4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: 173.2524

The EUR/USD currency pair starts the new trading week with a weak downward correction. However, the price is fixed above the moving average line, so the trend is now upward. It is not supported by any linear regression channel, however, the upward movement may continue. We still believe that the "correction against correction" option will continue to be executed and the euro will continue to grow to the psychological level of 1.10. However, in any case, the future outlook of the currency pair will be determined in the area of 1.09-1.10.

"Nothing lasts forever." This phrase has long been a classic. And although it is quite vague, that is, it does not give an exact date of origin of a particular event, it is nevertheless true. A striking example is the United Kingdom, which has been part of the European Union for more than 50 years, but at some point decided to leave the Alliance. After all, what is, in fact, EU membership? This is a set of pros and cons for each block member. There are positive aspects of membership in the union, but there are also negative ones. Accordingly, any country can leave the EU, any country can begin to express its disagreement with the general policy, any country can feel that it is being treated unfairly. Also, no one will have the opposite opinion of the fact that in quiet times, usually, everything suits everyone and things are going well for everyone. And if not good, at least stable. Both in Europe and the United States in recent years, perhaps even 12 years after the mortgage crisis, things have been fairly stable and confident. Yes, many goals were not met, such as GDP growth or target inflation. But was the economy growing? It was. This is the most important thing. However, at one point, the situation in the world turned upside down. There was an epidemic of "coronavirus", in 90% of cases of the non-fatal disease, a common strain of flu, and the entire world economy was paralyzed. Paralyzed for several months already. And it is unknown how long it will be in this state. Of course, governments all over the world, including the EU and the US, had a choice of two options. Or do nothing and see to what lows their economy will collapse. Or flood it with money and cheap loans to somehow reduce the negative impact of the quarantine. Both countries chose the second path. However, what is this path? It is a flood of money into the economy, that is, cash and liquidity. But just like that, no one will distribute money, even though any Central Bank can print any number of them. They are introduced into the economy either through the purchase of securities from major banks, companies and other legal entities. The disadvantage of this method is the overflow of the Central Bank's balance sheet, its bloat. Or by issuing cheap, preferential or even free loans. The disadvantage of this method is that you need to pay back loans, even if they are interest-free. It is the second problem that has recently become acute for the EU countries. In order not to print trillions of euro currency, the ECB believes that it is better to borrow this necessary money. In other words, the method of placing securities on foreign and domestic markets. This is how the idea of "coronabonds" was born, which were to be issued on behalf of the entire EU, that is, all 27 countries. This issue was raised during the mortgage crisis of 2008, when all the money received from the placement of bonds wanted to be used to support Greece. Now it is time for another crisis and it is quite logical that the EU countries are divided into two categories: 1) not badly affected by the "coronavirus" and able to fight it without serious economic and financial losses, or just countries that have a good "safety cushion". These are Germany, Austria, and Finland; 2) countries that have been severely affected by the epidemic and have budget deficits, high public debts, and so on. These are Spain, Italy, Greece, Ireland, Portugal, Slovenia, and France. Logically, the second category of countries needs assistance and they see this assistance in the issuance of "coronabonds" that will allow them to raise funds and direct them to the recovery of their economies. But, for example, Germany makes no sense in issuing "coronabonds", as the country copes best with the pandemic, although not without financial losses. It turns out that the governments of the crisis countries of the EU require help, their central banks cannot print money to support the economy, so there is only one way out – to issue government bonds. And this is where the fun begins. For bonds to be purchased, the borrower must be stable and solvent. Take Italy as an example. The country has suffered the most from the "coronavirus" in the EU and has a national debt twice as high as EU standards. For Italy to place its bonds, it will have to offer investors a high percentage. And the higher the percentage, the more you will have to give later, the greater the burden on the economy. But in pairs with Germany and Austria, the percentage of securities can be much less. In this case, the money will be sent to Spain, Italy, and others in need of assistance, and Austria and Germany will pay their debts along with all those who do not need these "coronabonds" at all. But the main problem of "coronabonds" is that any EU country could default at any time and to refuse to pay their debts. As was already the case with Greece. Thus, the debts will have to be returned to the rest of the EU member states. Otherwise, they will also have to default and lower their credit ratings to "junk". Thus, this stumbling block can destroy the integrity of the EU. The more disagreements there are, the more likely it is that a country will want to leave the EU after Britain.

On Monday, April 13, the European Union will celebrate Easter Monday. There are no planned macroeconomic publications for this day. Thus, volatility may remain low and there may be no trend movement.

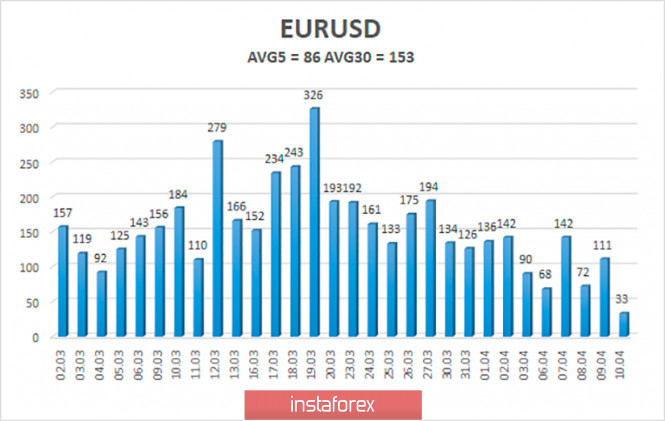

The volatility of the euro/dollar currency pair continues to decline and as of April 13, it is already 86 points. We believe that the markets continue to return to normal, however, there may be new outbreaks of panic in the future. Today, we expect a further decrease in volatility and price movement between the levels of 1.0849 and 1.1021. The pair tends to the level of 1.10, and the reversal of the Heiken Ashi indicator downwards indicates a possible round of downward correction.

Nearest support levels:

S1 - 1.0864

S2 - 1.0742

S3 - 1.0620

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1108

R3 - 1.1230

Trading recommendations:

The EUR/USD pair may start a corrective movement. Thus, traders are now recommended to consider purchases with the goals of the Murray level of "2/8"-1.0986 and 1.1021, but when the Heiken Ashi indicator turns down, reduce the short positions. It is recommended to sell the euro/dollar pair not before fixing the price below the moving average line and the Murray level of "1/8"-1.0864 with the first goal of 1.0742.

The material has been provided by InstaForex Company - www.instaforex.com