4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - up.

CCI: 205.5926

The British pound rose sharply against the US currency on the second trading day of the week. At the same time, as in the case of the euro currency, it is difficult for us to say what caused this behavior of market participants. Given the fact that both the euro and the pound have risen in price synchronously, you need to look for reasons either in the US or not to look for them at all. We remind you that the foreign exchange market has a fairly large number of major players, international companies, syndicates, conglomerates, banks, central banks, investment banks, and so on. Any participant can buy or sell a large amount of dollars or other currency at any time, which will lead to a sharp skew in supply and demand for a particular currency. Thus, it could well be that today one or more major traders sold an impressive amount of dollars on the foreign exchange market, which led to its fall. We do not see any fundamental or macroeconomic reasons for the collapse of the US currency on Tuesday. And since there were no reasons for the sharp fall of the dollar, its growth may resume tomorrow.

While the British pound sharply and unexpectedly resumed its upward movement against the US dollar, disappointing news about the "coronavirus" epidemic is beginning to arrive from the United States. Recall that according to the latest data, 1.663 million cases of the "Chinese virus" were recorded in America. Almost 100,000 deaths from the pandemic have also been recorded. President Donald Trump attributes such high morbidity and mortality rates to the large number of tests performed, "far more than in any other country in the world". However, we have already written that if we calculate the relative indicator "the number of tests performed per 1000 population", then the United States is not even in the top five. But, on the other hand, such high numbers are also explained by a much larger population in the United States than in many other countries of the world. However, many media outlets still believe that the Trump administration is to blame for the virus spreading so much across the country. And Trump blames WHO and China. However, America began to slowly relax the quarantine measures and all this led to the fact that on May 25, on Memorial Day, thousands of Americans rushed to the seas and lakes, without observing measures of social distance and without wearing masks. The Internet is flooded with photos from beaches that are literally teeming with people. It is reported that in some cities and states, the influx of people to beaches was so great that parking lots could not cope with it. According to Johns Hopkins University, the curve of the rate of growth of the disease in the United States is not slowing down, which means that the virus is spreading at the same rate, unlike, for example, in the European Union, where the "curves" begin to indicate a serious decline in the epidemic. Thus, the removal of quarantine measures or their easing in Europe is indeed justified, but not in the US. However, Donald Trump is eager to restart the country's economy in order to increase his chances of re-election in November. He is even willing to sacrifice Americans to achieve the goal. At the same time, it is not clear that the US leader himself adhered to at least some quarantine measures. No one has ever seen the US President in a mask, and as part of the election campaign, the President intends to hold thousands of rallies in many states of the country. Thus, we believe that America is the first candidate to receive the second wave of the epidemic.

Meanwhile, China is going to use the current deterioration in relations with Washington to its advantage. Chinese President Xi Jinping, during the third session of the 13th convocation of the National Political Advisory Council of China, said that the country will begin to gradually reorient from economic growth through exports to the development of domestic markets. "We believe that it is domestic demand that should guarantee long-term and strong economic growth in China. We are actively developing the internal consumer system, as well as actively working on innovations in science and technology," he said. Some experts believe that China is preparing not only to break ties with the United States, but also with the entire West.

An extremely small amount of fundamental information is still coming from the UK. The topic of Brexit and the Brussels-London negotiations has frankly stalled, although time is running out, on July 1, the countries will have to officially declare a decision on the "transition period" and, most likely, it will not be extended after December 31, 2020. However, negotiations have stalled, and London is frankly not eager to reach a consensus and sign an agreement. Thus, we believe that the government of Boris Johnson is ready for the fact that there will be no deal with the European Union or is openly bluffing, trying to force the Alliance to make concessions. Whether this is true or not, we will find out before the end of this year. We still fear for the British economy, which continues to suffer from the very fact of Brexit, and from the crisis caused by the pandemic, and next year may also start to suffer due to the lack of trade deals with the European Union and the United States. Yes, it is with the US. Just a few months ago, Donald Trump promised the British a "huge and profitable" trade agreement that would "undoubtedly bring the two nations closer together". We, however, even at the time of such speeches by the American President, believed that Trump meant "a favorable agreement for the United States". However, now that the COVID-2019 epidemic is raging in the world, negotiations are also put on pause, and Donald Trump himself may leave his post at the beginning of 2021. Thus, it is highly likely that Boris Johnson's team will negotiate with another US President.

At the same time, the UK is preparing to completely abandon the use of equipment from the Chinese company Huawei in British 5G networks. Earlier, Boris Johnson has already denied the Chinese company access to the most important, key and vulnerable 5G nodes. Members of the Conservative Party of Great Britain consider the issue of Huawei's participation in the establishment of 5G a matter of national security. According to media reports, this decision was made by Johnson not without the influence of his friend Donald Trump, who previously imposed sanctions against Huawei, believing that the company cooperates with the Chinese intelligence services and harms the United States.

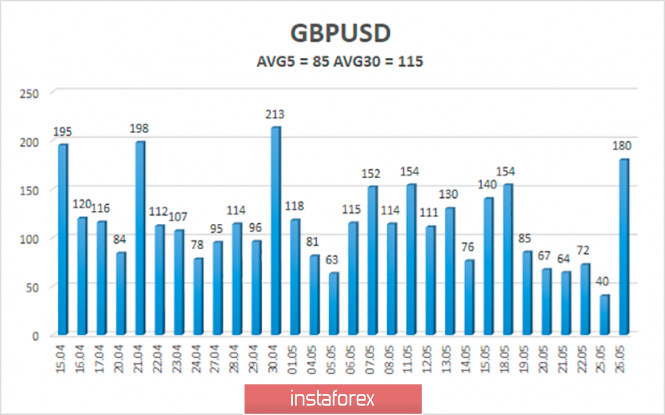

The average volatility of the GBP/USD pair has increased due to yesterday and is now 85 points. However, this is still a low indicator value. On Wednesday, May 27, we expect movement within the channel limited by the levels of 1.2245 and 1.2415. A reversal of the Heiken Ashi indicator downwards will indicate the beginning of a downward correction and a possible resumption of the downward trend. Fixing the price below the moving average will confirm some randomness of yesterday's growth of the pound.

Nearest support levels:

S1 – 1.2329

S2 – 1.2268

S3 – 1.2207

Nearest resistance levels:

R1 – 1.2390

R2 – 1.2451

R3 – 1.2512

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe was fixed back above the moving average, so the trend changed again to an upward one. Thus, it is now recommended to trade the pound/dollar pair for an increase with the goals of 1.2390 and 1.2415, before the Heiken Ashi indicator turns down. However, from our point of view, there is a high probability of a downward turn in the near future. It is recommended to sell the pound/dollar pair when the bears manage to return to the area below the moving average, with goals of 1.2207 and 1.2146.

The material has been provided by InstaForex Company - www.instaforex.com