EUR/USD 1H

The EUR/USD pair tried to gain a foothold below the long-term upward trend line on the hourly timeframe yesterday, however, the attempt again failed. After that, the bears slightly loosened their grip and the pair rolled up, however, it was also impossible to go above the downward trend line (less long-term, and besides, it was already overcome by traders). As a result, traders were caught in a very narrow price range. It seems that today one of the two trend lines will be overcome, which will show the trend for the pair in the coming days. Bears still need to overcome the area of 1.0763 - 1.0775 so that the US currency continues to rise in price.

EUR/USD 15M.

We see mixed trading on May 14th on the 15-minute timeframe. After forming a signal to complete the downward movement of the CCI indicator (entering the area below the "-200" mark), the pair began to grow, but by the end of the day it again returned to the lows of the day, failing to overcome them. Thus, chances for the euro's growth remain, and quite good, given the stubborn inability of the bears to overcome the trend line on the hourly timeframe. Both channels of linear regression are directed downward, which clearly indicates a downward trend in the context of several days.

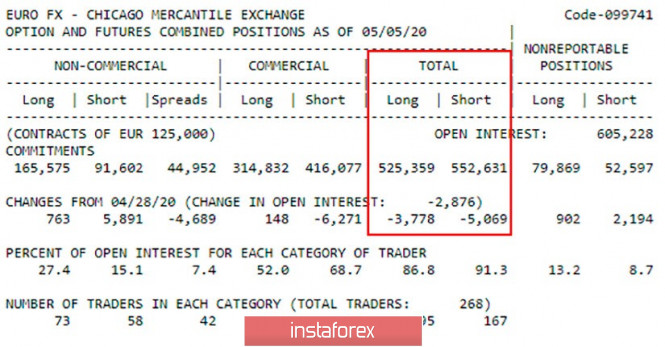

COT report.

The latest COT report of May 5 showed a decrease in the number of transactions for purchase among large traders by 3,778 and a decrease in the number of transactions for sale by 5.069. Thus, the downward mood slightly weakened for the euro. But, since the total number of sales contracts exceeds the number of purchase contracts, the overall trend still remains downward.

As we have repeatedly said in fundamental reviews, the entire macroeconomic background is now ignored by market participants. At least yesterday, the US dollar was not prevented from resuming growth by the failed report on applications for unemployment benefits. Today, we are waiting for failed reports on the GDP of the eurozone and Germany in the first quarter and no less failed reports on US retail sales and industrial production in April. Given the fact that macroeconomic data will be on both sides, we believe that they will not have a big impact on the pair's movement during the day. However, the overall technical picture, suggesting another rebound from the area of 1.0763 - 1.0775 and the trend line, can help the euro.

Based on the foregoing, we have two trading ideas for May 15:

1) A further drop in the quotes of the pair will be possible only after overcoming the area of 1.0763 - 1.0775. In this case, the immediate goal will be the support level of 1.0745, however it is located very close. In any case, you can open shorts when overcoming a trend line. But the goal would be better if you consider the support level of 1.0651. The potential to take profit is about 100 points.

2) The second option - bullish - suggests another rebound from the long-term upward trend line. We recommend buying the pair only if the price consolidates above the Kijun-sen line (1.0835). In this case, you should trade for an increase with a goal of 1.0893 (Senkou Span B line). The potential to take profit in executing this scenario will be around 55 points. Bulls are hardly capable of anything more now.

The material has been provided by InstaForex Company - www.instaforex.com