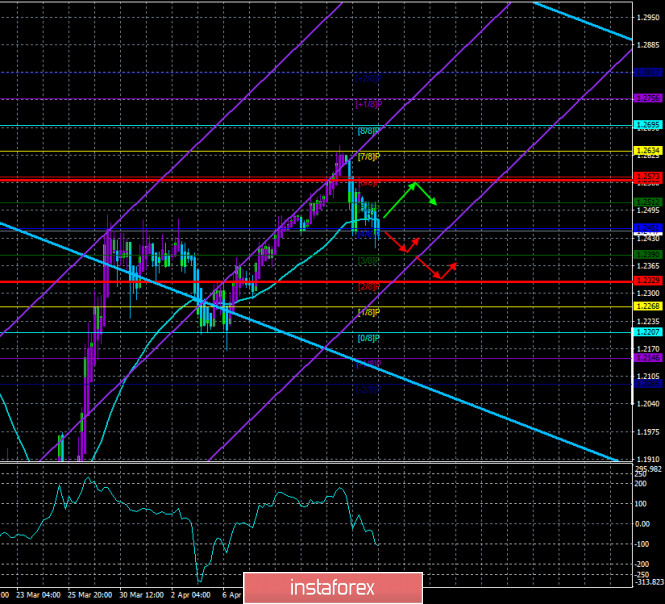

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -104.5099

Following the European currency, the British pound also settled below the moving average line in trading on Thursday, April 16. Traders found no reason to resume the upward movement. Thus, now the pound/dollar pair can try in the future to fall to 1.2200 – the previous local minimum. Traders yesterday confidently ignored the important report on unemployment in the US, and the US currency managed to even rise in price during the publication of the report.

The UK risks in the near future "catching up" with France, Italy, and Spain in the number of patients with "coronavirus", as well as in the number of deaths from this disease. Experts continue to note the belated response of the British government to the pandemic, as well as extremely loyal quarantine measures in place in the country. It is due to these two factors that the number of sick and fatal cases in the country continues to increase, while in Spain and Italy, there is a decrease in the growth rate of morbidity and mortality, and even begin to slowly weaken the quarantine measures. In the past 10 days, between 700 and 900 people have died every day in Britain. According to the forecasts of medical experts, it is the UK that will soon become the center of the pandemic in Europe, and the number of infections and deaths in this country will continue to grow. Experts also note that the country's authorities do not take into account the death statistics cases when a patient died outside the hospital, thus underestimating the real number of deaths. The chief health officer of Britain, Chris Whitty, believes that the peak of the disease has not yet passed.

Meanwhile, despite the "coronavirus" pandemic, the date of July 1 is steadily approaching, when Brussels and London must officially decide whether they extend the "transition period" or whether the final break between the EU and the Kingdom will take place on December 31, 2020 without any postponements. Initially, Boris Johnson was categorically opposed to any extension of the "transition period", even though there was little chance of an agreement with Brussels in just 10 months. Now we are not talking about 10 months, but at best two and a half. It is during this period, and at a time when both the UK and the EU are raging COVID-2019 virus pandemic, the parties need to discuss a huge agreement that will determine the future relationship between the parties after the final "divorce". What the parties will be able to agree on in 2.5 months is unclear, if initially, the European Union said that even 1 year is very little, citing the example of negotiations with Canada or Australia, which lasted for 7-8 years. However, the fact remains. Michel Barnier and David Frost will resume negotiations. By the way, it should be noted that negotiations between London and Washington, also concerning trade relations after Brexit, remain frozen at the moment. We have previously said that London needs a trade deal with the EU, and even better with both the EU and the US. If there are no such deals, then Brexit, in fact, will be "hard", that is, without any agreements. And this will be a new, additional blow to the UK economy, which is now weakened not only by Brexit itself (recall that due to the withdrawal from the Alliance, Britain has been losing 70 billion pounds every year since 2016), but also by the epidemic, which threatens the British economy with a 35% reduction in the second quarter alone. And given the fact that the "peak" of the epidemic has not yet passed, the losses may be much more severe. However, according to many experts, conducting video conversations is only an appearance that the parties are involved in the process. Experts believe that video conversations will not replace face-to-face meetings and their effectiveness will be much lower, which will be one of the main factors for the success of any negotiations under tight deadlines.

According to unconfirmed information, in connection with the "coronavirus" pandemic, both sides are ready for the option that will have to postpone the final exit of Britain from the European Union for a year or two. After all, the epidemic is making its own adjustments to the plans of the British and European governments.

On the last trading day of the week, no macroeconomic publications are scheduled either in the United States or in the UK. However, this does not matter, since the pound/dollar currency pair continues to ignore any statistics, as does the euro/dollar pair. The pair's quotes were fixed below the moving average line yesterday, so the trend has changed to a downward one. The lower channel of linear regression is still directed up, and the higher channel is directed down, which leaves approximately equal chances of both growth and decline. From a fundamental point of view, it is impossible to say now what is more likely than the beginning of a downward trend or the resumption of an upward trend.

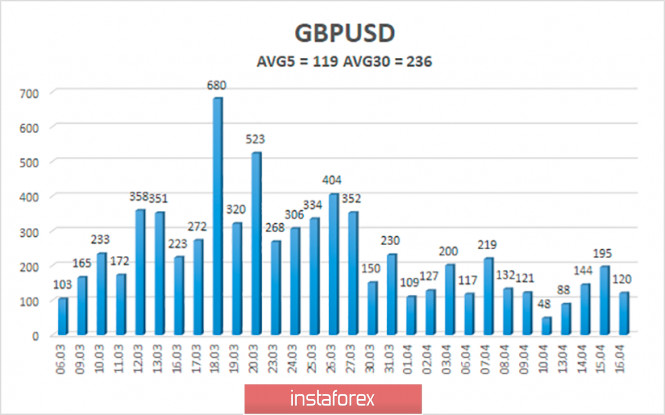

The average volatility of the pound/dollar pair has stopped decreasing and is currently 119 points. In the last 15 trading days, the pair almost every day passes from 100 to 200 points. Therefore, we can say that volatility is now stable. On Friday, April 17, we expect movement within the channel, limited by the levels of 1.2327 and 1.2565. Turning the Heiken Ashi indicator upward will signal a round of upward correction.

Nearest support levels:

S1 - 1.2451

S2 - 1.2390

S3 - 1.2329

Nearest resistance levels:

R1 - 1.2512

R2 - 1.2573

R3 - 1.2634

Trading recommendations:

The pound/dollar pair broke the moving average line on the 4-hour timeframe. Thus, today it is recommended to sell the pound with the goals of 1.2390 and 1.2329 and keep the short positions open until the Heiken Ashi turns up. It is recommended to consider new buy positions not earlier than the reverse overcoming of the moving average with the first goal of 1.2565.

The material has been provided by InstaForex Company - www.instaforex.com