Forecast for May 19:

Analytical review of currency pairs on the scale of H1:

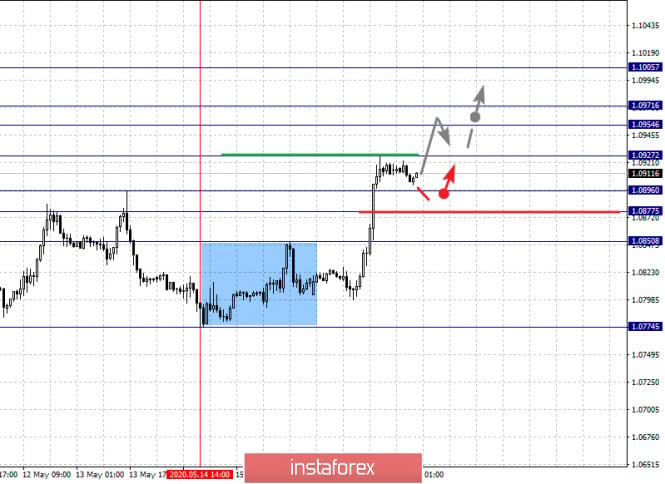

For the euro / dollar pair, the key levels on the H1 scale are: 1.1005, 1.0971, 1.0954, 1.0927, 1.0896, 1.0877 and 1.0850. Here, we are following the development of the ascending structure of May 14. The continuation of the upward movement is expected after the breakdown of the level of 1.0927. In this case, the target is 1.0954. Price consolidation is in the range of 1.0954 - 1.0971. For the potential value for the upward trend, we consider the level of 1.1005. Upon reaching which, we expect a downward pullback.

A short-term downward movement is expected in the range of 1.0896 - 1.0877. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.0850. This level is a key support for the top.

The main trend is the upward structure of May 14

Trading recommendations:

Buy: 1.0927 Take profit: 1.0954

Buy: 1.0971 Take profit: 1.1005

Sell: 1.0896 Take profit: 1.0878

Sell: 1.0875 Take profit: 1.0852

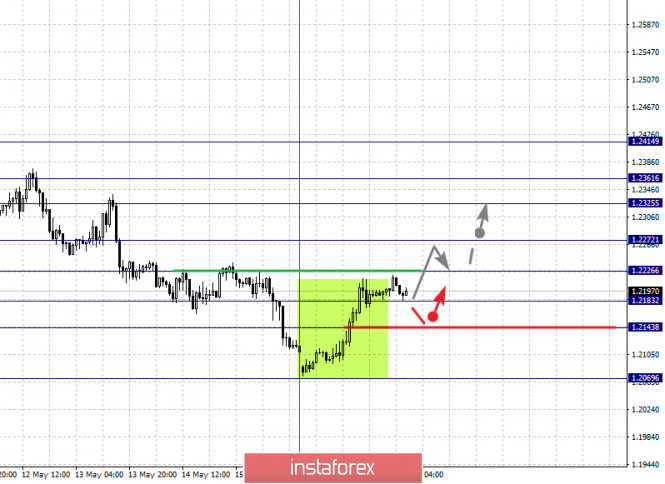

For the pound / dollar pair, the key levels on the H1 scale are: 1.2414, 1.2361, 1.2325, 1.2272, 1.2226, 1.2183, 1.2143 and 1.2069. Here, we are following the formation of the initial conditions for the upward cycle of May 15. The continuation of the upward movement is expected after the breakdown of the level of 1.2226. In this case, the target is 1.2272. Price consolidation is near this level. The breakdown of the level of 1.2272 will lead to a pronounced movement. Here, the target is 1.2325. Short-term upward movement, as well as consolidation is in the range of 1.2325 - 1.2361. For the potential value for the upward movement, we consider the level of 1.2414. Upon reaching this level, we expect a downward pullback.

A short-term downward movement is possible in the range of 1.2183 - 1.2143. The breakdown of the last level will favor the development of a downward structure. Here, the potential target is 1.2069.

The main trend is the formation of initial conditions for the top of May 15

Trading recommendations:

Buy: 1.2226 Take profit: 1.2270

Buy: 1.2274 Take profit: 1.2325

Sell: 1.2180 Take profit: 1.2145

Sell: 1.2140 Take profit: 1.2074

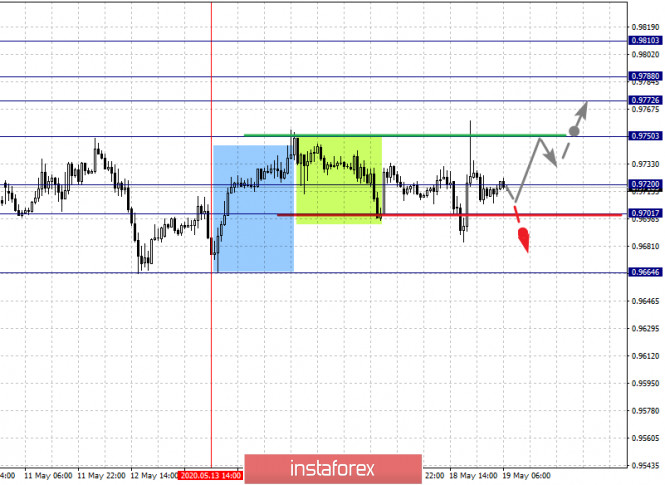

For the dollar / franc pair, the key levels on the H1 scale are: 0.9810, 0.9788, 0.9772, 0.9750, 0.9720, 0.9701 and 0.9664. Here, we are following the formation of initial conditions for the upward movement of May 13. The continuation of the upward movement is expected after the breakdown of the level of 0.9750. In this case, the target is 0.9772. Short-term upward movement, as well as consolidation is in the range of 0.9772 - 0.9788. For the potential value for the top, we consider the level of 0.9810. Upon reaching this level, we expect a downward pullback.

A short-term downward movement is possible in the range of 0.9720 - 0.9701. Hence, there is a high probability of an upward reversal. The breakdown of the level of 0.9701 will lead to the development of a downward trend. In this case, the potential target is 0.9664.

The main trend is the upward structure of May 13

Trading recommendations:

Buy : 0.9750 Take profit: 0.9786

Buy : 0.9790 Take profit: 0.9810

Sell: 0.9720 Take profit: 0.9702

Sell: 0.9698 Take profit: 0.9665

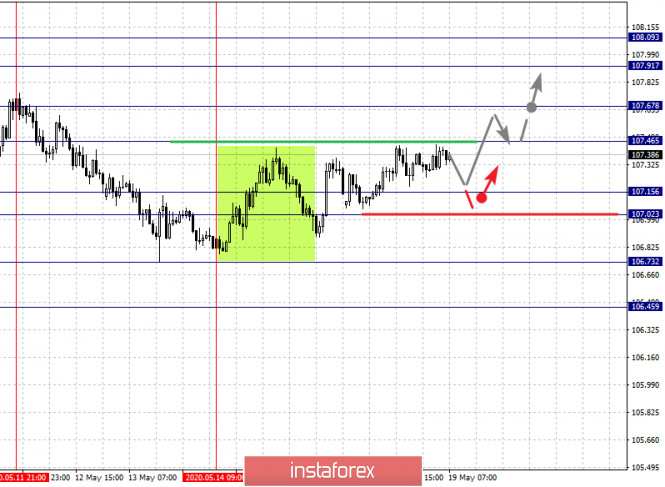

For the dollar / yen pair, the key levels on the scale are : 108.09, 107.91, 107.67, 107.46, 107.15, 107.02, 106.73, 106.45, 106.08 and 105.84. Here, we are following the formation of the descending structure of May 11. At the moment, the price is in correction and has formed a small potential for the top. We expect a short-term downward movement in the range of 107.15 - 107.02. The breakdown of the last level will lead to a resumption of a downward trend. In this case, the first target is 106.73. The breakdown of which will allow us to expect movement to the level of 106.45. Price consolidation is near this level. The breakdown of the level of 106.45 should be accompanied by a pronounced downward movement. Here, the goal is 106.08. We consider the level of 105.84 to be a potential value for the bottom. Upon reaching which, we expect consolidation, as well as an upward pullback.

We expect the development of the rising structure from May 14 after the breakdown of 107.46. Here, the first goal is 107.67. Price consolidation is near this level. The breakdown of the level of 107.67 should be accompanied by a pronounced upward movement. Here, the goal is 107.91. We consider the level of 108.09 to be a potential value for the top. Upon reaching which, we expect a downward pullback.

The main trend: the descending structure of May 11, the stage of deep correction

Trading recommendations:

Buy: 107.47 Take profit: 107.65

Buy : 107.69 Take profit: 107.90

Sell: 107.00 Take profit: 106.75

Sell: 106.71 Take profit: 106.47

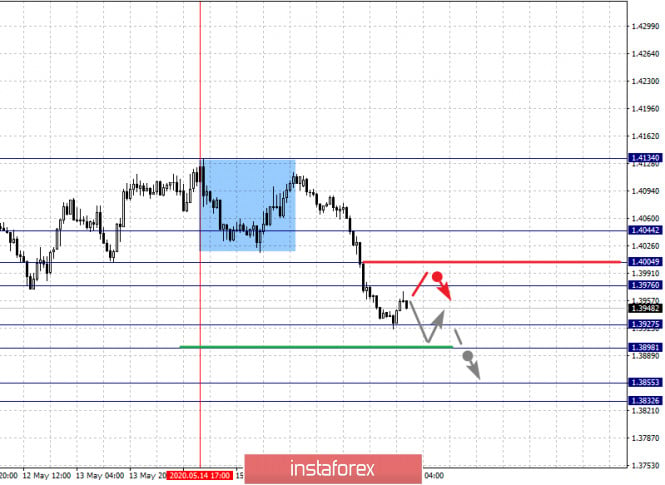

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4044, 1.4004, 1.3976, 1.3927, 1.3898, 1.3855 and 1.3832. Here, we are following the development of the descending structure of May 14. Short-term downward movement is expected in the range of 1.3927 - 1.3898. The breakdown of the last level will lead to a pronounced movement. Here, the target is 1.3855. For the potential value for the bottom, we consider the level 1.3832. Upon reaching which, we expect consolidation, as well as an upward pullback.

Short-term upward movement is possible in the range of 1.3976 - 1.4004. The breakdown of the last level will lead to an in-depth correction. In this case, the target is 1.4044. This level is a key support for the downward structure.

The main trend is the downward cycle of May 14

Trading recommendations:

Buy: 1.3976 Take profit: 1.4002

Buy : 1.4006 Take profit: 1.4042

Sell: 1.3927 Take profit: 1.3900

Sell: 1.3896 Take profit: 1.3855

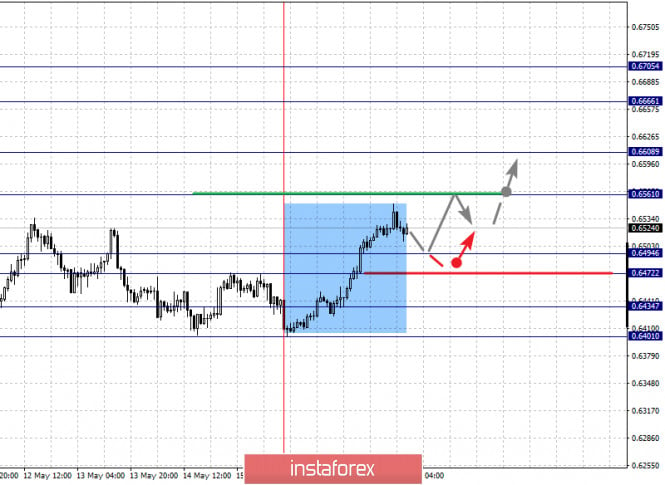

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6705, 0.6666, 0.6608, 0.6561, 0.6494, 0.6472, 0.6434 and 0.6401. Here, we are following the formation of the initial conditions for the upward cycle of May 15. The continuation of the upward movement is expected after the breakdown of the level of 0.6561. In this case, the target is 0.6608. Price consolidation is near this level. The breakdown of the level of 0.6608 will lead to the development of pronounced movement. Here, the goal is 0.6666. For the potential value for the top, we consider the level of 0.6705. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possibly in the range of 0.6494 - 0.6472. The breakdown of the last level will lead to an in-depth correction. Here, the target is 0.6434. This level is a key support for the upward structure and the price passing this level will have the formation of initial conditions for the downward cycle. In this case, the potential goal is 0.6401.

The main trend is the formation of initial conditions for the top of May 15

Trading recommendations:

Buy: 0.6561 Take profit: 0.6606

Buy: 0.6610 Take profit: 0.6666

Sell : 0.6494 Take profit : 0.6474

Sell: 0.6470 Take profit: 0.6440

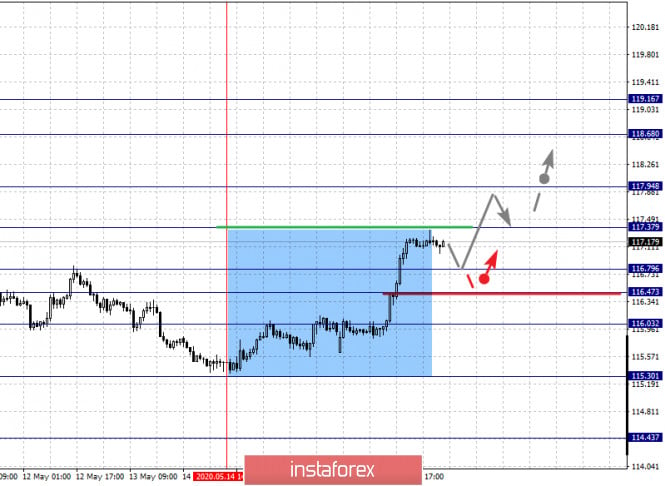

For the euro / yen pair, the key levels on the H1 scale are: 119.16, 118.68, 117.94, 117.37, 116.79, 116.47 and 116.03. Here, we consider the ascending structure of May 14 as the medium-term initial conditions for the ascending cycle. The continuation of the upward movement is expected after the breakdown of the level of 117.37. In this case, the target is 117.94. Price consolidation is near this level. The breakdown of the level of 117.96 will lead to the development of pronounced movement. Here, the goal is 116.68. For the potential value for the top, we consider the level of 119.16. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement, possibly in the range of 116.79 - 116.47. The breakdown of the last level will lead to an in-depth correction. Here, the target is 116.03. This level is a key support for the top and its breakdown will lead to the development of a downward trend. In this case, the potential target is 115.30.

The main trend is the formation of medium-term initial conditions for the top of May 14

Trading recommendations:

Buy: 117.40 Take profit: 117.92

Buy: 117.96 Take profit: 116.68

Sell: 116.79 Take profit: 116.50

Sell: 116.45 Take profit: 116.05

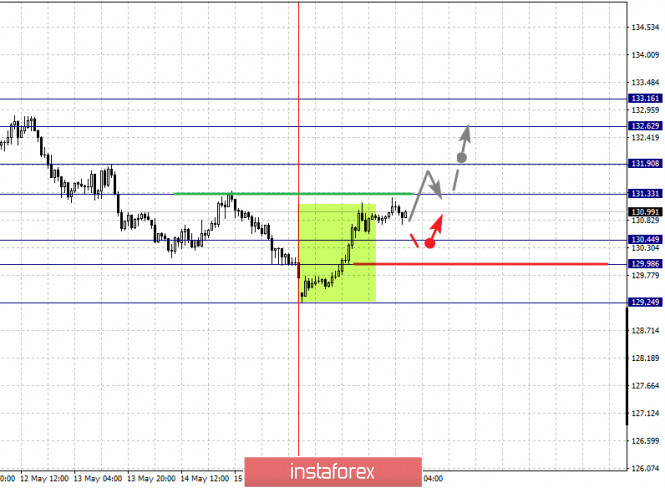

For the pound / yen pair, the key levels on the H1 scale are : 133.16, 132.62, 131.90, 131.33, 130.44, 129.98 and 129.24. Here, we are following the formation of the initial conditions for the top of May 15. Short-term upward movement is expected in the range of 131.33 - 131.90. The breakdown of the last level will lead to a pronounced movement. Here, the target is 132.62. We consider the level of 133.16 to be a potential value for the top; upon reaching this level, we expect a downward pullback.

A short-term downward movement is possible in the range of 130.44 - 129.98; hence, there is a high probability of an upward reversal. The breakdown of the level of 129.98 will lead to the development of a downward movement. In this case, the potential target is 129.24.

The main trend is the formation of initial conditions for the top of May 15

Trading recommendations:

Buy: 131.33 Take profit: 131.85

Buy: 131.94 Take profit: 132.62

Sell: 130.44 Take profit: 130.00

Sell: 129.95 Take profit: 129.30

The material has been provided by InstaForex Company - www.instaforex.com