4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: -18.1735

On Monday, May 11, the EUR/USD currency pair starts with an upward correction against a downward trend. However, this is only a formality. In fact, the quotes of the euro/dollar pair pushed off from the lower border of the side channel, limited by the levels of 1.0750 and 1.1000, and began an upward movement, respectively, to the upper line of the channel. Thus, based on this scenario, we believe that in the first days of the new week, the moving average line will be overcome, which will change the trend in the short term to an upward one. It will be possible to count on the formation of a new trend only when the pair leaves the current channel.

There are few macroeconomic publications scheduled for the first trading day. Thus, volatility on this day may be weak. Market participants will only have to track various fundamental information, which is very interesting in itself but does not have any effect on the movement of the pair. For example, this is a continuous stream of data from the White House or personally from Donald Trump. We have repeatedly noticed that if you read Trump's comments in a row, without temporary breaks, you can assume that they were given by completely different people who do not even live in the same state. They are so different from each other, and sometimes they just contradict each other. Moreover, it often happens that the US President comments on something and after some time his words are refuted by more competent representatives of this sphere. Recently, the most important topic is "coronavirus". And all of Trump's comments about the disease were broken down and criticized by all US medical professionals. Only the country's chief epidemiologist, Anthony Fauci, has repeatedly refuted the words of Donald Trump, putting the US leader in a very awkward position. In the end, Fauci abruptly went into self-isolation, saying that he had been in contact with an infected White House employee. As far as this can be true, judge for yourself.

Meanwhile, Americans who are very fond of suing are starting to do their favorite thing about China. It is noted that several lawsuits have already been filed against the Chinese authorities in American courts, each of which offers Beijing to compensate for the losses of certain individuals, companies, states or the entire country from the "coronavirus" epidemic, which, according to the plaintiffs, is China's fault. It is exciting, especially given the principle of sovereign immunity, which is enshrined in international law and involves the disobedience of any country to the courts of other countries. However, in the state of Florida, 2 lawsuits were filed against the Chinese province of Hubei and the city of Wuhan, as well as the Chinese government, by the law companies Lucas-Compton and Berman Law, which is associated with Donald Trump and Joe Biden. The total amount of claims is 6 trillion dollars. A $ 20 trillion lawsuit has been filed in a Texas district court by a private lawyer who believes that the Chinese military created the COVID-2019 virus as a biological weapon. Thus, according to Larry Kleiman, China has committed an act of international terrorism and used weapons of mass destruction. Similar lawsuits have been filed in other states. We have already said that Donald Trump urgently needs to find fault for his own mistakes and frivolous attitude to the "coronavirus", thanks to which the quarantine was introduced too late. We are not defending China, but the US President has elections and possible re-elections at stake, and at this time, his position is not the most favorable. Joe Biden's ratings are higher, which could cost Trump a victory. Thus, the US President needs to "whitewash", and this can only be done in one way: the Americans must believe that China is to blame, and at the same time that Joe Biden is a friend of China. Thus, it is China that can become the savior of Donald Trump, but the propaganda wheel must work extremely effectively. It is possible that the lawsuits filed are part of this very propaganda, creating the impression that it is the American population that believes China is guilty. However, according to international law, no state in the world can claim damages from China. This is obvious and clearly spelled out in international charters. Thus, all claims filed in the United States will remain without compensation in any case. And we get a situation similar to the situation with the impeachment of Donald Trump. It was clear to the Democrats from the very beginning, like everyone else, that Trump could not be removed from his post since most of the members of the Senate are Republicans who would not remove their party members from their posts. However, the whole thing was intended (by the Democrats) to lower Trump's reputation. The same will now happen with China. The more lawsuits are filed against him, which will not have any effect, the more countries speak out against China, the higher the chances that the number of Americans who believe in China's guilt will be enough for the elections in November 2020. And the most important thing! Washington certainly has certain levers of pressure on China, but they will entail not compensation for damage from the "coronavirus", but a new aggravation of relations between Beijing and Washington. The United States can, for example, under the pretext of China's "proven" guilt in the global epidemic, confiscate Chinese property on US territory. However, China can respond in kind. Given that a huge amount of American companies' production capacity is concentrated in China, it is still unknown who will benefit from this step. Further, Washington may impose new trade sanctions against China, but Beijing will respond immediately with mirror measures. Thus, absolutely any transition from words to deeds will only lead to a new round of conflict between America and the PRC. The majority of world experts, political scientists, and economists share this opinion, They say with one voice that the chances of all filed claims are zero, and "pressure" on China will only be possible collectively if a large number of countries express claims to Beijing.

Thus, a new round of conflict has not yet begun, but it is unlikely that Washington and Donald Trump personally will leave everything as it is. It is possible that in the near future we will see a new conflict between the US and China, which will also negatively affect the world economy, which will already suffer from the pandemic in any case. From a technical point of view, both channels of linear regression are directed downward, so the trend is now downward. However, the side channel remains a priority.

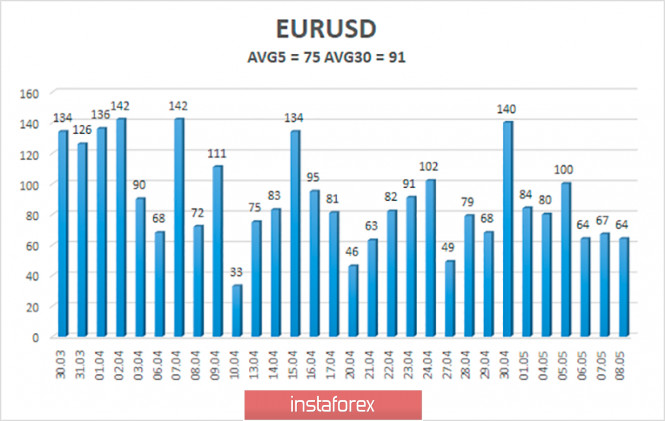

The average volatility of the euro/dollar currency pair as of May 11 is 75 points. Thus, the indicator has decreased slightly and now its value is characterized as "average". Today, we expect quotes to move between the levels of 1.0763 and 1.0913. Turning the Heiken Ashi indicator down may signal the end of the upward correction cycle.

Nearest support levels:

S1 – 1.0742

S2 – 1.0620

S3 – 1.0498

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0986

R3 – 1.1108

Trading recommendations:

The EUR/USD pair continues to be adjusted. Thus, sales of the pair with targets in the area of 1.0750-1.0740 remain relevant now, if there is a rebound from the moving average line. It is recommended to consider buying the euro/dollar pair not before the price is re-anchored above the moving average line with the goals of 1.0913 and 1.0986.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com