4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

CCI: 130.6571

The GBP/USD currency pair worked out the moving average line on March 25, as well as the Murray level of "1/8"-1.1963. But as of now, we can say that these obstacles have not been overcome. Thus, the chances that the downward trend will be resumed increase, unfortunately for fans of the British pound. As before, we see that the reason for the new strengthening of the US currency can only be one – the belief of markets in the steadfastness of the US currency and its strength at any time. The pound has certainly been weak in the past three years, but not by so much as to lose 1,500 points in 10 days. Volatility, however, in contrast to the EUR/USD pair, remains quite high, about 300 points per day. Therefore, it is illogical to talk about calming the currency market now.

During today, only one worthwhile and significant report was published in the UK – inflation for February. We can immediately say that there was no special reaction from market participants to this publication. And the consumer price index did not change so much in February that you can expect a drop of 300 points in the afternoon. Inflation in Britain slowed from 1.8% to 1.7% y/y, while core inflation, on the contrary, increased from 1.5% to 1.7% y/y. However, in the current conditions, these data are frankly secondary.

However, the fact that the British currency was again under market pressure in the second half of the third trading day of the week cannot be ignored. We believe that the markets remain in a state of panic, at least for the GBP/USD pair. Both in the UK and the United States, the situation with the epidemic is difficult. Moreover, the forecasts of experts in the medical field predict a much higher number of diseases and deaths caused by the "coronavirus" in the next month and a half. Thus, the state of both economies is almost guaranteed to deteriorate. However, traders have more faith in the US dollar, whose government is willing to pour trillions of dollars into the economy just to stimulate it. It doesn't matter that such a huge amount of dollars simply increases the supply of the currency market. That is, logically, the US dollar should become cheaper after such government measures. However, traders and investors see positive aspects in this step and are ready to buy the US currency again. At least that's what it looks like right now.

Meanwhile, the US Senate, after two failed attempts to pass a bill to provide 2 trillion dollars in aid to the economy, is likely to approve it today. Previously, this bill was blocked by Democrats, but in a difficult time for the country, they still found common ground with Republicans and came to a common denominator. The administration of Donald Trump and the Senate also reached a consensus. This was announced today by the head of the Republican majority in the Senate, Mitch McConnell. "This is good news for doctors who are waiting for more masks and funding, for US families. We have an agreement. It will help workers, families, small businesses and all sectors of the economy," McConnell said. Senate Democratic leader Chuck Schumer said today that this is the largest aid package in US history. It is expected that about $500 billion will be directed to providing cheap loans to the most affected industries, $3,000 will be paid to American families, $350 billion will be directed to loans to small businesses, $250 billion – to increase unemployment benefits, and $ 100 billion – to help the health sector.

Meanwhile, the total number of "coronavirus" patients in the UK has exceeded 8,000. 434 people were killed. Over the past 24 hours, 87 people have died, which is the highest daily rate since the beginning of the epidemic in the country. It is also reported that a total of about 90,000 Britons were tested. Thus, it is possible that the calculations that we published in previous articles, concerning the fact that more than half of the population of the UK may be infected, may well be true. What are 90,000 people for a country of millions? Moreover, as doctors have repeatedly warned, the virus can not cause any symptoms and ailments in a person for up to 14 days. However, all this time, the person is the distributor of infection. However, the British authorities are well aware that with 90,000 British people tested, it is impossible to be sure that the COVID-19 epidemic has not already captured a large part of the country's population and purchased 3.5 million tests, as well as ordered millions more to test every citizen of the country. Also, scientists from Oxford report that as a result of the epidemic on the territory of the United Kingdom for more than two months, certain segments of the population have acquired immunity against the virus. If these hypotheses are confirmed, all quarantine measures can be lifted ahead of time.

From a technical point of view, the Heiken Ashi indicator turned down, and the bulls failed to overcome the confidently moving and the Murray level of "1/8"-1.1963. Thus, there is already a fairly high probability of resuming the downward movement. At the same time, we remind traders that the market continues to remain panicked, and the pound/dollar pair passes by three hundred points daily. Thus, it is also not necessary to exclude a trip to the north. Both linear regression channels are directed downward, so the overall trend remains downward. The bulls remain extremely weak, and the macroeconomic background has no influence on the pair's movement now. We believe that we still need to wait for the markets to calm down, as any trade now involves increased risks.

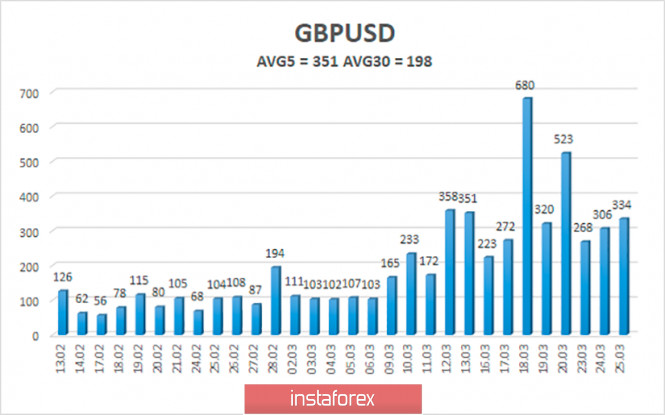

The average volatility of the pound/dollar pair over the past 5 days has started to decline and is already 351 points. However, the main decline was due to March 18, when the pair passed a record of 680 points. In general, the pound continues to pass at least 300 points a day, which is a lot. On Thursday, March 26, we expect the pair to move within the volatility channel of 1.1510-1.2208. Near the moving average line, the fate of the next few days will be decided.

Nearest support levels:

S1 - 1.1719

S2 - 1.1475

S3 - 1.1230

Nearest resistance levels:

R1 - 1.1963

R2 - 1.2207

R3 - 1.2451

Trading recommendations:

The GBP/USD pair continues to adjust at the moment. Thus, sales of the pound remain relevant with a target volatility level of 1.1510, but it is recommended to open new sell positions, not before the price is fixed below the level of 1.1719. It is recommended to buy the British currency with the target of 1.2207, but not before fixing the price above the moving average and the Murray level of "1/8"-1.1963. We remind you that in the current conditions, opening any positions is associated with increased risks.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com