Markets continue their cautious recovery, supported by news of the gradual withdrawal of a number of countries from restrictive measures on the spread of coronavirus. At the same time, this factor has a limited impact, because it is based on expectations, and not on real changes.

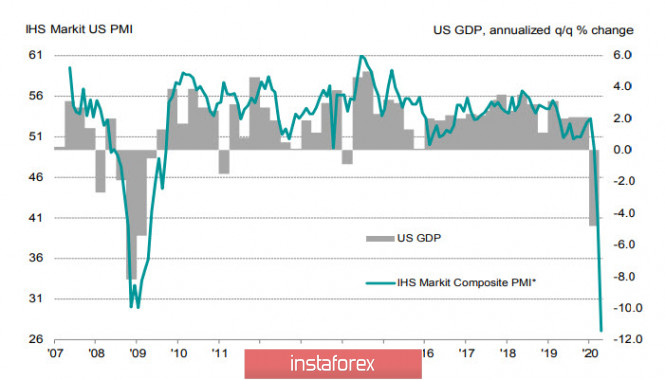

US service activity indices continue to drop rapidly. The Markit index has already fallen to a level below 2008/09, setting an absolute record for the entire history of observations, and there is no doubt that the fall in the PMI will also entail an unprecedented decline in GDP, which, in turn, will sharply reduce the budget revenue and contribute to a record increase in the deficit.

The ISM index in the services sector fell to 41.8p, which is slightly better than expected, but only due to the only parameter that is growing – the supply index. In other words, companies continue to fulfill their obligations taken in previous periods, and this circumstance prevents the ISM from collapsing on a large scale. At the same time, other sub-indexes are telling - business activity 26%, new orders 32.9%, and employment 30%.

The last parameter is especially important for Friday non farm - an increase in unemployment claims by 26 million in just 5 weeks indicates the largest crisis in US history, the depth of which cannot be estimated at the current stage.

Most likely, the positivity will continue in the next 2-3 days, which will support raw materials and commodity currencies, but Friday may turn the market sentiment towards the continuation of sales.

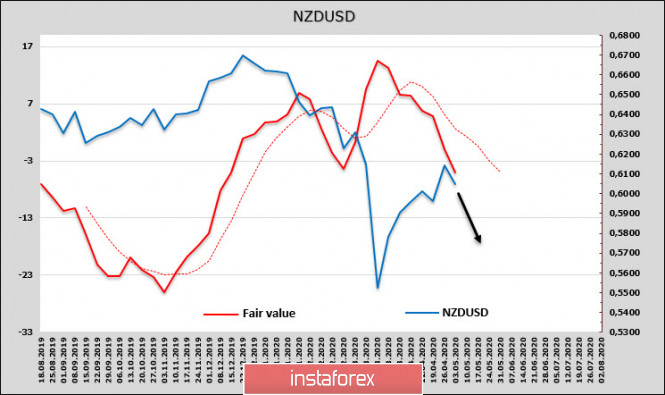

NZD/USD

The employment report for the 1st quarter (Q1) published Wednesday morning was outdated, not having time to go out, and therefore did not have any effect on the kiwi rate. ANZ Bank warns that the labor market has deteriorated significantly in April and the depth of the economic decline remains to be seen later. It is expected that a strong decline in demand will force the government to expand the scope of incentives in order to preserve jobs as much as possible, but "this cannot last forever", and a sharp increase in unemployment is inevitable.

In turn, The RBNZ may double QE volumes in the near future, lowering rates below zero is currently considered unlikely. Thus, the dynamics of kiwi will largely be determined by how much stimulus will be involved in relation to similar programs in the USA and Australia.

The total short position on the NZD for the week has not changed much, the bearish advantage is confidently strong, and the local peak 0.6175, reached by the end of April, is highly likely to be a turning point before the approaching decline.

A decline in the NZD/USD pair seems inevitable; technically, a reversal will be made after consolidation below the level of 0.5908. On Wednesday morning, the kiwi is near the maximum, there is a high possibility that the possible last bull attack will fall near the resistance zone of 0.6130/50. The recommendation is to sell with a nearest goal of 0.5840.

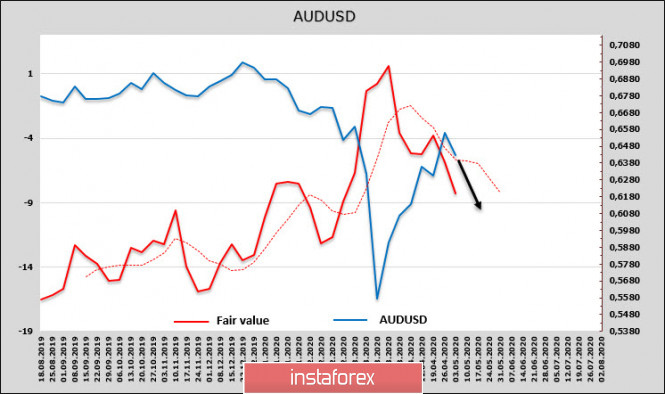

AUD/USD

The RBA meeting, which ended on Tuesday, did not bring news and did not add volatility to the Australian dollar. The RBA supported the liquidity of the markets by providing additional measures for pledging repo transactions to maintain the investment level of corporate bonds, and expressed concern about the fall in the labor market, suggesting unemployment to rise to 10% at the peak.

The PMI in the services sector fell in April to 19.5 p, which is the worst indicator among developed countries at the moment, which does not add confidence to the AUD bulls.

The total short position of AUD grew by the results of the previous week by more than 10% to 2.45 billion, the Australian currency does not receive support either from oil attempts to push off from the local minimum, or from improving the situation with the spread of coronavirus in Australia.

The correction after the fall to 0.5505 on March 16 is highly likely to be considered completed, the chances of updating the maximum of 0.6572 are low. The recommendation is to sell from the current levels, and if you try to increase to 0.6570 add to sales, stop in the zone of 0.6580/6600, the nearest goal is 0.6360, the next 0.6260, if the price is consolidated below this level, the fall may increase.

The material has been provided by InstaForex Company - www.instaforex.com