To open long positions on GBP/USD, you need:

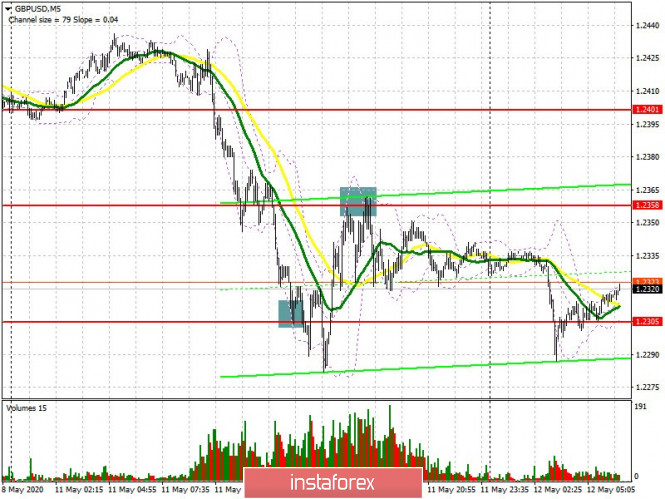

Yesterday, in my forecast, I advised opening long positions to rebound from the support of 1.2305, and even if not immediately, the market turned around, which led to a good upward correction of about 45-50 points and to the resistance of 1.2358. From this level, I also advised opening short positions in continuing the downward trend, and if you look carefully at the 5-minute chart, you will see how after the second attempt to grow, the bears regain control and arrange another sell-off of the pound in the area of 1.2305, which has now transformed into support for 1.2290. In the Commitment of Traders (COT) reports for May 5, as well as for April 28, there was an increase in short positions, which made the Delta even more negative, saying that most traders expect a further decline in the pound in the medium term, especially given the current situation of the UK economy. According to the data, during the reporting week, there was an increase in short non-commercial positions from the level of 38,147 to the level of 40,101, while long non-commercial positions decreased from the level of 31,466 to 28,096. As a result, the non-commercial net position became even more negative and ended up at the level of -12,001, against -6,681, which indicates the continuation of the bearish trend in GBP/USD. As for the intraday situation, the bulls need to protect the support of 1.2290 today, but there is very little hope for it, since, in fact, this will be the fourth test of this level, which may lead to a breakout. Therefore, in my opinion, the best scenario for opening long positions is a false breakout in the support area of 1.2250, or buying for a rebound after updating the lows of 1.2211 and 1.2169. However, it is worth remembering that you are going against the trend and expect a correction of more than 30-40 points from these levels is unlikely to be correct. An equally important task for the bulls will be to break through and consolidate above the resistance of 1.2358, above which the moving averages are located. Only this option will result in strengthening the pound and an update of the resistance levels 1.2425 and 1.2463, where I recommend taking profits.

To open short positions on GBP/USD, you need:

Sellers of the pound will rely on weak fundamental statistics on the US economy today, and in particular on a poor report on inflation in the US, which will increase pressure on the British pound and return demand for the us dollar. A repeated test of support for 1.2290 will probably lead to a breakout of this range and a larger sell-off of GBP/USD to the area of the lows of 1.2250 and 1.2211, where I recommend taking profits. A longer-term goal for the middle of the week will be a low of 1.2169. However, a more suitable scenario for selling the pound will be an upward correction and forming a false breakout in the resistance area of 1.2358, where the moving averages also pass. If there is no pressure on the pound in this range, it is best to postpone short positions for a rebound to test the highs of 1.2425 and 1.2463 in the expectation of a correction of 40-50 points within the day.

Signals of indicators:

Moving averages

Trading is below 30 and 50 moving averages, which indicates that the pressure on the pound will remain.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

A break of the lower border of the indicator in the area of 1.2290 will increase the pressure on the pound. Growth will be limited by the upper level of the indicator at 1.2358.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between short and long positions of non-profit traders.