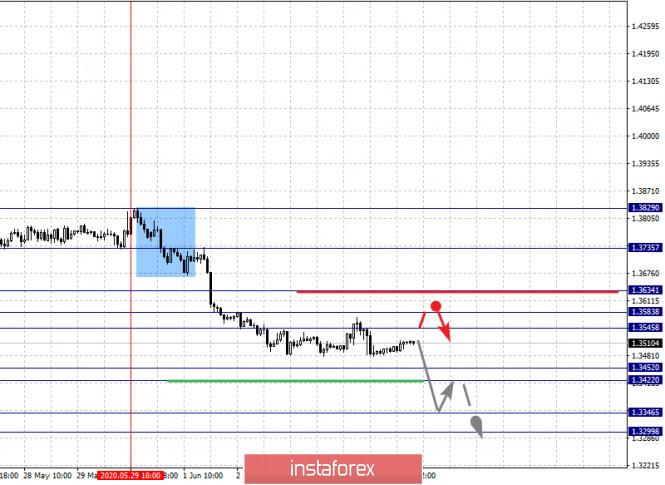

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3735, 1.3634, 1.3583, 1.3545, 1.3452, 1.3422, 1.3346 and 1.3299. Here, we are following the development of the local downward cycle of May 29. The continuation of the downward movement is expected after the price passes the noise range 1.3452 - 1.3422. In this case, the target is 1.3346. For the potential value for the bottom, we consider the level of 1.3299. Upon reaching which, we expect consolidation, as well as an upward pullback.

A short-term upward movement is possible in the range of 1.3545 - 1.3583. The breakdown of the last level will lead to the development of an in-depth correction. Here, the potential target is 1.3634. This level is a key support for the downward structure and its breakdown will lead to the formation of initial conditions for the upward cycle. In this case, the target is 1.3735.

The main trend is the local descending structure of May 29

Trading recommendations:

Buy: 1.3445 Take profit: 1.3581

Buy : 1.3585 Take profit: 1.3632

Sell: 1.3422 Take profit: 1.3348

Sell: 1.3344 Take profit: 1.3300

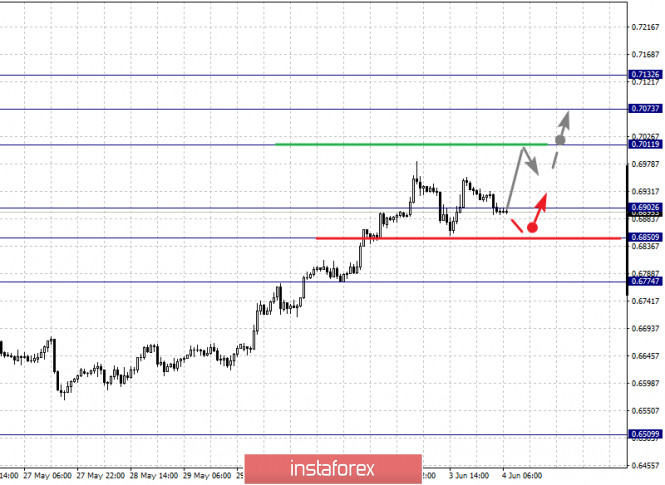

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.7132, 0.7073, 0.7011, 0.6902, 0.6850 and 0.6774. Here, we are following the development of the upward cycle of May 15. The continuation of the upward movement is expected after the breakdown of the level of 0.7011. In this case, the target is 0.7073. For the potential value for the top, we consider the level of 0.7132. Upon reaching which, we expect a downward pullback. However, it is most likely that the reversal to the correction will occur earlier than reaching the potential level, namely from the range 0.7011 - 0.7073.

A short-term downward movement is possible in the range of 0.6902 - 0.6850. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6774. This level is a key support for the top.

The main trend is the upward structure of May 15

Trading recommendations:

Buy: 0.7011 Take profit: 0.7070

Buy: 0.7075 Take profit: 0.7130

Sell : 0.6902 Take profit : 0.6853

Sell: 0.6848 Take profit: 0.6780

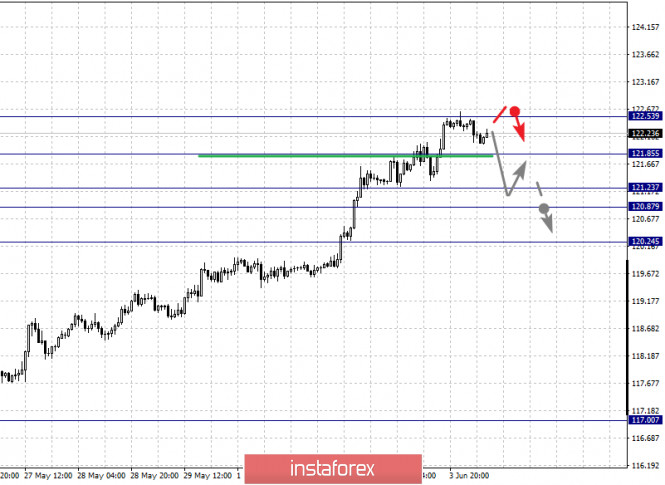

For the euro / yen pair, the key levels on the H1 scale are: 122.53, 121.85, 121.23, 120.87 and 120.24. Here, the price reached the limit value for the ascending structure of May 22, and therefore, we expect the correction to go after the breakdown of the level of 121.85. In this case, the target is 121.23. Price consolidation is in the range of 121.23 - 120.87. For the potential value for the bottom, we consider the level of 120.24, to which we expect the initial conditions for a downward cycle.

The main trend is a local ascending structure of May 22, a correction is expected

Trading recommendations:

Buy: Take profit:

Buy: Take profit:

Sell: 121.85 Take profit: 121.25

Sell: 120.85 Take profit: 120.26

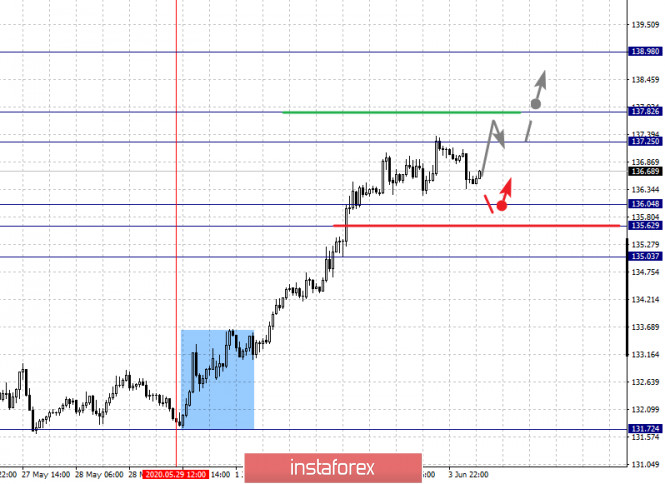

For the pound / yen pair, the key levels on the H1 scale are : 138.98, 137.82, 137.25, 136.04, 135.62 and 135.03. Here, we continue to monitor the development of the upward cycle of May 29. Short-term upward movement is possible in the range of 137.25 - 137.82. The breakdown of the last level will lead to movement to a potential target - 138.98. We expect a pullback to the bottom from this level.

A short-term downward movement is possible in the range of 136.04 - 135.62. The breakdown of the last level will lead to an in-depth correction. Here, the potential target is 135.03. This level is a key support for the upward structure.

The main trend is the upward structure of May 29

Trading recommendations:

Buy: 137.25 Take profit: 137.80

Buy: 137.86 Take profit: 138.96

Sell: 136.04 Take profit: 135.64

Sell: 135.60 Take profit: 135.05

The material has been provided by InstaForex Company - www.instaforex.com