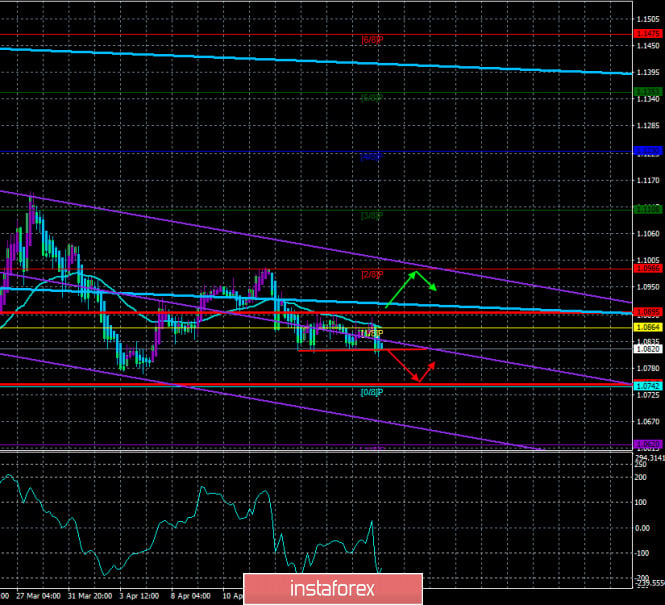

4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

CCI: -164.7434

During the third trading day of the week, the euro/dollar currency pair again fell to the lower border of the side channel, limited by the levels of 1.0817 and 1.0900. Thus, the pair shows a persistent desire to overcome this level of support and continue the downward movement, possibly within the framework of a new downward trend. We believe that it is too early to start selling the euro currency until the level of 1.0817 is successfully overcome. And even if the quotes are fixed at 1.0817, the rather sluggish movement may continue. In the current situation, it is even difficult to say whether the sluggish movement of the euro currency in recent days is good or bad? On the one hand, it is bad, because it complicates the trading process. On the other hand, it is good, because there are no signs of a new wave of panic in the pair yet. But there is something to panic about. First, it is the oil market, which is now being talked about no less than in its time about bitcoin. Second, the "coronavirus", which, despite all the reports of slowing down the spread, continues to infect more and more people in all countries of the world. The first factor reflects what is happening in the economy of any country in the world. The lack of functioning of this very economy. If the demand for oil falls by almost 30 million barrels a day, it is obvious that the business and economic activity of any country in the world is now much lower than in quiet times. The second factor also shows that things are pretty bad in the world right now. The total number of infected people is already 2.6 million, and we repeat, this is just official data from the American Johns Hopkins Institute. They only take into account officially confirmed cases of "coronavirus". Thus, if a person did not pass the test or, for example, does not feel unwell (in this case, he may be a carrier of the COVID-2019 virus), then he is not counted in these statistics. Therefore, according to unofficial opinions of representatives of the medical field and experts, the total number of infected people on the planet may already be 10 million. Thus, we do not see any reason for joy yet.

Meanwhile, the EU will hold a video summit today, the theme of which will be "assistance to the EU economy in the face of a pandemic". We have already written about 540 billion dollars that will be used to support small and medium-sized businesses (so that they do not lay off their employees), so-called "targeted compensation". Part of this money will also be sent to small and medium-sized businesses in the form of soft loans (about 200 billion euros). Another 240 billion will be used to support the countries most affected by the epidemic to avoid their default.

However, this money will not be enough. The head of the European Council, Charles Michel, said on Tuesday that 540 billion euros will not be enough to restart the economy after its almost 2-month downtime. On the morning of the same day, European Commissioner for Internal Market Affairs Thierry Breton said that the program to restore the economy after the pandemic may require an additional 1.6 trillion euros. This amount is proposed to be collected by raising borrowed funds. However, it is not yet clear whether the idea of so-called "coronabonds", i.e. pan-European bonds, whose guarantors will be each EU country, will be implemented. We have already said that Germany, Austria, the Netherlands, and Finland are against this idea. These countries do not like the concept of going into debt for the sake of Italy, Spain, and others who have been most affected by the crisis.

According to other information, the EU summit will consider proposals to assist with 2 trillion euros over the next 7 years. The so-called "plan for the long-term recovery of the EU economy". It is expected that the EU summit will fail, the parties will not come to a common denominator on the source of borrowed funds. As we can see, the alliance has problems in assisting its economy, since it requires the approval of the plan by 27 EU members at once, and in contrast to the same America, which very easily accepts any program to stimulate the economy. From our point of view, if the European Union does not come to a common opinion today, this may create pressure on the European currency.

In addition to the fundamental background on April 23, the pair will be pursued by the macroeconomic one. To date, quite a large number of different statistics are planned. The day will start with the publication of business activity in the alliance countries. Unfortunately, nothing optimistic can be said about these reports. Preliminary values for April are likely to show another collapse in business activity indices. This applies to all countries and all areas of the economy. The most important indices for Germany and the European Union can be: 39 - the German manufacturing sector, 28.5 - the German services sector, 39.2 - the EU manufacturing sector, 23.8 - the EU services sector. In principle, nothing new can be said for these indicators. Market participants are unlikely to pay attention to this data. And after lunch, a report will be published in the United States that has been roiling markets in recent weeks. This is a report on applications for unemployment benefits in the United States. According to experts' forecasts, the actual value for the previous week will be equal to 4.2 million new applications. And the total number of unemployed in the United States will grow to 26 million (this is only in the last 5 weeks). A little later, the business activity indices in the services and manufacturing sectors will also be published by Markit, which is also forecast to decline.

Unfortunately, all this interesting package of macroeconomic statistics is likely to be ignored by traders again. At least, you need to be prepared for this option. The first place will again be given to "technology", which should be very closely monitored since it is the technical factors that now work best in the market. "Technique" also suggests that the downward movement will continue after a few days of downtime. Above the moving average line, the pair failed to gain a foothold, so it continues to slide down. Both linear regression channels also continue to expand downward. We can only hope that the downward movement will not collapse, as at the beginning of the crisis.

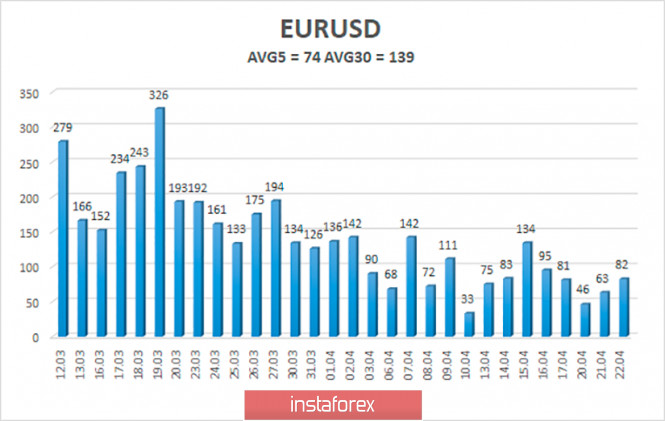

The volatility of the euro/dollar currency pair as of April 23 is 74 points. So far, this indicator does not give cause for concern. 74 points is not even "strong" volatility. Today, we expect the pair's quotes to move between the levels of 1.0747 and 1.0895. If the level of 1.0817 is broken, it will show a strong desire of the bears to continue moving south. A reversal of the Heiken Ashi indicator upward, on the contrary, may indicate a new round of upward correction.

Nearest support levels:

S1 - 1.0742

S2 - 1.0620

S3 - 1.0498

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0986

R3 - 1.1108

Trading recommendations:

The EUR/USD pair is trying to continue the downward trend. Thus, traders are advised to wait for the exit from the side channel, that is, fixing below the level of 1.0817, and again trade down with the goals of 1.0747 and 1.0742. It is recommended to consider buying the euro/dollar pair not before fixing the price above the moving average line with the goal of the Murray level of "2/8"-1.0986.

The material has been provided by InstaForex Company - www.instaforex.com