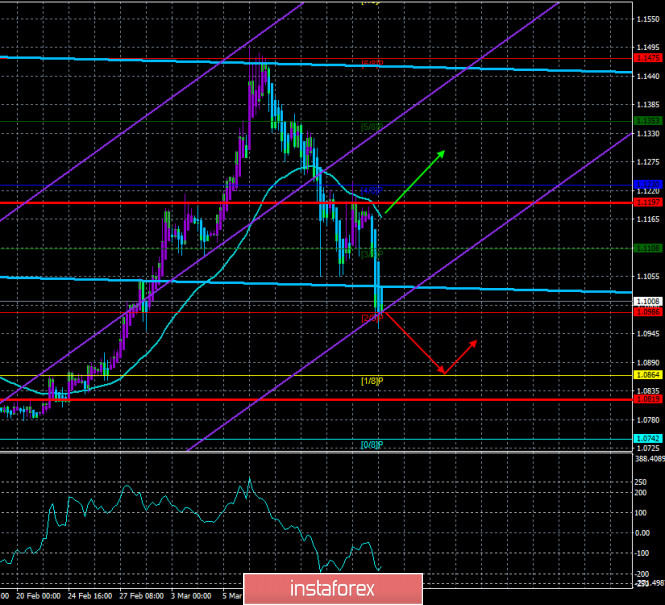

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction -upward.

Moving average (20; smoothed) - downward.

CCI: -163.1966

Another disastrous day for the European currency. If yesterday the EUR/USD currency pair managed to somehow adjust to the moving average line, yesterday the quotes of the euro currency fell down with a new terrible force. As before, there were no specific reasons for the collapse. "Coronavirus" continued to spread across the planet, confirming its status as a pandemic. The US stock indices fell by impressive values, and oil continued to fall in price. That's the full news summary for March 17. What can I say about the result? Chaos and panic continue to reign in all markets. The Fed cut the emergency rate from 1.75% to 0.25% and the US dollar is still in demand (with high demand). This only means that traders continue to buy the US currency. And the reasons why they invest in the dollar are completely unimportant. Recall that at the beginning of the current crisis, it was the euro currency that became more expensive, and it became very expensive. So, many traders have already begun to seriously count on the formation of a new long-term upward trend, and put an end to the "dollar" trend. However, as practice shows, despite the fact that the epidemic has reached the States, despite all the stock market crashes, despite the "extra-dovish" actions of the Fed, traders continue to believe in the dollar.

The EU is closing its borders. This was announced yesterday by French President Emmanuel Macron. The measures are taken as part of the fight against the "coronavirus" epidemic and will be in effect for at least thirty days. In his speech, the French President described the current situation as "military". And these measures do not seem excessive. In Italy alone, 349 people died from the epidemic during March 16. This is the highest daily number of deaths, and the total number of victims is already more than 2,500. Also, over the past day, another 2,500 people were infected in Italy, and in total, almost 32,000 people were infected. Around the world, the epidemic has already reached 196,100 people, approximately 10,000 are infected per day. And this is only official data. And how many infected people are not registered anywhere? How many people infected with the virus do not even know about it yet, because they have not passed the appropriate tests, or simply do not feel any discomfort? Thus, we believe that the real numbers are much higher. And what can we expect from the participants of the currency market in such conditions? Clearly not calm and measured trading.

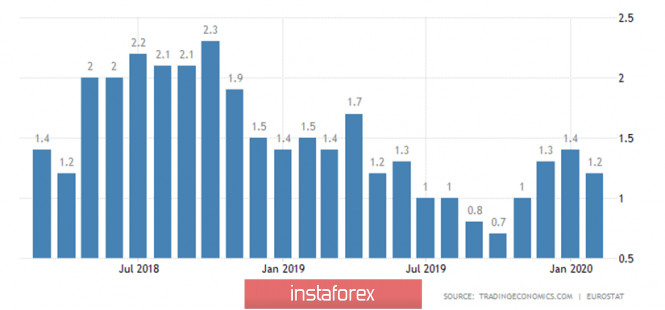

As we have said many times, macroeconomic statistics do not play any role at the moment. Many countries are in quarantine and borders are closed. Thus, it does not matter how much industrial production in the United States increased in February. The same applies to today's publication of inflation in the European Union. A month ago, it was the inflation figures that worried traders almost the most. Now we can say with confidence that there will be no reaction to this report. However, the consumer price index is expected to be 1.2% y/y in February. Most of all, both traders and analysts are interested in the question of how strong the cuts in all key indicators of the US and EU economies will be at the end of March. Yesterday's ZEW index, which reflected the mood of investors, has already shown a strong collapse, which is not surprising. A day earlier, data on industrial production and retail sales in China showed what to expect from similar indicators in the US and the EU. Thus, we are waiting for the official statistics for March and, most likely, there will be a lot of unpleasant surprises in it. But it is absolutely impossible to predict how this statistics will affect the movement of the EUR/USD currency pair. Therefore, we still recommend that traders follow the trend and do not try to "catch" the price turning up.

From a technical point of view, the downward movement continues. The Heiken Ashi indicator is directed downward, as is the senior linear regression channel. Most likely, the lower channel will also turn down in the near future.

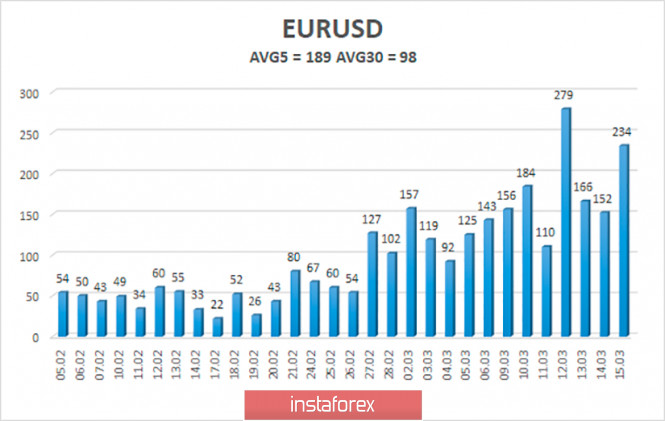

The average volatility of the euro/dollar currency pair remains at record values and continues to grow. At the moment, the average value for the last 5 days is 189 points. Markets remain in an agitated state and can move in any direction with renewed vigor at almost any moment. Thus, on Wednesday, we again expect a decrease in volatility and movement within the channel, limited by the levels of 1.0819 and 1.1197.

Nearest support levels:

S1 - 1.0986

S2 - 1.0864

S3 - 1.0742

Nearest resistance levels:

R1 - 1.1108

R2 - 1.1230

R3 - 1.1353

Trading recommendations:

The euro/dollar pair resumed its downward movement. Thus, traders are recommended to sell the euro currency again with the targets of 1.0864 and 1.0819 before the Heiken Ashi indicator turns up, which will indicate a new round of upward correction. It will be possible to buy a pair no earlier than the price fixing above the moving average line with the first target of 1.1349. When opening any positions, increased caution is recommended, since a frank panic reigns in the market now.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com